Online Accounting Software USA

Online accounting software in the USA is a solution that allows businesses to manage their financial activities digitally, saving time and improving accuracy. With its cloud-based nature, businesses can access their financial data from anywhere in real-time, enabling efficient collaboration and decision-making.

Improved security, automated processes, and customizable features make online accounting software a valuable tool for businesses of all sizes. In today’s fast-paced and digitally-driven business world, managing financial activities efficiently is crucial for success. Traditional paper-based accounting methods are not only time-consuming but also prone to errors.

This is where online accounting software comes into play. With its user-friendly interface and advanced features, online accounting software has revolutionized the way businesses manage their financial activities. By shifting to a cloud-based platform, businesses in the USA can streamline their accounting processes, improve accuracy, and save valuable time. We will explore the benefits of using online accounting software in the USA and why it is a must-have tool for businesses in today’s competitive landscape.

Table of Contents

Benefits Of Online Accounting Software

Managing your finances and keeping track of your company’s financial health is crucial for any business. With the advancements in technology, the traditional way of managing accounts on spreadsheets or desktop accounting software is being replaced by online accounting software. Switching to online accounting software in the USA can bring numerous benefits to your business. Let’s explore some of the key advantages that online accounting software offers.

Increased Efficiency

One of the major advantages of using online accounting software is the increased efficiency it brings to your financial management processes. With automated features and real-time data synchronization, online accounting software streamlines tasks such as invoicing, expense tracking, and reporting, allowing your finance team to work more efficiently. By automating mundane and time-consuming tasks, you can focus on core business activities, driving productivity and saving valuable time.

Cost Savings

Online accounting software also offers significant cost savings compared to traditional accounting methods. With online solutions, there is no need to invest in expensive on-premises software or hardware infrastructure. Instead, you can simply subscribe to a cloud-based accounting software service for a monthly or annual fee, reducing the upfront costs and ongoing maintenance expenses. Additionally, you can eliminate the need for manual data entry and paperwork, resulting in reduced administrative costs.

Real-time Access To Financial Data

Having real-time access to your financial data is vital for making informed business decisions. Online accounting software provides you with a centralized and secure cloud platform where you can access your financial data anytime, anywhere, as long as you have an internet connection. Whether you are on the go, working from home, or in the office, you can instantly view your cash flow, sales figures, and other critical financial information. This real-time access ensures that you have the most up-to-date information at your fingertips, enabling you to make well-informed decisions promptly.

Key Features To Look For In Online Accounting Software

Choosing the right online accounting software for your business is crucial for efficient financial management. With the wide range of options available in the market, it’s essential to understand the key features to look for. From invoicing to payroll management, each feature plays a vital role in making your accounting tasks easier and more streamlined. In this blog post, we will explore the key features of online accounting software that you should consider before making a decision.

Invoicing

Efficient and accurate invoicing is a fundamental feature of any online accounting software. It allows you to create professional invoices, track payments, and manage overdue invoices with ease. Look for software that provides customizable invoice templates, options for recurring invoices, and the ability to accept online payments. These features will help you streamline your invoicing process and improve cash flow for your business.

Expense Tracking

Keeping track of expenses is essential for maintaining a clear financial picture of your business. Look for online accounting software that offers robust expense-tracking capabilities. It should allow you to easily capture and categorize expenses, attach receipts, and generate expense reports. With accurate expense tracking, you can make informed financial decisions and maximize your tax deductions.

Bank Reconciliation

Bank reconciliation is a necessary task to ensure the accuracy of your financial records. Look for software that offers seamless integration with your bank accounts. It should be able to automatically import and match transactions, saving you time and effort. With bank reconciliation features, you can easily identify any discrepancies and reconcile your accounts promptly.

Financial Reporting

Generating detailed and comprehensive financial reports is vital for analyzing the financial health of your business. Look for online accounting software that provides a wide range of financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports should be easy to understand, customizable, and accessible in real-time. With reliable financial reporting features, you can gain valuable insights into your business performance and make data-driven decisions.

Payroll Management

Payroll management can be complex and time-consuming, but with the right online accounting software, it can be simplified. Look for software that offers payroll management features, including automatic calculation of taxes and deductions, direct deposit capabilities, and employee self-service options. These features will help you streamline your payroll process, ensure compliance with payroll regulations, and keep your employees satisfied.

Popular Online Accounting Software In The USA

Online accounting software has become an essential tool for businesses, providing a convenient and efficient way to manage their financial transactions. In the USA, there are several popular online accounting software options available, each offering unique features and benefits. In this article, we will explore some of the most popular online accounting software in the USA to help you make an informed decision for your business needs.

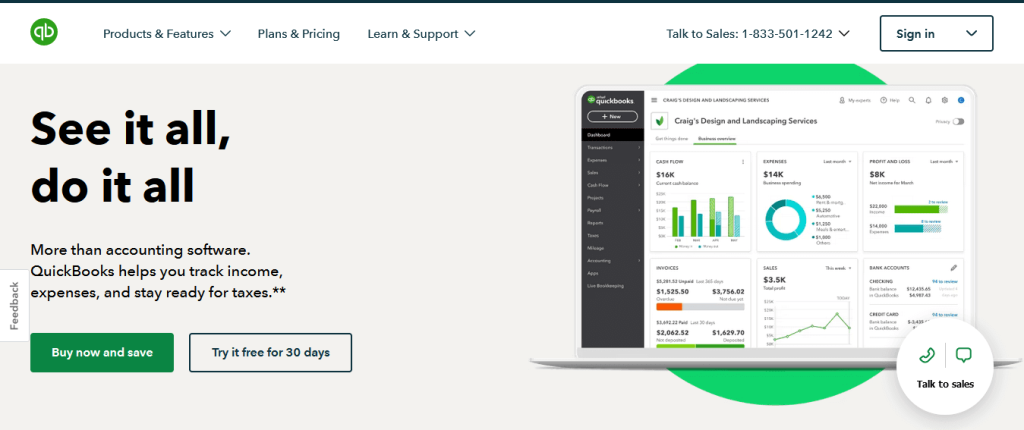

Quickbooks Online

QuickBooks Online is one of the most widely used online accounting software in the USA. With its user-friendly interface and robust features, QuickBooks Online provides a comprehensive solution for managing finances. It allows you to track income and expenses, create invoices, manage inventory, and generate financial reports. The software also integrates seamlessly with other QuickBooks products, making it a preferred choice for businesses of all sizes.

Xero

Xero is another popular online accounting software option for businesses in the USA. It offers a range of features designed to simplify financial management, including invoicing, bill payment, bank reconciliation, and expense tracking. Xero also provides real-time financial reporting, allowing you to monitor your business’s financial health with ease. With its intuitive interface and extensive integrations, Xero is a preferred choice for small businesses and accounting professionals.

Freshbooks

FreshBooks is an online accounting software designed specifically for small businesses and self-employed professionals. It offers features like invoicing, time tracking, expense management, and project management. FreshBooks also provides a user-friendly interface and mobile apps, allowing you to manage your finances on the go. With its extensive integrations and excellent customer support, FreshBooks is a trusted choice for businesses in the USA.

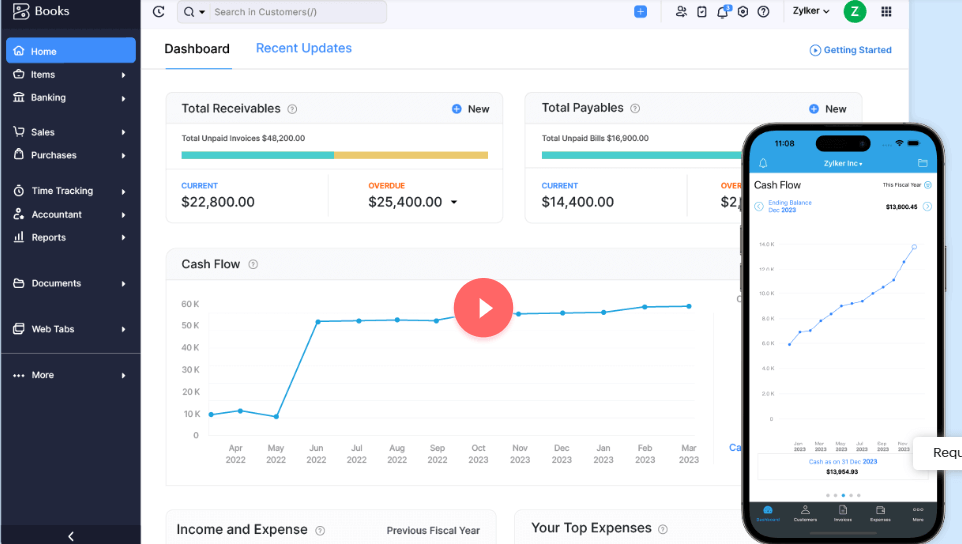

Zoho Books

Zoho Books is a cloud-based accounting software that offers a range of features designed to streamline financial management. It allows you to track income and expenses, create invoices, manage inventory, and reconcile bank accounts. Zoho Books also provides advanced automation capabilities, such as recurring transactions and automatic bank feeds. With its affordable pricing and customizable workflows, Zoho Books is a popular choice for small to medium-sized businesses in the USA.

Wave

Wave is a free, user-friendly online accounting software that caters to small businesses and freelancers in the USA. It offers features like invoicing, expense tracking, and financial reporting. Wave also provides integration with popular payment processors, allowing businesses to easily accept payments online. Although it may lack some advanced features compared to other options, Wave’s affordability and simplicity make it a popular choice for startups and solopreneurs.

Factors To Consider When Choosing Online Accounting Software

When selecting online accounting software in the USA, it is crucial to consider factors such as user-friendliness, integration with existing systems, security measures, scalability, and customer support. Making an informed choice ensures seamless financial management for your business.

Factors to Consider When Choosing Online Accounting Software In today’s digital age, online accounting software has revolutionized the way businesses handle their accounting needs. It offers flexibility, convenience, and efficiency, making it an essential tool for businesses of all sizes. However, with the multitude of options available in the market, choosing the right online accounting software for your business can be a daunting task. To help you make an informed decision, there are several important factors that you should consider. In this article, we will explore these factors in detail, including cost, scalability, integration, ease of use, and customer support.

Cost

One of the first factors to consider when choosing online accounting software is the cost. Not only should you consider the upfront cost of the software, but also any ongoing fees or subscriptions that may be required for certain features or updates. Evaluating your budget and determining what you are willing to invest in an accounting solution is important. Keep in mind that while some software may have a higher upfront cost, they may offer added features or superior functionality that could potentially save you time and money in the long run. Therefore, it’s crucial to strike a balance between your budget and the value that the software provides.

Scalability

As your business grows, so do your accounting needs. Therefore, it’s essential to choose an online accounting software that can scale along with your business. Consider the size and complexity of your organization, as well as your future growth projections. Look for software that offers scalability, allowing you to upgrade to a higher level of service or add additional users and features as your business expands. By choosing a scalable accounting solution, you can avoid the hassle of having to switch platforms or transfer your data to a new system down the line.

Integration

Another critical factor to consider is how the online accounting software integrates with your existing tools and systems. Seamless integration can save you time and eliminate the need for manual data entry, reducing the risk of errors and streamlining your processes. Look for software that offers integration with popular applications such as customer relationship management (CRM) software, e-commerce platforms, inventory management systems, and payroll solutions. This integration will ensure that your financial data is accurately synced across all your business systems, providing you with a comprehensive view of your organization’s financial health.

Ease Of Use

While functionality and features are important, the ease of use of online accounting software cannot be overlooked. The last thing you want is to invest in software that requires a steep learning curve and extensive training to get started. Look for a user-friendly interface and intuitive navigation that simplifies the accounting processes. Consider the level of technical expertise required to operate the software and evaluate whether it aligns with your team’s capabilities. Additionally, look for software that offers robust reporting and dashboard features, allowing you to monitor your financial performance at a glance.

Customer Support

Last but not least, customer support is a crucial aspect to consider when choosing online accounting software. Inevitably, you may encounter issues or have questions while using the software, so reliable and responsive customer support is vital. Look for a provider that offers various support channels such as phone, email, or live chat. Additionally, consider reading reviews or seeking recommendations from other users to gauge the level of customer support provided by the software company. In conclusion, when choosing online accounting software for your business, it’s essential to consider factors such as cost, scalability, integration, ease of use, and customer support. By thoroughly evaluating each of these factors, you can ensure that you select an online accounting software that aligns with your business needs and facilitates smooth financial management. So take your time, do your due diligence, and make an informed decision to set your business up for long-term success.

Online Accounting Software USA

Steps To Implement Online Accounting Software

Online accounting software has become an essential tool for businesses to streamline their financial processes and improve efficiency. Whether you’re a small business owner or a financial manager in a large company, implementing online accounting software can greatly benefit your organization.

Evaluate Your Business Needs

The first step in implementing online accounting software is to evaluate your business needs. Take the time to assess your current accounting practices and identify areas that could be improved. Consider factors such as the complexity of your financial transactions, the number of employees who will need access to the software, and any specific features or integrations that are important to your business.

Research And Compare Software Options

Once you have a clear understanding of your business needs, it’s time to research and compare software options. Look for online accounting software providers that offer features that align with your requirements. Read reviews and customer testimonials to get an idea of how the software performs in real-world scenarios. Consider factors such as ease of use, customer support, and the software’s track record in terms of security.

Choose And Purchase The Software

After thorough research, choose the online accounting software that best suits your business needs. Make sure the software provider offers the necessary features and integrations you require, and that it fits within your budget. Once you’ve decided, follow the software provider’s purchasing process to complete the transaction.

Migrate Data And Set Up The Software

Once you have purchased the online accounting software, it’s time to migrate your data and set up the software. Carefully review the instructions provided by the software provider and follow the steps to import your financial data into the new system. Take the time to configure the software settings according to your business preferences and ensure that all necessary integrations are properly set up.

Train Employees

Training your employees is a crucial step in the implementation process of online accounting software. Provide comprehensive training sessions to all relevant employees, ensuring they understand how to navigate the software, input data accurately, and utilize the available features. Encourage employees to ask questions and address any concerns they may have during the training sessions.

Regularly Review And Update

Implementing online accounting software is not a one-time task but an ongoing process. Regularly review and update the software to meet changing business needs and stay up-to-date with any system updates or new releases from the software provider. Continuously assess the software’s performance and effectiveness, making adjustments as necessary to ensure optimal functionality for your business.

Implementing online accounting software can be a game-changer for your business, improving efficiency, accuracy, and decision-making capabilities related to your financial processes. By following these steps, you’ll be well on your way to successfully implementing online accounting software and reaping the benefits it has to offer.

Security And Privacy Concerns With Online Accounting Software

When it comes to choosing the right online accounting software for your business, security, and privacy concerns should be at the forefront of your decision-making process. With sensitive financial information and potentially confidential client data being stored in the software, it is crucial to ensure that the platform you choose offers robust security measures to protect your data from unauthorized access and breaches. In this article, we will explore some key considerations in terms of security and privacy with online accounting software in the USA.

Data Encryption

Data encryption plays a vital role in safeguarding your information from unauthorized parties. Look for online accounting software that utilizes advanced encryption algorithms, such as 256-bit SSL encryption, to secure your data during transmission and while it is stored on their servers. This encryption ensures that even if data is intercepted, it will be virtually impossible for anyone to decode and access the sensitive information it contains.

Secure Login And User Permissions

Secure login protocols are another crucial aspect of online accounting software security. A reputable platform will offer multi-factor authentication options, such as using a combination of passwords, security questions, or even biometric verification. This helps mitigate the risk of unauthorized access to your account. Additionally, user permissions allow you to control and restrict access to specific features and data within the software. This means that only authorized individuals can view or modify certain financial data, minimizing the potential for data breaches.

Regular Software Updates

Regular software updates are essential to staying one step ahead of potential security vulnerabilities. Reputable online accounting software providers frequently release updates that not only introduce new features but also address any discovered security issues. These updates often include patches and fixes for known vulnerabilities, ensuring that your software remains secure and up to date. Choosing a provider that prioritizes and maintains a regular update schedule is essential for the long-term security of your financial data.

Backup And Disaster Recovery

Another critical aspect of security is ensuring that your data is backed up and can be recovered in the event of a disaster. Look for online accounting software that offers automated backup features and redundant storage systems. This way, your information is regularly backed up and stored in multiple secure locations, minimizing the risk of permanent data loss. Disaster recovery plans should also be in place, ensuring that even if a catastrophic event occurs, your data can be recovered and your business can continue to operate smoothly.

Common Challenges Of Using Online Accounting Software

Online accounting software has revolutionized the way businesses handle their financial transactions and manage their books. With its convenience and accessibility, it offers a host of benefits that traditional accounting methods simply cannot match. However, like any technological solution, it also poses its own set of challenges. To help you make an informed decision about whether online accounting software is right for your business, let’s explore some of the common challenges you may encounter when using this technology.

Learning Curve

While online accounting software offers immense advantages, it is important to note that there can be a learning curve associated with it. As with any new software, getting accustomed to the interface and features can take time. It might require a period of adjustment for you and your team to fully grasp the functionalities and navigate the software effectively. However, once you overcome this initial hurdle, you can reap the rewards of streamlined financial management.

Data Entry Errors

One of the key challenges that users face when using online accounting software is the potential for data entry errors. With manual data entry being a crucial part of the accounting process, there is always the possibility of human error. Inaccurate or incomplete data can have a ripple effect on your financial records, leading to misinformation and financial discrepancies. It is essential to exercise caution and implement thorough data validation processes to minimize the risk of errors.

Technical Issues

Just like any other software, online accounting software is not immune to technical issues. Unexpected system glitches, software updates, or compatibility problems may arise, hindering your workflow. These technical challenges can disrupt your accounting operations and potentially affect the accuracy and timeliness of your financial data. To mitigate these issues, it is advisable to regularly update your software, employ reliable IT support, and have contingency plans to keep your accounting process running smoothly.

Integration Challenges

Effective integration of online accounting software with other business applications is crucial for a seamless workflow. However, integrating accounting software with existing systems can present its own set of challenges. Different software platforms may have incompatible data formats or limited integration capabilities. This can result in data duplication, inconsistencies, and a disjointed workflow. Employing the expertise of a dedicated IT professional or using integration tools can help overcome these challenges and ensure smooth data synchronization across your business applications.

Online Accounting Software USA

Tips For Maximizing The Benefits Of Online Accounting Software

Maximize the benefits of online accounting software in the USA with these tips. Learn how to optimize your financial management and increase efficiency.

Automate Processes

One of the significant advantages of online accounting software is the ability to automate various processes. By automating routine tasks such as data entry, invoicing, and expense tracking, you can save valuable time and reduce the risk of human errors. Automating processes not only improves efficiency but also provides you with real-time financial information that can help you make informed business decisions.

Additionally, automation allows you to generate invoices and send payment reminders automatically, ensuring that you get paid on time and maintain a healthy cash flow. By leveraging the automation capabilities of your online accounting software, you can streamline your daily operations and focus on more strategic aspects of your business.

Regularly Reconcile Accounts

Regularly reconciling your accounts is crucial for maintaining accurate financial records. Reconciliation involves comparing your online accounting software’s records with your bank statements, credit card statements, and other financial documents to ensure that all transactions are recorded correctly.

By staying on top of reconciliation, you can identify any discrepancies, missing transactions, or potential fraud early on. This allows you to take immediate action, minimizing the impact on your financial health. Regular reconciliation also helps you gain a better understanding of your cash flow, outstanding payments, and overall financial performance.

Utilize Reporting Tools

Online accounting software typically offers a range of robust reporting tools that can provide valuable insights into your business finances. These tools allow you to generate financial statements, profit and loss reports, balance sheets, and cash flow statements with just a few clicks.

By regularly utilizing these reporting tools, you can identify trends, spot areas of improvement, and make informed strategic decisions. A comprehensive understanding of your financial data empowers you to set realistic goals, allocate resources effectively, and optimize your business operations for maximum profitability.

Stay Up To Date With Software Updates

To ensure that your online accounting software functions optimally and remains secure, it is crucial to stay up to date with software updates. Software updates often include bug fixes, performance improvements, and new features that can enhance your overall experience.

By regularly updating your software, you can benefit from the latest advancements and ensure that your accounting processes run smoothly. Additionally, staying up to date with updates helps protect your financial data from potential security threats, providing you with peace of mind.

Train Employees Effectively

Properly trained employees are essential for maximizing the benefits of online accounting software. Invest the time and resources to train your employees on how to use the software effectively, including how to input data accurately, generate reports, and utilize automation features.

Encourage your employees to ask questions, provide ongoing support, and offer refresher training sessions as needed. By ensuring that your team is well-versed in using the software, you can optimize its capabilities, minimize errors, and maintain the integrity of your financial data.

Frequently Asked Questions Of Online Accounting Software USA

Which Accounting Software Is Most Used In the USA?

The most commonly used accounting software in the USA is QuickBooks. It is widely utilized by many businesses for its user-friendly interface and comprehensive features. With its extensive functionality, QuickBooks has become the go-to choice for managing financial processes effectively.

What Is The Easiest Online Accounting Software?

Xero is the easiest online accounting software. It’s user-friendly, efficient, and suitable for small businesses.

How Much Is Accounting Software In the USA?

Accounting software prices in the USA vary based on features and providers. Prices can range from $10 to over $500 per month. Numerous options are available to cater to different business sizes and requirements. It is recommended to research and compare various software options to find one that suits your needs and budget.

Can I Do Bookkeeping Without Quickbooks?

Yes, bookkeeping can be done without QuickBooks. There are alternative software and manual methods available for bookkeeping tasks.

Conclusion

To sum up, online accounting software has revolutionized the way businesses in the USA manage their finances. With its user-friendly interface and numerous features, it provides efficiency and accuracy in bookkeeping, invoicing, and financial reporting. By automating tedious tasks, businesses can save time and focus on strategic decision-making.

Furthermore, the cloud-based nature of these platforms ensures easy access and data security. In this digital age, leveraging online accounting software has become essential for businesses looking to thrive and stay competitive.