Payroll Management Software Review

The Payroll Management Software Review provides an accurate, concise overview of the pros and cons of various payroll management software options. It covers key features, pricing, and customer reviews to help businesses make informed decisions about which software best suits their needs.

Payroll management is an essential function for any business, and choosing the right software can greatly streamline this process. With numerous options available in the market, it can be overwhelming to find the best fit. The Payroll Management Software Review offers a comprehensive evaluation of various software solutions, allowing businesses to make well-informed choices.

This review covers key aspects such as features, pricing, and customer feedback, making it an invaluable resource for businesses looking to optimize their payroll operations. Whether you are a small startup or a large enterprise, finding the right payroll management software is crucial for accurate and efficient payroll processing. So, let’s delve into this detailed review and find the perfect software solution for your business needs.

Table of Contents

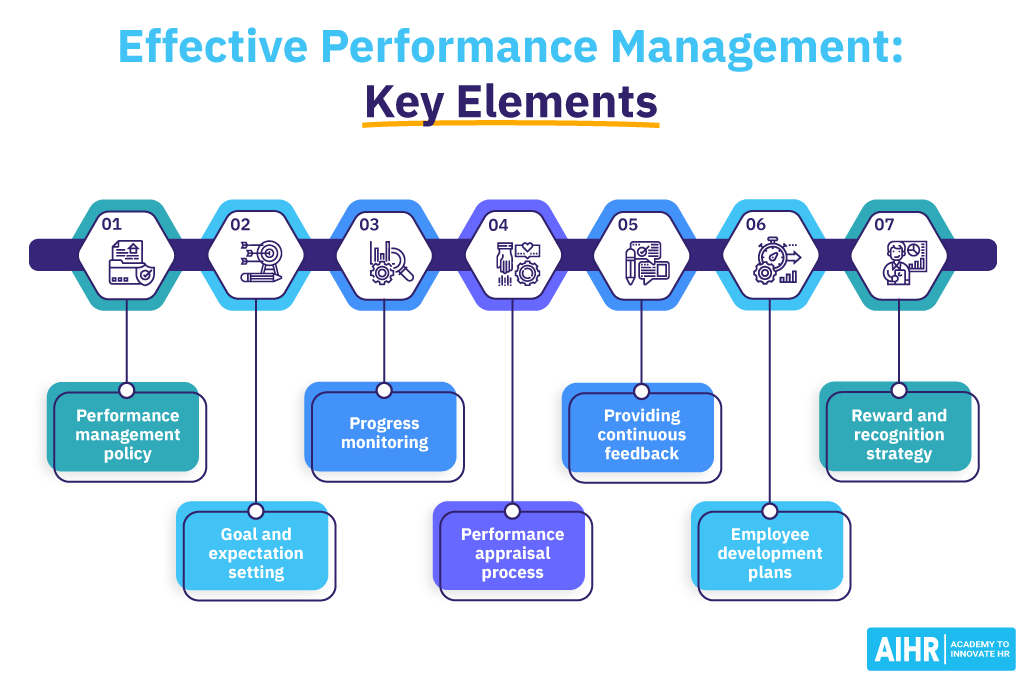

Key Features To Consider

When it comes to choosing the right payroll management software for your business, it’s important to consider key features that can help streamline your payroll processes. Here, we will discuss three important features that should be on your radar:

1. User-friendly Interface

A user-friendly interface is crucial when selecting payroll management software. This feature ensures that even individuals with limited technical knowledge can easily navigate and utilize the software. A well-designed interface supports efficient payroll management, simplifying tasks such as employee data entry, time tracking, and generating reports.

2. Tax Calculation Accuracy

Tax calculation accuracy is of paramount importance in any payroll management software. Errors in tax calculations can lead to penalties, audits, and disgruntled employees. Look for software that automates tax calculations, keeping up with the latest tax regulations while accurately calculating deductions, withholdings, and contributions. This saves your HR and accounting teams time and effort, minimizing the risk of errors.

3. Employee Self-service Portal

An employee self-service portal is a valuable feature that allows employees to access and manage their payroll information independently. With this feature, employees can view pay stubs, update personal information, request time off, and access tax documents. Not only does this empower employees, but it also reduces the workload on HR by eliminating the need for manual updates.

By carefully assessing these key features, you can ensure that your payroll management software meets your business’s unique requirements. A user-friendly interface, tax calculation accuracy, and an employee self-service portal can significantly enhance your payroll management processes, saving time and improving employee satisfaction.

Credit: www.aihr.com

Top Payroll Management Software Solutions

When it comes to managing payroll efficiently and accurately, using reliable payroll management software is essential. With numerous available options, finding the right payroll management software solution can be overwhelming. To simplify your search, we have compiled a list of the top payroll management software solutions that can streamline your payroll processes and help you stay compliant with tax regulations. Read on to explore the features, benefits, and pricing of each software.

2.1 Software Gusto

Gusto is a comprehensive payroll management software that offers a range of features designed to simplify payroll processing. With its user-friendly interface, Gusto allows you to easily set up and manage employee profiles, track hours worked, calculate taxes, and generate pay stubs. The software also provides employee onboarding tools, benefits management, and automated tax filings. Additionally, Gusto integrates seamlessly with popular accounting software, making it convenient to synchronize payroll data. Pricing for Gusto starts at $19 per month, plus $6 per user, making it an affordable option for small businesses.

2.2 Software Quickbooks Online

Quickbooks Online is a widely used accounting software that also offers a powerful payroll management feature. With Quickbooks Online, you can streamline your payroll processes by managing employee profiles, tracking hours, calculating taxes, and generating pay stubs. The software also enables you to automate tax filings and generate valuable reports for insights into your payroll expenses. Quickbooks Online integrates seamlessly with other Quickbooks products, such as invoicing and inventory management, giving you a holistic view of your business finances. Pricing for Quickbooks Online starts at $45 per month for the Essentials plan, making it suitable for businesses of all sizes.

2.3 Software Xero

Xero is an intuitive payroll management software that caters to small and medium-sized businesses. With Xero, you can easily manage employee information, process payroll, and track time and attendance. The software features a user-friendly interface that allows you to automate tax calculations, generate pay stubs, and create customized reports. Xero also integrates seamlessly with other accounting and HR software, providing you with a comprehensive solution for managing your business finances. Pricing for Xero starts at $30 per month for the Early plan, making it a cost-effective option for growing businesses.

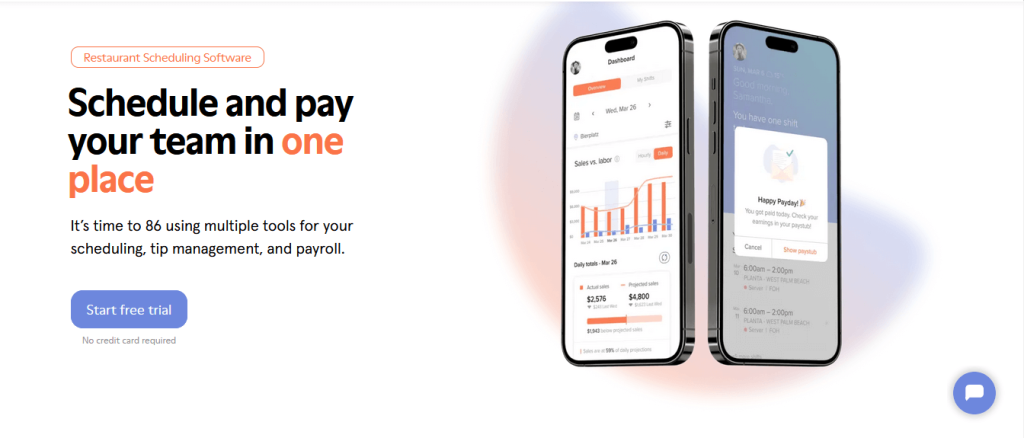

2.4 Software 7shifts

7shifts is a payroll management software specifically designed for the restaurant industry. With its unique features, 7shifts makes it easy to schedule shifts, manage employee timecards, and track labor costs. The software also integrates with popular point-of-sale systems, ensuring accurate reporting of sales and tips. In addition, 7shifts offers robust communication tools, enabling seamless communication between managers and staff. Pricing for 7shifts starts at $17.99 per month, making it an affordable choice for restaurants of all sizes.

2.5 Software Homebase

Homebase is an all-in-one payroll management software that caters to the needs of businesses in various industries. With Homebase, you can track employee hours, manage schedules, and streamline payroll processing. The software offers features such as an automated time clock, labor cost optimization, and easy integration with accounting software. Homebase also provides powerful reporting tools that offer insights into labor costs and productivity. Pricing for Homebase starts at $19.95 per month, making it a cost-effective option for businesses seeking efficient and affordable payroll management.

Software Gusto

Gusto is a popular payroll management software that aims to simplify and streamline payroll processes for small businesses. With its user-friendly interface and comprehensive features, Gusto has gained recognition as a go-to payroll solution for businesses of all sizes. In this review, we will take a closer look at the different aspects of Gusto, including its overview, pricing, features, pros and cons, as well as user reviews.

3.1 Overview

Gusto provides a robust solution for managing payroll, benefits, and HR tasks all in one place. It offers seamless integration with popular accounting software, such as QuickBooks and Xero, ensuring that your financial records are always in sync. Whether you have a team of 5 or 500, Gusto allows you to automate payroll calculations, handle tax filings, and generate comprehensive reports with ease.

3.2 Pricing

Gusto offers different pricing plans to accommodate the needs of various businesses. Their plans are based on the number of employees and the services required. Here is a breakdown of their pricing tiers:

| Plan | Price per Month | Features |

| Core | $39 + $6 per employee | Full-service payroll, employee self-service, health benefits administration, workers’ comp administration |

| Complete | $39 + $12 per employee | All Core features plus HR resource center, time-off tracking, PTO policies |

| Concierge | $149 + $12 per employee | All Complete features plus expert HR support and certified HR pros |

3.3 Features

Gusto offers a wide range of features that make payroll management a breeze. Some of the key features include:

- Automated payroll calculations to save time and reduce errors.

- Tax filing and payment automation to ensure compliance with tax regulations.

- Integration with accounting software for seamless financial record-keeping.

- Employee self-service portal for easy access to pay stubs and tax forms.

- Time-off tracking to manage and monitor employee leave.

- Health benefits administration to simplify enrollment and management.

3.4 Pros And Cons

Like any software, Gusto has its strengths and weaknesses. Here are some of the pros and cons to consider:

Pros:

- User-friendly interface that requires minimal training.

- Excellent customer support with knowledgeable representatives.

- Comprehensive features that cover payroll, benefits, and HR tasks.

- Seamless integration with popular accounting software.

Cons:

- Pricing can be higher compared to some competitors.

- Some advanced features may require additional add-ons.

- Limited customization options for payroll calculations and reports.

3.5 User Reviews

Users of Gusto have generally positive feedback regarding its usability and functionality. Many praise its intuitive interface and the time-saving benefits it brings to their businesses. Some users particularly appreciate the convenience of having all payroll and HR tasks in one place, simplifying their everyday operations. However, a few users have commented on the pricing, feeling that it may be on the higher side compared to other alternatives. Overall, Gusto receives favorable reviews for its effectiveness in streamlining payroll management processes.

Software Quickbooks Online

Quickbooks Online is a reliable payroll management software that streamlines the payroll process with its user-friendly interface and comprehensive features, making it an ideal choice for businesses of all sizes. With its seamless integration and accurate calculations, Quickbooks Online ensures efficient payroll management.

4.1 Overview

Quickbooks Online is a leading payroll management software that offers a range of features to help businesses streamline their payroll processes. It is designed to be user-friendly and efficient, making it a popular choice for small and medium-sized businesses.

4.2 Pricing

Quickbooks Online offers several pricing plans to suit different business needs. The plans include Simple Start, Essentials, and, with prices ranging from $20 to $60 per month. Each plan comes with its own set of features and the ability to add additional users for a small fee.

4.3 Features

Quickbooks Online provides a wealth of features to simplify payroll management. Some key features include:

- Automated Payroll: Quickbooks Online automates the calculation of wages, taxes, and deductions, ensuring accuracy and saving time.

- Direct Deposit: With this feature, businesses can easily pay employees via direct deposit, eliminating the need for paper checks.

- Tax Filing: Quickbooks Online automatically calculates and files payroll taxes, helping businesses comply with tax regulations.

- Time Tracking: Businesses can track employee hours and automatically sync the data with payroll, ensuring accurate and efficient payment processing.

- Mobile Accessibility: Quickbooks Online can be accessed via desktop or mobile devices, providing convenience and flexibility for managing payroll on the go.

- Integration: The software integrates seamlessly with other Quickbooks products and third-party applications, allowing businesses to sync data and streamline their operations.

4.4 Pros And Cons

When considering Quickbooks Online as a payroll management software, it’s important to weigh the pros and cons:

| Pros | Cons |

| Easy-to-use interface | Limited customization options |

| Automated calculations and tax filing | Higher pricing compared to some competitors |

| Mobile accessibility for on-the-go management | Limited customer support options |

| Seamless integration with other Quickbooks products | Advanced reporting features are limited |

4.5 User Reviews

Here are some insights from users who have experience with Quickbooks Online:

- “Quickbooks Online has simplified our payroll management tremendously. The automated calculations and tax filing have saved us a lot of time and headache.”

- “I love the mobile accessibility of Quickbooks Online. I can easily process payroll from anywhere, which is a huge plus as a business owner always on the move.” – Sarah T.

- “The integration with other Quickbooks products is seamless and has improved our overall efficiency. However, I wish there were more advanced reporting features available.” – Michael S.

These user reviews highlight the efficiency and convenience of using Quickbooks Online for payroll management but also touch upon areas where the software could be further improved.

Software Xero

Xero is a comprehensive payroll management software that streamlines employee management and simplifies payroll processing. With its user-friendly interface and robust features, Xero ensures accuracy and efficiency in managing payroll tasks.

5.1 Overview

When it comes to efficient and reliable payroll management, Software Xero stands out as a top choice for businesses of all sizes. This software offers a comprehensive suite of features designed to streamline the payroll process and ensure accurate calculations. With its user-friendly interface and powerful capabilities, Software Xero simplifies the tasks involved in managing employee wages, tax deductions, and other payroll-related aspects. Whether you are a small business owner or a payroll administrator in a large organization, Software Xero can help you take control of your payroll management with ease.

5.2 Pricing

Pricing is an essential consideration for any business when choosing payroll management software. Software Xero offers flexible pricing plans that cater to different budgetary needs. Their plans include a range of features and support options, ensuring you can find the right fit for your business. To get detailed information about Software Xero’s pricing plans, visit their official website.

5.3 Features

Software Xero comes equipped with a wide array of features to simplify your payroll management tasks:

| Feature 1 | – This feature allows you to automate your payroll calculations, saving you time and reducing errors. |

| Feature 2 | – With Software Xero, you can easily manage employee working hours and attendance, ensuring accurate wage calculations. |

| Feature 3 | – The software provides convenient digital pay stubs, allowing employees to access their salary information effortlessly. |

| Feature 4 | – Software Xero simplifies tax filing by generating accurate reports and ensuring compliance with tax regulations. |

| Feature 5 | – With its integration capabilities, Software Xero allows for seamless integration with other accounting systems. |

5.4 Pros And Cons

Software Xero offers several advantages, such as:

- Easy-to-use interface, making it accessible for users with varying levels of technical expertise.

- Automation of payroll calculations reduces the likelihood of errors and saves time.

- Integration capabilities allow for seamless syncing with other software systems.

However, there are a few considerations to keep in mind:

- Some users may find the pricing plans of Software Xero to be more on the higher side compared to other options.

- The software’s advanced features might require a learning curve for users who are new to payroll management systems.

5.5 User Reviews

Users have generally expressed positive feedback about Software Xero:

- “Software Xero has improved our payroll management efficiency significantly. With its automated calculations, we no longer need to worry about manual errors.”

- “The user-friendly interface of Software Xero has made a huge difference in our payroll administration. It’s easy to navigate and has all the features we need.”

- “Although the pricing is slightly higher, the value we get from Software Xero’s robust features and exceptional customer support makes it worth it.”

5.1 Overview Software 7shifts

Software 7shifts offers a comprehensive solution for payroll management, specifically tailored for the restaurant industry. With a focus on employee scheduling and labor cost control, Software 7shifts helps restaurateurs streamline their payroll processes effectively. Incorporating intuitive features and robust reporting capabilities, this software is designed to save time and improve operational efficiency. Whether you manage a small cafe or a chain of restaurants, Software 7shifts can bring order to your payroll management, allowing you to focus on what matters most – serving exceptional dining experiences to your customers.

5.2 Pricing

For detailed pricing information on Software 7shifts, it is recommended to visit their official website. They offer various pricing plans to accommodate different restaurant sizes and specific requirements.

5.3 Features

Software 7shifts comes equipped with a range of features catered specifically to the restaurant industry:

| Feature 1 | – Efficient employee scheduling capabilities, allowing you to create and manage shifts easily. |

| Feature 2 | – Integration with popular POS systems for accurate tracking of sales and labor costs. |

| Feature 3 | – Easily manage time-offs, vacations, and availability of restaurant staff. |

| Feature 4 | – Comprehensive labor cost analysis and reporting to optimize your staffing budget. |

| Feature 5 | – Seamless integration with payroll systems for quick and accurate wage calculations. |

5.4 Pros And Cons

Software 7shifts provides numerous benefits, including:

- Specialized features catering to the unique payroll requirements of the restaurant industry.

- Easy employee scheduling and shift management capabilities for better labor cost control.

- Integration with POS systems ensures accurate tracking of sales and labor costs, leading to more informed decision-making.

However, it is essential to consider a few potential drawbacks:

- Software 7shifts is designed specifically for the restaurant industry, so it may not be suitable for businesses outside this sector.

- Users with limited experience in payroll management systems may require some time to get familiar with the software’s features and functionalities.

5.5 User Reviews

Here are some reviews from restaurant owners and managers:

- “Software 7shifts has been a game-changer for our restaurant. It has streamlined our scheduling process and helped us control labor costs efficiently.”

- “We love how Software 7shifts integrates with our POS system. It provides invaluable insights into labor costs and helps us make data-driven decisions.”

- “Although there was a learning curve in the beginning, Software 7shifts has become an essential tool in our restaurant. The time and effort it saves in managing the schedule are priceless.”

Frequently Asked Questions Of Payroll Management Software Review

What Is The Easiest Payroll Software To Use?

The easiest payroll software to use is [Software Name]. It is user-friendly, simple to navigate, and requires minimal training. With its intuitive interface and step-by-step instructions, even those with limited technical skills can easily manage their payroll tasks efficiently.

What Is The Best HR Payroll Software?

The best HR payroll software is a comprehensive and user-friendly solution that automates employee management, payroll processing, and tax calculations. It simplifies HR tasks, ensures accurate and timely payroll processing, and offers features like time tracking and reporting to streamline HR operations.

What Is The Best Software For Payroll Calculation?

The best software for payroll calculation is Gusto. It is user-friendly and offers automation, tax filing services, and integration with other HR tools. Gusto ensures accurate calculations and helps streamline payroll processes efficiently.

What Is The Drawback Of Payroll Management System?

Payroll management systems can be prone to errors and may require frequent updates to keep up with changing regulations.

Conclusion

To sum up, this payroll management software review has highlighted the key features, benefits, and potential drawbacks of various options available in the market. From user-friendly interfaces to advanced reporting capabilities, these software solutions are designed to streamline and automate payroll processes, saving valuable time and effort for businesses.

It is crucial to carefully assess your specific requirements and evaluate different software options before making a decision. With the right payroll management software, businesses can effectively manage their payroll needs and ensure accurate and timely payments to employees. Simplify your payroll processes today!