Why Invoice is Important?

Why Invoice is Important: The Key to Business Success

An invoice is important because it serves as a legal transaction record and helps ensure timely payment. It can be easier to track payments and resolve disputes with an invoice.

Invoices provide precise details of the goods or services, the agreed-upon price, and payment terms, making it easier for both parties to stay organized and avoid confusion. With an accurate and well-documented invoice, businesses can maintain a transparent and professional relationship with their clients or customers, ultimately contributing to better financial management and customer satisfaction.

Table of Contents

Importance Of Invoices For Businesses

An invoice is more than just a piece of paper or a digital document. It plays a vital role in the financial operations of a business. Invoices are essential for companies of all sizes and industries, from ensuring timely payments to legal compliance and tracking financial transactions. In this blog post, we will dive deeper into the importance of invoices and why businesses should prioritize the proper invoicing process.

- Ensuring Payment

One of the primary reasons why invoices are important for businesses is that they ensure timely payment for products or services rendered. When you send an invoice to your customers, you formally request payment for the goods or services provided. This transparent communication helps in minimizing confusion and delays in payments.

By clearly stating the amount owed, due date, and payment methods accepted, invoices remind customers to make payments promptly. They provide a documented transaction record, making tracking outstanding payments easier and following up with customers if necessary.

- Legal Compliance

Invoices are not just a means to request payment but also serve a legal purpose for businesses. They are essential to meet legal compliance requirements, especially regarding taxes and financial regulations. Invoices often contain critical information such as the supplier’s and customer’s details, a unique invoice number, and a breakdown of goods or services provided.

By adhering to legal invoicing requirements, businesses can avoid penalties or legal issues. Properly documented invoices also provide valuable evidence in case of any disputes or audits. They ensure transparency and demonstrate the authenticity of business transactions, helping maintain trust and credibility with customers and regulatory authorities.

- Tracking Financial Transactions

For businesses, keeping track of financial transactions is crucial for managing cash flow and monitoring business performance. Invoices serve as an essential tool for tracking these transactions. They document the revenue generated, the payment received, and the outstanding amounts.

By maintaining a record of all invoices, businesses can quickly identify any late payments or unpaid invoices, enabling them to take appropriate actions such as sending reminders or initiating collections. Invoices also provide:

- Valuable insights into customer behavior and purchasing patterns.

- Helping businesses make informed decisions regarding pricing.

- Inventory.

- Marketing strategies.

Furthermore, invoices are necessary for financial reporting, budgeting, and tax planning. They assist with accurate bookkeeping, allowing businesses to reconcile their accounts and generate financial statements.

In conclusion, invoices are critical to any business’s financial operations. From ensuring timely payments to legal compliance and tracking financial transactions, invoices play a pivotal role in the success and sustainability of companies. By implementing an efficient invoicing system, businesses can maintain a healthy cash flow, manage their finances effectively, and foster strong customer relationships.

Types Of Invoices

In the world of business transactions, invoices play a crucial role. They are necessary to track payments and finances and establish transparency and professionalism. This section will explore the different invoices businesses use to facilitate their operations.

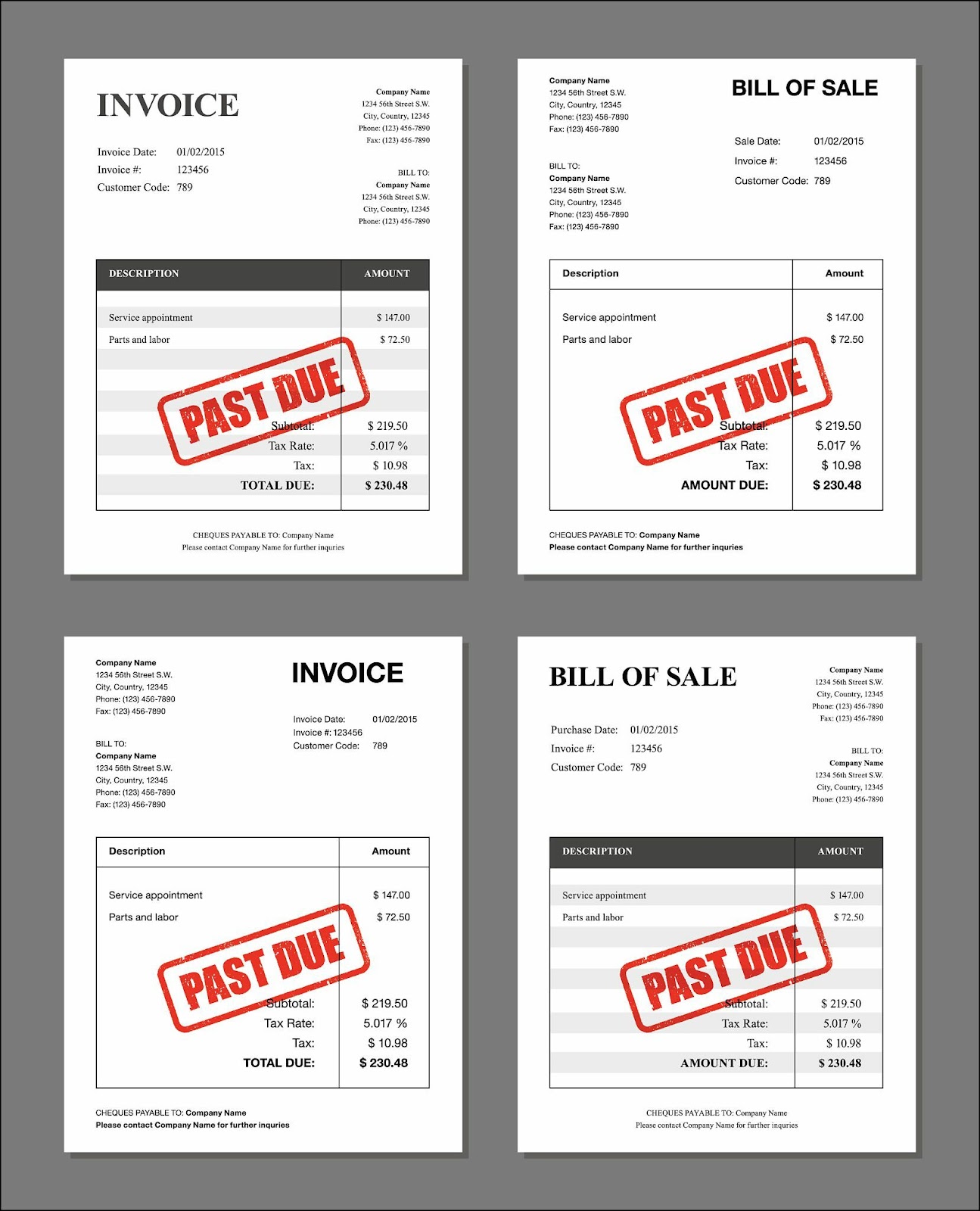

- Standard Invoice

A standard invoice is the most common type of invoice used by businesses. It is a formal document that clearly outlines the details of a transaction, including the products or services provided, quantity, unit price, and the total amount due. This type of invoice is typically used for one-time purchases or services rendered.

Businesses usually include their contact information on a standard invoice, such as the name, address, phone number, and the customer’s details. Additionally, it is essential to include the invoice number, issue date, payment terms, and any applicable taxes or discounts.

- Recurring Invoice

A recurring invoice is designed for businesses that regularly provide ongoing services or products, typically at predetermined intervals. It eliminates the need to manually create and send invoices for every transaction, saving time and effort.

With a recurring invoice, businesses can set up an automated system to generate and send invoices periodically. Whether it is a monthly subscription, a membership fee, or a retainer arrangement, recurring invoices ensure a seamless payment process for recurring services.

- Proforma Invoice

A proforma invoice is a preliminary document issued by the seller to the buyer before the actual goods or services are provided. It serves as a quotation or an estimate that outlines the anticipated costs and terms of the transaction.

Proforma invoices are commonly used in international trade to give buyers an idea of the total cost, including shipping fees, customs duties, and taxes. While proforma invoices are not legally binding, they facilitate communication and negotiation between buyers and sellers.

Understanding the different types of invoices is essential for any business to ensure efficient financial management. Whether it is a standard invoice for one-time transactions, a recurring invoice to streamline regular payments, or a proforma invoice for international trade, each type serves a specific purpose in keeping the financial wheels of a business turning smoothly.

Key Components Of An Invoice

An invoice is a crucial document that plays a vital role in the smooth functioning of any business. It serves as a formal record of the goods or services provided by a company, as well as the corresponding payment due. An invoice typically consists of several vital components to ensure accuracy and clarity. Let’s look at these components and understand their importance in invoicing.

Contact Information

The first essential component of an invoice is the contact information. This includes the details of both the supplier and the customer involved in the transaction. The supplier’s information typically includes the company name, address, phone number, and email address. Similarly, the customer’s information should be mentioned, including their name, address, and contact details. Providing accurate contact information ensures that both parties can easily communicate and resolve any issues or queries that may arise.

Invoice Number And Date

The invoice number and date are crucial for record-keeping and tracking purposes. Each invoice should have a unique identification number assigned to it, making it easier to reference and organize. Along with the invoice number, the issue date should also be mentioned. This allows for easy invoice identification and provides a reference point for the supplier and the customer.

Descriptions Of Goods Or Services

Clear and concise descriptions of the goods or services are essential for transparency and clarity. Each item or service should be described in detail, including its name, quantity, and relevant specifications. Providing accurate descriptions ensures that both parties agree on what was delivered or completed, minimizing the chance of any disputes or misunderstandings.

Pricing And Payment Terms

Pricing and payment terms are fundamental components of any invoice. The invoice should clearly state each item or service’s unit price, quantity, and total cost. Additionally, any applicable taxes or discounts should be mentioned. Alongside the pricing details, the invoice should outline the agreed-upon payment terms, such as the due date and any late payment penalties. Transparent pricing and payment terms help establish trust and avoid confusion or discrepancies between the supplier and the customer.

Total Amount Due

The final component of an invoice is the total amount due. This is the sum of all the costs, taxes, and discounts applied. The invoice should clearly state the total amount the customer must pay. This section is crucial for both the supplier, as it serves as a reference for tracking outstanding payments, and the customer, as it provides a clear understanding of the amount owed.

How To Create An Effective Invoice

Creating a professional and effective invoice is crucial for the success of any business. Not only does it provide a clear record of the products or services provided, but it also ensures timely and accurate payment. This section will discuss five essential elements of an effective invoice that will help you streamline your invoicing process and maintain a healthy cash flow.

- Use Professional Invoice Templates

Using a professional invoice template can make all the difference when creating an invoice. These templates are pre-designed and formatted, saving you time and effort. Additionally, they provide a unified and consistent appearance that reflects your brand identity. Whether you choose a template from your accounting software or create your own, ensure it includes all the necessary details, including your company name, logo, contact information, and your client’s details.

- Include Clear Payment Instructions

Clear payment instructions on your invoice are crucial to ensure prompt payment from your clients. Highlight the different payment methods you accept, such as credit cards, bank transfers, or checks. Provide your bank account details if applicable, and if you buy online payments, include a link to your payment gateway. Clearly state the due date and payment terms, such as “net 30,” indicating when the payment is expected.

- Provide Detailed Descriptions

Including detailed descriptions of the products or services provided is essential for transparency and avoiding confusion or disputes. Break down each item, specifying the quantity, unit price, and applicable taxes or discounts. If you offer different packages or options, clearly outline the differences and their corresponding prices. This level of detail will help your clients understand the invoice and convey the value of your work.

- Set Clear Payment Terms And Due Dates

Setting clear payment terms and due dates is crucial for maintaining a healthy cash flow. Communicate your payment expectations and avoid any ambiguity. Specify the due date prominently on the invoice, and if necessary, mention the consequences of late payment, such as late fees or interest. This will incentivize your clients to pay on time and ensure a smooth business relationship.

- Double-check For Accuracy

Accuracy is vital when creating an invoice, as errors or omissions can lead to delayed payment or disputes. Double-check each invoice element, including the client’s details, payment amount, and product or service description. Ensure that all calculations are correct and there are no typos or formatting issues. Reviewing and verifying your invoice will help you maintain a professional image and avoid unnecessary complications.

Creating an adequate invoice is not just about getting paid; it is also an opportunity to showcase your professionalism and attention to detail. You can ensure seamless invoicing and maintain positive client relationships by using professional invoice templates, including clear payment instructions, providing detailed descriptions, setting clear payment terms and due dates, and double-checking for accuracy.

Common Invoice Mistakes To Avoid

When it comes to invoicing, accuracy and clarity are paramount. Your invoice is not just a document requesting payment; it reflects your professionalism and attention to detail. Unfortunately, many businesses fall into common invoice mistakes that can lead to payment delays, misunderstandings, and even strained client relationships. This article will discuss the most prevalent invoice mistakes and provide practical tips on avoiding them.

- Missing Or Incorrect Information

Having missing or incorrect information on your invoice can cause confusion and frustration for you and your clients. It is essential to double-check all the details before sending out an invoice. Here are some crucial pieces of information that should be included:

- Your company’s name, address, and contact information

- Client’s name, address, and contact information

- Invoice date and due date

- Invoice number

- A clear description of the goods or services provided

- The quantity, price, and total amount

Ensuring that all the necessary information is present and correct reduces the risk of confusion and delays in payment.

- Unclear Payment Terms

Unclear payment terms can lead to misunderstandings and disputes between you and your clients. Specifying the payment terms on your invoice is essential to set the expectations for payment. Include the following information related to payment terms:

- Accepted payment methods (e.g., bank transfer, credit card, PayPal)

- The due date for payment

- Late payment penalties or interest charges, if applicable

By providing clear payment terms, you establish a clear understanding with your clients and minimize the risk of payment delays or disagreements.

- Inaccurate Pricing

Incorrect pricing on an invoice can cause confusion and frustration for both parties. Ensure that your pricing is accurate and reflects the agreed-upon rate or price for your goods or services. Detailing any applicable discounts, taxes, or additional charges is crucial. You avoid potential disputes and build trust with your clients by providing accurate pricing information.

- Late Or Incorrect Delivery

The timely delivery of an invoice is as important as the accuracy of its content. Delaying the delivery of an invoice can lead to payment delays, as clients may prioritize invoices based on their arrival dates. It’s advisable to send out invoices promptly after delivering your goods or services. Moreover, ensure the invoice is paid to the correct recipient to avoid confusion or delays. By providing invoices on time, you enhance the professionalism of your business and maintain healthy client relationships.

- Inconsistent Numbering

Using consistent numbering for your invoices can result in clarity and disorganization. Assigning a unique invoice number to each invoice is vital for easy tracking and reference. Ensure you stick to a consistent numbering system to prevent any mix-ups. Additionally, consider using alphanumeric characters in your invoice numbering to enhance organization further and eliminate potential duplication issues.

Invoice Management And Organization

An efficient invoice management and organization system is crucial for the smooth functioning of any business. Not only does it ensure timely payments and accurate record-keeping, but it also helps you gain a clear overview of your financial transactions. By establishing an efficient system, digitizing and automating processes, implementing invoice tracking tools, and ensuring proper storage and backup, you can streamline your invoice management process and focus on other core aspects of your business.

- Establishing An Efficient System

A well-structured and efficient invoicing system is the first step towards effective invoice management and organization. Begin by establishing clear guidelines and procedures for generating and sending invoices. This includes identifying the necessary information to include on each invoice, such as the name and contact details of the client, invoice number, description of services provided, and payment terms. Standardizing the process can reduce errors, enhance professionalism, and ensure consistency across all your invoices.

- Digitizing And Automating Processes

The manual handling of paper invoices can be time-consuming and prone to errors. By digitizing your invoice management process, you can significantly improve efficiency and reduce the likelihood of mistakes. Utilize accounting software or cloud-based invoicing platforms that allow you to create, send, and track invoices electronically. This not only saves time but also provides real-time visibility into the status of your invoices. Automation features such as recurring invoices and automatic payment reminders can streamline your invoicing workflow and ensure timely payments.

- Implementing Invoice Tracking Tools

Keeping track of invoices can be challenging, especially when dealing with multiple clients and ongoing projects. Implementing invoice tracking tools can make this task much simpler and more organized. These tools enable you to monitor the status of each invoice, track payment deadlines, and identify any overdue payments. You can promptly follow up with clients and address any payment issues by having a clear overview of your outstanding invoices. Invoice tracking tools also provide insights into your accounts receivable, helping you better manage your cash flow.

- Ensuring Proper Storage And Backup

Proper storage and backup of your invoices are essential for both record-keeping purposes and legal compliance. Maintain a systematic filing system to store your invoices’ physical and electronic copies. This ensures easy retrieval of invoices when required and helps with accounting audits or tax filing. Consider implementing a backup solution, such as cloud storage, to safeguard your invoices against data loss or damage. By having secure and reliable backup options, you can have peace of mind knowing that your invoices are protected and easily accessible.

Dealing With Late Payments And Non-payment

When running a business, dealing with late payments and non-payment can significantly impact your cash flow and overall financial stability. That’s why establishing a solid invoicing system is vital. Not only does it ensure timely and accurate payment collection, but it also provides you with essential documentation for your business records. Here are three strategies you can adopt to handle late payments and non-payment effectively.

Sending Payment Reminders

Sending payment reminders is a proactive way to encourage clients to settle their outstanding invoices. By reminding them politely and professionally about their pending payments, you assert yourself as a responsible business owner and nudge them to take immediate action.

Here’s how you can structure your payment reminders:

- Use a friendly yet firm tone: Be polite while emphasizing the importance of timely payment.

- Mention the invoice details: Include the invoice number, amount due, and due date to jog your client’s memory.

- Highlight late fees policy: If applicable, clearly state your late fees policy, which can motivate clients to make prompt payments.

- Offer assistance: Show your willingness to address any concerns or queries your client may have regarding the invoice.

Regularly sending payment reminders increases the chances of receiving timely payments and reduces the risk of late payments or non-payment.

Imposing Late Payment Penalties

Impose penalties for late payments to discourage clients from delaying their invoice settlement. Late payment penalties act as a financial incentive for clients to honor their payment obligations promptly. Clearly outlining your late payment policy establishes firm expectations for your clients, ensuring they understand the consequences of delayed payments.

Here’s a suggested structure for your late payment policy:

Here’s a suggested structure for your late payment policy:

| Days Past Due | Late Payment Penalty |

| 15-30 days | 5% of the invoice amount |

| 31-60 days | 7% of the invoice amount |

| Over 60 days | 10% of the invoice amount |

By implementing clear and reasonable late payment penalties, you not only encourage timely payments but also compensate for the potential financial losses caused by delayed payments.

Enlisting The Help Of Collection Agencies

In cases of persistent late payments or non-payment, enlisting the help of collection agencies can effectively retrieve the funds. Collection agencies specialize in handling debt recovery and have the expertise and resources to pursue delinquent clients.

When considering the services of a collection agency:

- Conduct thorough research: Look for reputable collection agencies with a proven track record.

- Please review the terms and fees: Understand the agency’s terms, fees, and the percentage they charge on successfully recovering the unpaid amounts.

- All necessary documentation: Provide the collection agency with all relevant information and documentation regarding the outstanding invoices and your attempts to recover the payments.

- Collaborate closely: Maintain open communication with the agency to monitor their progress and provide any additional assistance they may require to resolve the situation.

Enlisting the help of collection agencies can be a last resort to recoup your losses and ensure your business runs smoothly due to late payments or non-payment.

Invoicing Best Practices

Having efficient invoicing practices is essential for any business. It ensures that you get paid on time, maintain good client relationships, and have a clear record of transactions. To help you optimize your invoicing process, here are five best practices that you should follow:

- Regularly Review And Update Invoices

Regularly reviewing and updating your invoices is crucial for accuracy and professionalism. Take the time to double-check all the details and ensure that they are correct, including client information, project details, and payment terms. This helps to avoid any confusion or disputes down the line. By implementing a regular review process, you can catch any errors or inconsistencies and rectify them before sending out invoices.

- Establish Clear Communication Channels

Establishing clear communication channels with your clients is essential for effective invoicing. Clearly outline how clients should contact you if they have any questions or concerns regarding the invoice. Provide multiple contact options like email, phone, or a dedicated communication platform. This ensures that both parties can quickly and efficiently resolve any issues that may arise, minimizing payment delays and misunderstandings.

- Maintain Professionalism In Correspondence

When communicating with clients about invoices, it’s important to maintain a professional tone and demeanor. Use polite language in all your correspondence, whether through email, phone calls, or written letters. This professionalism helps to build trust and a positive working relationship with your clients. Remember, even in challenging situations, maintaining a professional approach can significantly resolve payment issues amicably.

- Keep Detailed Records

Keeping meticulous records of your invoices and payments is crucial for financial management. Create a dedicated system for organizing and storing all your invoices and related documentation. This can be a physical filing system or a digital solution like cloud storage or accounting software. By maintaining detailed records, you can easily track all your transactions, analyze your cash flow, and resolve any discrepancies or disputes that may arise.

- Continuously Improve Invoicing Processes

To ensure efficient invoicing, evaluating and improving your processes is important. Periodically review your invoicing workflow and identify any areas for optimization. Look for ways to streamline the process, such as automating recurring invoices or integrating your invoicing software with your accounting system. Embrace technology solutions that can help you save time, reduce errors, and enhance your overall invoicing efficiency.

Credit: www.smartdatainc.com

Frequently Asked Questions On Why Invoice Is Important

What Are The Importance Of An Invoice?

An invoice is important as it records a transaction between a buyer and a seller. It ensures timely payment and helps in tracking and organizing financial transactions. Invoices also serve as legal documents and are essential for taxation purposes.

What Is The Most Important Aspect Of An Invoice?

The most important aspect of an invoice is accuracy. It should contain correct details, such as the right amount, item descriptions, and customer information. Accurate invoices help prevent payment delays and disputes.

What Are The Five Uses Of An Invoice?

An invoice is used for multiple purposes, including recording sales transactions, requesting customer payments, tracking accounts receivable, documenting tax obligations, and providing proof of purchase for both businesses and customers.

Why Is the Invoicing Process Important?

The invoicing process is important because it ensures timely payment, helps track business finances, maintains accurate records, and ensures legal compliance. It also improves cash flow, builds client trust, and streamlines accounting tasks.

Conclusion

Invoices play a crucial role in any business, serving as a vital record of transactions and ensuring prompt payment. Invoices promote transparency and trust between companies and clients through their ability to provide a clear breakdown of products and services rendered.

By adhering to good invoicing practices, businesses can maintain healthy cash flow, reduce payment disputes, and effectively manage their accounts receivable. Therefore, companies must prioritize creating and maintaining accurate and timely invoices.