What is professional accounting software?

What is Professional Accounting Software? Explore the Power of Efficient Financial Management

What is Professional Accounting Software? Explore the Power of Accounting Software

Professional accounting software is a comprehensive tool designed to manage financial processes for businesses efficiently. It enables streamlined bookkeeping, invoicing, and financial reporting, improving accuracy and saving time for accountants and finance teams.

This software optimizes financial operations and enhances decision-making by automating repetitive tasks, generating detailed reports, and integrating with other business systems. With features like expense tracking, payroll management, and tax preparation, professional accounting software enables businesses to maintain compliance, reduce errors, and gain valuable insights into their financial health.

It is an essential tool for businesses of all sizes, providing the necessary tools and functionality to manage and monitor their finances effectively.

Table of Contents

Critical Features Of Professional Accounting Software

In today’s fast-paced business environment, accurate financial management is critical for organizations to stay ahead. Professional accounting software has become an indispensable tool for businesses of all sizes, providing a streamlined and efficient financial management solution. This article will explore the key features that make professional accounting software a must-have for any organization.

Automated Bookkeeping

One of the primary features of professional accounting software is automated bookkeeping. Gone are the days of manually recording every transaction and maintaining multiple spreadsheets. With computerized bookkeeping, the software records all financial transactions in real-time, including sales, purchases, and expenses. By eliminating the need for manual data entry, it not only saves time but also minimizes the risk of data entry errors.

Financial Reporting And Analysis

Accurate and timely financial reporting is essential for organizations to make informed decisions and assess their financial health. Professional accounting software provides:

- Comprehensive financial reporting capabilities.

- Allowing businesses to generate reports such as profit and loss statements.

- Balance sheets.

- Cash flow statements.

These reports provide vital insights into the company’s financial performance and help identify trends, strengths, and areas for improvement.

Tax Management

Tax management is a complex task that requires careful planning and adherence to compliance regulations. Professional accounting software simplifies tax management by automating tax calculations and ensuring accurate and timely filing. It allows businesses to generate tax reports, calculate tax liabilities, and prepare the necessary documentation for tax returns. With built-in tax rules and updates, the software ensures compliance with ever-changing tax laws.

Invoicing And Billing

An efficient invoicing and billing system is crucial for businesses to get paid promptly and track revenue streams. Professional accounting software offers robust invoicing and billing features that simplify the process. It allows companies to create and customize professional invoices, send them to clients, and track payment status. Additionally, the software can automate recurring invoices and payment reminders and even integrate with payment gateways for seamless transactions.

Inventory Management

Managing inventory effectively is vital for businesses dealing with physical products to optimize costs and maintain customer satisfaction. Professional accounting software includes inventory management features that help organizations track stock levels, monitor product movement, and streamline inventory workflows. From recording purchases and sales to generating detailed inventory reports, the software provides valuable insights into inventory valuation, order management, and stock optimization.

Benefits Of Professional Accounting Software

When it comes to managing the financial aspects of a business, the importance of professional accounting software cannot be emphasized enough. Gone are the days of relying on manual calculations and paper-based records. With the help of advanced technology, professional accounting software has revolutionized how businesses handle their financial processes.

Time And Cost Savings

One of the key benefits of professional accounting software is the significant time and cost savings it offers. With manual accounting processes, businesses often spend endless hours on tasks such as data entry, invoice processing, payroll management, and financial reporting. However, with professional accounting software, these time-consuming activities can be automated, freeing up valuable time for business owners and employees to focus on core business operations. Moreover, by streamlining these processes, businesses can reduce the need for additional workforce, thereby minimizing labor costs.

Improves Accuracy And Efficiency

Inaccuracies in financial records can lead to severe consequences for businesses, ranging from compliance issues to costly monetary errors. Professional accounting software plays a crucial role in mitigating these risks by improving the accuracy and efficiency of financial processes. With automated data entry and calculations, the chances of human error are significantly reduced. Additionally, the software’s ability to generate detailed financial reports and perform real-time data analysis ensures that businesses can always access accurate and up-to-date financial information. This enhances decision-making and allows for better financial planning and forecasting.

Streamlines Financial Processes

Efficient financial process management is essential for any business, regardless of size. Professional accounting software streamlines these processes by automating invoicing, expense tracking, bank reconciliations, and inventory management. Moreover, the software’s integration capabilities enable seamless data synchronization across various platforms, ensuring that all departments and individuals have real-time access to the same information. This promotes collaboration, eliminates duplication of efforts, and ultimately streamlines the entire financial workflow.

Enhances Decision Making

Businesses thrive on informed decision-making, and professional accounting software facilitates this process by providing accurate and comprehensive financial insights. With easy access to real-time financial data, companies can monitor and analyze key metrics such as cash flow, profitability, and revenue trends. This enables business owners to make informed decisions regarding budget allocation, investment opportunities, and strategic planning. By clearly understanding the financial health of the business, leaders can optimize resources and capitalize on growth opportunities.

Ensures Regulatory Compliance

Complying with the ever-changing financial regulations and standards can be daunting, especially for businesses operating in multiple jurisdictions. Professional accounting software simplifies this process by ensuring regulatory compliance through built-in features and capabilities. The software is designed to adhere to the latest accounting standards and regulations, making it easier for businesses to generate accurate financial statements and reports that meet the required compliance standards. This helps companies to avoid legal penalties, audits, and reputation damage associated with non-compliance.

Choosing The Right Professional Accounting Software

Finding the right professional accounting software is crucial when managing your business finances. A robust accounting software can help streamline your financial tasks, save time, and provide valuable insights into your business’s financial health. However, with so many available options, choosing the right accounting software can take time and effort. To help you make an informed decision, here are some essential factors to consider when selecting professional accounting software.

Identify Your Business Needs

Before you evaluate different accounting software options, you must identify your business needs. Take the time to assess your accounting requirements and determine the specific features and functionalities you need from the software. Consider factors such as the volume of transactions, the complexity of your financial processes, and any particular reporting requirements you may have. By understanding your unique business needs, you can narrow the options and focus on software that aligns with your requirements.

Consider Scalability

As your business grows, so will your accounting needs. Therefore, choosing a professional accounting software that can scale with your business is crucial. Look for software that offers flexible pricing plans and can accommodate increasing transactions and users. Scalability ensures that the software can meet your future needs without the hassle of switching to a new system.

Evaluate Ease Of Use And Integration

Adopting new software can be a steep learning curve, so it’s essential to consider the ease of use when choosing professional accounting software. Look for software with a user-friendly interface and intuitive features that make it easy for your staff to navigate and perform their accounting tasks. Additionally, consider how well the software integrates with other tools and systems you use in your business, such as payroll or customer relationship management (CRM) systems. Seamless integration will save you time and minimize errors by eliminating the need for manual data entry.

Compare Pricing And Support

Price is essential when choosing professional accounting software but shouldn’t be the sole determining factor. Compare the pricing plans of different software options and consider factors such as the number of users included, additional costs for add-ons or upgrades, and ongoing subscription fees. Additionally, look for software providers that offer reliable customer support. If you encounter any issues or questions, having access to responsive and knowledgeable support can significantly impact your experience with the software.

Read User Reviews And Testimonials

Lastly, before making a final decision, take the time to read user reviews and testimonials about the accounting software you are considering. Hearing from actual users can provide valuable insights into the software’s strengths, weaknesses, and overall user experience. Please pay attention to reviews from similar businesses, as their feedback will be more relevant to your specific needs. User reviews help you determine if the software aligns with your expectations and provides the required functionality and reliability.

Considering these factors and thoroughly evaluating your options, you can choose the professional accounting software that best suits your business needs. Make the right decision and watch your accounting processes become more accessible and efficient.

Popular Professional Accounting Software Solutions

Having reliable and efficient accounting software is crucial when managing your business finances. With the advancements in technology, numerous professional accounting software solutions are available on the market today. These software options streamline your financial processes and provide valuable insights into your business performance. This blog post will delve into some of the most popular professional accounting software solutions to help you keep your finances in order and take your business to new heights.

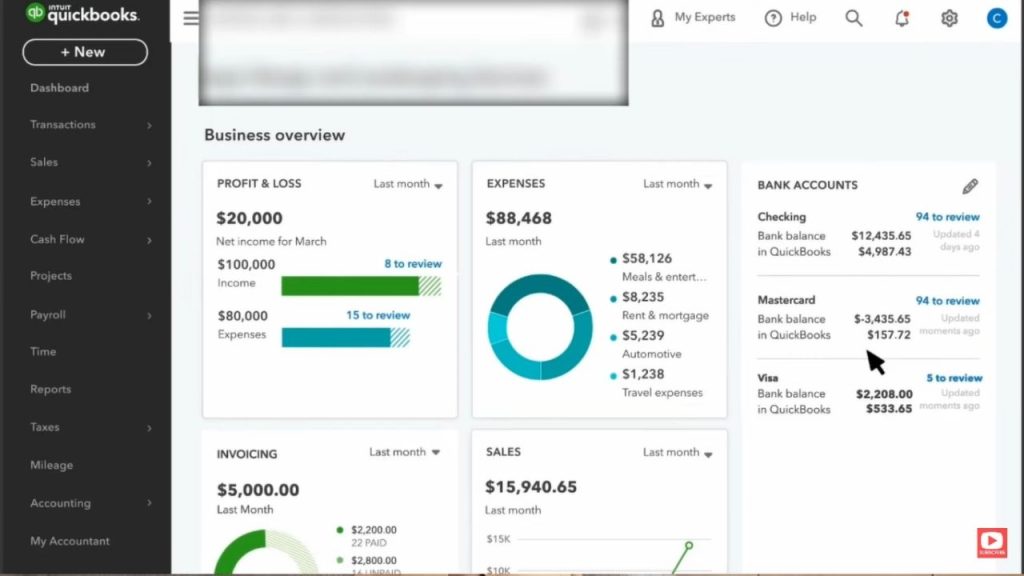

Quickbooks

QuickBooks is undeniably one of the industry’s most well-known and widely used accounting software solutions. Trusted by millions of small and medium-sized businesses, QuickBooks offers a range of features and functionalities that enable you to manage your financial transactions efficiently. From invoicing and inventory management to payroll processing and bank reconciliation, QuickBooks has got you covered. Its user-friendly interface and intuitive navigation make it a favorite among accounting professionals and those with little accounting knowledge.

Xero

Xero is a top choice if you’re looking for a cloud-based accounting software solution. With Xero, you can access your financial data anytime, anywhere, with an internet connection. This makes it a convenient option for businesses with remote teams or multiple locations. Xero offers a comprehensive suite of features, including bank feeds, expense tracking, invoicing, and project management. The platform also integrates seamlessly with other business applications, allowing you to streamline workflows and save valuable time.

Sage Intacct

Sage Intacct is geared towards growing businesses that require more advanced accounting features. With its robust financial management capabilities, Sage Intacct enables you to effectively handle complex financial tasks, such as multi-entity consolidation and revenue recognition. The software provides real-time visibility into your business performance with powerful reporting and analytics tools. From accounts payable and receivable to budgeting and forecasting, Sage Intacct offers a comprehensive solution for today’s finance teams.

Netsuite

NetSuite is a cloud-based ERP (Enterprise Resource Planning) software incorporating accounting functions and other business modules. It caters to businesses of all sizes, from startups to multinational organizations. NetSuite’s accounting module covers all the essential financial processes, including general ledger, accounts payable, and accounts receivable. The software also offers advanced asset management, revenue recognition, and financial planning features. With its integrated approach, NetSuite allows for seamless data sharing across different departments, providing a holistic view of your business operations.

Zoho Books

Zoho Books is a popular choice for small businesses and freelancers due to its simplicity, affordability, and powerful features. This cloud-based accounting software solution offers essential functions like invoicing, expense tracking, financial reporting, and bank reconciliation. Zoho Books also integrates with other Zoho applications, offering a complete suite of business tools for efficient operations. With its user-friendly interface and cost-effective pricing plans, Zoho Books is an ideal option for a straightforward and budget-friendly accounting software solution.

Implementing Professional Accounting Software

Implementing professional accounting software is crucial for businesses looking to streamline their financial management processes. With the right software, companies can manage financial transactions, track expenses, generate accurate reports, and make well-informed decisions. However, implementing accounting software requires careful planning and execution to ensure a smooth transition and maximum effectiveness. This section will explore the critical aspects of implementing professional accounting software, including data migration and integration, training and support, testing, and customization.

Data Migration And Integration

When implementing professional accounting software, one of the essential tasks is migrating existing data from previous accounting systems or manual records. This process involves transferring financial data such as transactions, sales records, and inventory information into the new software. Data migration requires careful planning to ensure accuracy and completeness, as any errors or missing data can lead to discrepancies and financial inefficiencies.

The chosen accounting software should offer easy data integration capabilities to facilitate a seamless transition. This allows for the effortless import and export of data between the accounting software and other business applications, such as customer relationship management (CRM) systems or inventory management tools. By integrating data from multiple sources, businesses can centralize their financial information, eliminate manual data entry, and reduce the risk of errors.

Training And Support

Proper training plays a vital role in successfully implementing professional accounting software. Inadequate training can hinder user adoption and lead to underutilization of the software’s potential. It is crucial to provide comprehensive training to all staff using the accounting software to ensure they understand its features, functionalities, and workflows.

When selecting an accounting software solution, consider whether the vendor provides sufficient training and ongoing support. This might include online resources, user manuals, tutorial videos, and in-person training sessions. By investing in training and ongoing support, businesses can empower their employees to use the software effectively, improving efficiency and accuracy in financial management.

Testing And Customization

Before fully implementing professional accounting software, thorough testing is necessary to identify and address potential issues or bugs. This can help avoid disruptions to daily operations and prevent data loss. Testing should cover all aspects of the software, including data accuracy, report generation, and integration with other systems.

Furthermore, accounting software often allows for customization to suit specific business needs. Customization options may include creating custom reports, adding user-defined fields, or setting up workflows tailored to the organization’s requirements. By customizing the software, businesses can improve efficiency and ensure that the software aligns with their unique processes and reporting requirements.

In conclusion, implementing professional accounting software involves several critical aspects, such as data migration and integration, training, support, testing, and customization. By carefully considering these aspects and choosing the right software solution, businesses can achieve enhanced financial management, streamlined processes, and improved decision-making capabilities.

Best Practices For Efficient Financial Management

Efficient financial management is crucial for any business, and implementing the correct practices can streamline processes and improve overall financial performance. Professional accounting software plays a vital role in achieving this efficiency, offering a range of tools and features designed to simplify financial tasks and provide accurate and real-time data. By following these best practices with accounting software, businesses can ensure the smooth operation of their financial management processes.

Maintaining Accurate And Up-to-date Records

One of the fundamental best practices for efficient financial management is maintaining accurate and up-to-date records. With professional accounting software, businesses can easily record and track financial transactions, including income, expenses, sales, and purchases. By consistently entering all financial data into the software, companies can ensure the accuracy of their records and have a clear overview of their financial position.

Regularly Reconciling Accounts

Another critical best practice is regularly reconciling accounts. Businesses can detect any discrepancies or errors by comparing the transactions recorded in the accounting software with the bank statements. Regular reconciliation ensures that the financial records are accurate and complete, reducing the risk of financial misstatements and providing a better understanding of the company’s financial health.

Utilizing Financial Analysis Tools

Professional accounting software offers various financial analysis tools that allow businesses to gain valuable insights into their financial performance. These tools can generate reports, charts, and graphs that depict crucial economic indicators such as revenue, expenses, and profitability. By utilizing these analysis tools, businesses can identify trends, spot areas for improvement, and make informed financial decisions based on reliable data.

Monitoring Cash Flow

Managing cash flow is a critical aspect of efficient financial management. Accounting software enables businesses to track their cash inflows and outflows, allowing for better cash flow management. By regularly monitoring cash flow, companies can identify potential cash shortages, take proactive measures to improve liquidity and ensure they have enough funds to cover their expenses and investments.

Preparing For Tax Season

Preparing for tax season can be daunting, but professional accounting software can significantly simplify the process. By diligently recording and categorizing financial transactions, businesses can generate accurate financial statements and reports required for tax purposes. Additionally, accounting software often provides features such as tax calculators and automatic tax form generation, further easing the burden of tax compliance.

By adhering to these best practices for efficient financial management with professional accounting software, businesses can enhance their financial processes, optimize decision-making, and ultimately achieve tremendous success.

Challenges Of Implementing Professional Accounting Software

When adopting professional accounting software, businesses often encounter various challenges. From resistance to change to data security concerns, these obstacles can hinder the successful implementation of accounting software solutions. Understanding and addressing these challenges is crucial for businesses transitioning smoothly to efficient and effective accounting systems.

Resistance To Change

One significant hurdle in implementing professional accounting software is resistance to change. Employees accustomed to traditional manual accounting methods may be reluctant to embrace new technology. This resistance can stem from a fear of the unknown or a need for more confidence in their skills to utilize the software effectively. Overcoming this resistance requires proper communication and training to help employees understand the benefits and ease of using accounting software.

Data Security Concerns

Data security is a top priority for businesses, and accounting software implementation raises concerns about the confidentiality and integrity of financial data. With cyber threats becoming increasingly sophisticated, protecting sensitive financial information is paramount. Addressing data security concerns requires selecting a reputable software provider with robust security measures like encryption and regular data backups. Additionally, implementing strict access controls and regularly updating software to patch any vulnerabilities are vital steps to mitigate data security risks.

Training And Adoption Issues

Training and adoption issues may arise when implementing professional accounting software. Inadequate training can result in employees needing help to navigate the software and utilize its features effectively. This affects productivity and hampers the accurate recording and analysis of financial data. To overcome these challenges, businesses should invest in comprehensive training programs that cover all aspects of the software and provide ongoing support. Encouraging employees to embrace learning opportunities and offering incentives can foster a culture of adoption and proficiency.

Integration Challenges

Integration challenges can arise when businesses connect their accounting software with other existing systems, such as inventory management or customer relationship management (CRM) software. Incompatibilities between systems can lead to data discrepancies and disrupt seamless information flow. It is crucial to choose accounting software that offers integration capabilities and work closely with software providers to ensure a smooth integration process. Proper testing and data integration validation are essential to avoid potential issues impacting accurate financial reporting and decision-making.

Future Trends In Professional Accounting Software

As the accounting world continues to evolve, introducing new technologies plays a vital role in shaping the future of professional accounting software. In this article, we will explore some emerging trends expected to revolutionize how accountants and businesses manage their finances. Let’s dive into the future of professional accounting software:

Artificial Intelligence And Automation

Artificial intelligence (AI) and automation are rapidly transforming the accounting industry. With AI-powered algorithms and machine learning capabilities, professional accounting software can now perform complex calculations, analyze vast amounts of financial data, and detect patterns and anomalies faster and more accurately.

Automation features, such as automated data entry and reconciliation, streamline mundane and repetitive tasks, allowing accountants to focus on higher-value activities like data analysis and strategic decision-making.

Cloud-based Solutions

Cloud-based accounting software has gained traction recently due to its numerous advantages. It offers flexibility, scalability, and accessibility, allowing accountants to access financial data anywhere.

With cloud-based solutions, multiple users can collaborate in real-time, eliminating the need for manual file transfers. Moreover, cloud storage ensures data security and disaster recovery, providing peace of mind to accounting professionals.

Mobile Accessibility

In today’s mobile-centric world, professionals need the ability to manage their accounting tasks on the go. Mobile accessibility in professional accounting software allows accountants to access financial information from their smartphones or tablets, providing the flexibility and convenience they require.

Accounting software with mobile apps enables users to perform essential tasks such as tracking expenses, approving invoices, and accessing financial reports at their fingertips.

Blockchain Technology

Blockchain technology, renowned for its transparency and security, is gradually entering the accounting industry. With blockchain-enabled accounting software, transactions can be recorded and verified in real-time, enhancing trust and reducing fraud risks.

Blockchain technology also ensures the immutability of financial records, eliminating the need for manual audits and making it easier to track the origin and authenticity of financial data.

These future trends in professional accounting software have the potential to streamline financial processes, enhance accuracy, and empower accountants to focus on strategic decision-making. Stay ahead of the curve by embracing these emerging technologies and maximizing the efficiency of your accounting operations.

Case Studies

Case studies are a powerful way to understand the real-world impact of professional accounting software. By examining specific companies and their experiences with these tools, we can gain valuable insights into the benefits and advantages they offer. This article will delve into two compelling case studies that showcase how professional accounting software has transformed financial management and streamlined operations for companies A and B.

How Company A Transformed Their Financial Management With Professional Accounting Software

Company A, a growing tech startup, needed help to keep up with the increasing demands of its financial management processes. With a manual approach to accounting, they faced challenges such as tedious data entry, inaccuracies in financial reporting, and difficulty in generating timely insights for decision-making.

Recognizing the pressing need for a more efficient and reliable solution, Company A implemented professional accounting software. This software provided them with a centralized platform that streamlined their financial management process, from recording transactions to producing comprehensive financial statements.

The results were remarkable. With the adoption of professional accounting software, Company A experienced:

- Increased accuracy in financial reporting, minimizing the risk of errors and ensuring compliance with regulatory standards.

- Time savings through automated processes, reducing the need for manual data entry and enabling staff to focus on more value-added tasks.

- Improved visibility into financial data, allowing for better decision-making and strategic planning.

- Enhanced scalability as the company grew, with the software seamlessly accommodating their expanding financial needs.

Overall, the transformation in Company A’s financial management was remarkable. By embracing professional accounting software, they overcame their previous challenges and established a solid foundation for future growth and success.

Success Story: How Professional Accounting Software Streamlined Operations For Company B

Company B, a well-established manufacturing company, faced inefficiencies and bottlenecks in its operational processes. Their accounting department struggled with manual inventory management, outdated financial systems, and a need for real-time visibility into their financial performance.

Company B decided to implement professional accounting software to address these challenges, which revolutionized their operations. The software provided them with a comprehensive suite of tools to streamline their accounting and inventory management processes.

The impact was transformative. Through the implementation of professional accounting software, Company B achieved:

- Improved accuracy and reliability in inventory management, leading to reduced stockouts and fewer instances of excess inventory.

- Real-time visibility into financial performance, enabling timely decision-making and proactive planning.

- Efficient management of purchases and sales orders, optimizing the order fulfillment process.

- Automated financial reporting, saving time and resources while ensuring compliance with accounting standards.

Company B overcame operational inefficiencies by leveraging professional accounting software and significantly improved its financial management practices. The streamlining of their processes resulted in cost savings and positioned the company for sustained growth and competitiveness in their industry.

Additional Resources

Professional accounting software plays a crucial role in streamlining and automating financial processes in finance and business. It allows businesses to manage financial transactions efficiently, track expenses, generate reports, and maintain accurate records. However, finding the right accounting software for your business can take time and effort, given the multitude of options available in the market.

List Of Professional Accounting Software Providers

When it comes to professional accounting software providers, there are numerous options catering to businesses of all sizes and industries. Below is a curated list of some renowned accounting software providers:

| 1. QuickBooks Online2. Xero3. Zoho Books4. FreshBooks | 5. Sage Intacct6. NetSuite ERP7. Wave8. Microsoft Dynamics 365 |

Recommended Books And Articles About Financial Management

To gain a deeper understanding of financial management and enhance your knowledge in this field, you can refer to the following highly recommended books and articles:

- 1. “Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Mean” by Karen Berman and Joe Knight

- 2. “Accounting Made Simple: Accounting Explained in 100 Pages or Less” by Mike Piper

- 3. “Financial Management for Small Business” by Terry Dickey

- 4. “The Wall Street Journal Guide to Understanding Money and Investing” by Kenneth M. Morris and Virginia B. Morris

Additionally, you can browse through reputable online platforms such as Investopedia, Harvard Business Review, and Forbes for insightful financial management and accounting articles.

In conclusion, when choosing professional accounting software and expanding your financial management knowledge, exploring the list of providers and recommended books and articles mentioned above will prove beneficial. Finding the right resources can empower you to make informed decisions and efficiently manage your business’s finances, leading to long-term success.

Credit: www.netsuite.com

Frequently Asked Questions Of What Is Professional Accounting Software?

What Are The Three Types Of Accounting Software?

The three types of accounting software are:

- Sage Intacct is a cloud-based software for small to mid-sized businesses.

- QuickBooks is a popular choice for small businesses with invoicing and expense tracking features.

- SAP ERP Financials is a comprehensive software for large enterprises with advanced financial management capabilities.

What Do You Mean By Professional Accounting?

Professional accounting refers to maintaining and analyzing financial records for businesses and individuals. It involves bookkeeping, preparing financial statements, and ensuring compliance with accounting standards and regulations. Professional accountants provide accurate and reliable financial information to assist decision-making and planning.

What Is Considered Accounting Software?

Accounting software is a computer program that helps individuals or businesses manage financial transactions, record income and expenses, reconcile accounts, and generate financial reports. It provides efficiency, accuracy, and real-time insights for effective financial management.

What Do You Mean By Accounting Software?

Accounting software is a computer program that helps businesses and individuals manage financial transactions. It automates invoicing, payroll, tracking expenses, and generating reports. With its user-friendly interface and advanced features, accounting software streamlines financial processes, saves time, and improves accuracy.

Conclusion

To summarize, professional accounting software is crucial for businesses to manage their financial tasks efficiently. It streamlines processes like bookkeeping, invoicing, and tax preparation, saving time and reducing errors. Its cloud-based capabilities, real-time insights, and automation features empower businesses to make informed financial decisions and drive growth.

By integrating accounting software into their operations, businesses can gain a competitive advantage, increase productivity, and achieve financial goals. So, embrace the power of professional accounting software and take control of your finances today.