Streamline Your Finances: Online Accounting Software for Nonprofit Organizations

Online accounting software for nonprofit organizations is designed to efficiently manage financial transactions and reporting. It helps streamline bookkeeping, budgeting, and financial planning for nonprofit entities, ensuring transparent and accurate financial records, and aiding in compliance with regulatory requirements.

Whether it’s tracking donations, managing grants, or producing financial statements, online accounting software provides nonprofit organizations with the tools they need to effectively manage their finances and focus on their mission. Nonprofit organizations play a vital role in society, addressing various social and environmental issues.

Like any other organization, nonprofits need effective accounting systems to manage their finances. However, given their unique needs and requirements, traditional accounting software may not be the best fit. Online accounting software specifically designed for nonprofit organizations offers tailored features that help ease financial management processes, ensuring accurate recording and reporting of financial data. We will explore the benefits and features of online accounting software for nonprofit organizations and its role in enhancing financial management for these entities. So, let’s delve into the world of online accounting software, and discover how it can support the financial health and sustainability of nonprofit organizations.

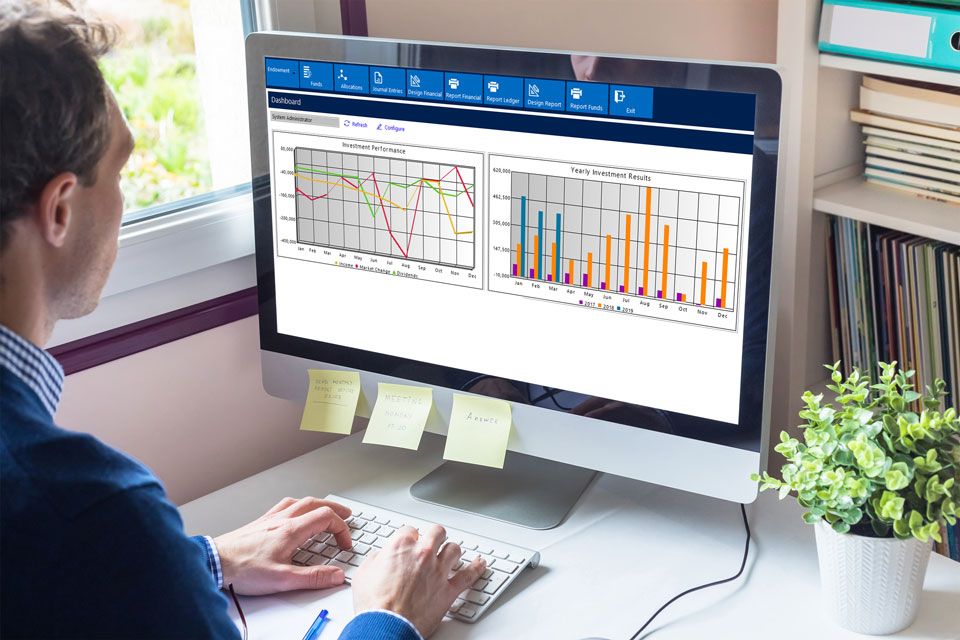

Credit: www.accufund.com

Table of Contents

Features Of Online Accounting Software

Online accounting software is a valuable tool for nonprofit organizations, offering a range of features designed to streamline financial management processes. With the right software, nonprofits can automate bookkeeping, manage fund accounting, track expenses, generate financial reports, facilitate donation management, and more. In this article, we will explore the key features of online accounting software that can greatly benefit nonprofit organizations.

Automated Bookkeeping

One of the primary features of online accounting software for nonprofit organizations is automated bookkeeping. With this functionality, organizations can eliminate the need for manual data entry, reducing the risk of errors and saving valuable time. By integrating with bank accounts and payment processors, the software can automatically download and categorize transactions, ensuring that financial records are accurate and up to date.

Fund Accounting

Fund accounting is another essential feature of online accounting software for nonprofits. Nonprofits often have multiple funds with specific restrictions that require careful tracking and reporting. Online accounting software allows organizations to manage these funds separately, ensuring compliance with donor restrictions and enabling transparent financial reporting. This feature provides nonprofits with a comprehensive view of their financial activities, making it easier to demonstrate accountability to stakeholders.

Donation Management

Donation management is a critical aspect of financial operations for nonprofit organizations. Online accounting software simplifies the process of managing donations by providing a centralized platform to track and record contributions. This feature allows nonprofits to generate tax receipts, send acknowledgments to donors, and monitor fundraising progress. With built-in reporting capabilities, organizations can gain insights into donation trends and make informed decisions to optimize their fundraising efforts.

Expense Tracking

Effective expense tracking is crucial for nonprofit organizations to ensure proper stewardship of resources. Online accounting software offers features that simplify expense tracking, allowing nonprofits to easily record and categorize expenses. With real-time visibility into spending, organizations can identify cost-saving opportunities and make informed decisions to allocate resources more efficiently. Additionally, expense tracking functionality enables nonprofits to track project-specific expenses, making it easier to manage grants and comply with donor requirements.

Financial Reporting

Accurate and timely financial reporting is essential for nonprofit organizations to track performance, meet regulatory requirements, and provide transparency to stakeholders. Online accounting software provides robust financial reporting capabilities, allowing nonprofits to generate customizable reports that offer insights into their financial health. With features like balance sheets, income statements, and cash flow statements, organizations can evaluate their financial position and make data-driven decisions to achieve their mission effectively.

Budgeting And Forecasting

Budgeting and forecasting features in online accounting software empower nonprofit organizations to plan their financial activities and set realistic goals. By creating budgets and monitoring actual spending against planned amounts, nonprofits can gain better control over their finances and identify areas for improvement. The software also facilitates forecasting by providing historical financial data and trends, allowing organizations to make accurate projections and plan for future expenses and fundraising initiatives.

Grant Management

For many nonprofit organizations, managing grants is a complex process that requires meticulous tracking of funds and compliance with specific grant requirements. Online accounting software offers grant management features that streamline this process, ensuring proper allocation and tracking of grant funds. With this functionality, nonprofits can monitor grant milestones, generate reports for donors, and demonstrate the impact of grant programs. This feature helps organizations adhere to grant restrictions, maintain transparency, and build strong relationships with grantors.

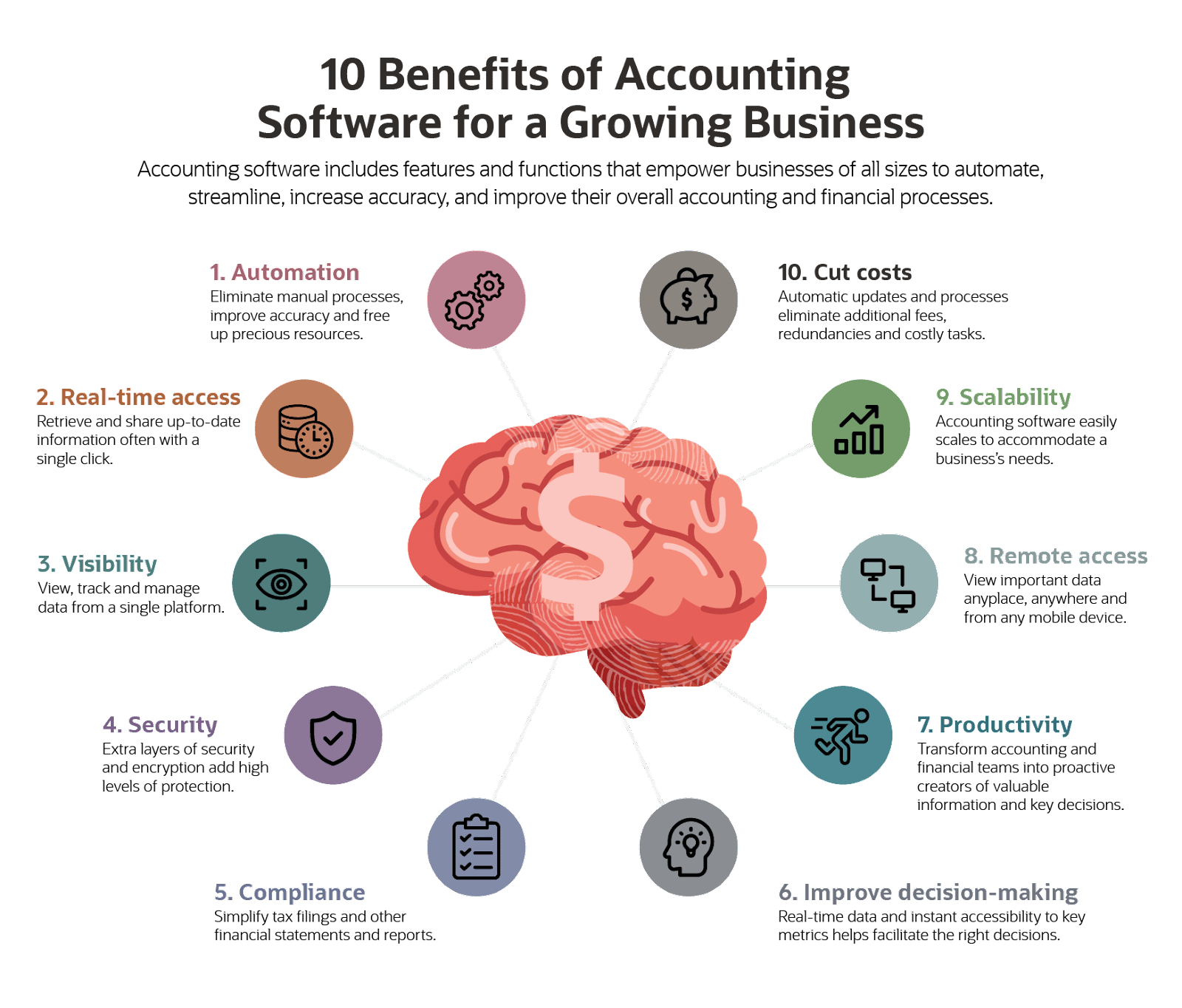

Benefits Of Online Accounting Software For Nonprofit Organizations

Benefits of Online Accounting Software for Nonprofit Organizations

Nonprofit organizations play a crucial role in serving the community and achieving social impact. To effectively manage their finances, these organizations need to adopt modern and efficient accounting practices. That’s where online accounting software for nonprofit organizations comes into play. This powerful tool offers numerous benefits that can revolutionize the financial management of nonprofits, saving time, enhancing transparency, and enabling effective fund and grant management.

Saves Time And Reduces Manual Work

One of the significant advantages of online accounting software for nonprofits is the amount of time it saves and the reduction in manual work. With manual bookkeeping, staff members have to spend countless hours on data entry, reconciliation, and generating reports. However, online accounting software automates these processes, allowing staff to focus on more critical tasks. Moreover, the software streamlines workflows, eliminating the need for repetitive data entry, and minimizes the chances of human error.

Improves Financial Transparency And Accountability

Financial transparency and accountability are paramount for nonprofit organizations. Donors, board members, and stakeholders demand clear visibility into how funds are allocated and utilized. Online accounting software provides the necessary transparency by maintaining accurate and up-to-date financial records. It enables organizations to generate detailed reports and statements, making it easier to share financial information with stakeholders. This transparency fosters trust, helps attract more donors, and ensures compliance with reporting requirements.

Enables Effective Fund Management

Fund management is a critical aspect of nonprofit organizations. They need to efficiently track and manage multiple sources of funding, such as grants, donations, and sponsorships. Online accounting software simplifies this process by allowing nonprofits to create separate funds, allocate expenses, and track income for each source. It provides real-time insights into fund balances, allowing organizations to make informed decisions and avoid overspending. By effectively managing funds, nonprofits can optimize their financial resources and focus on achieving their mission.

Streamlines Grant Management

Nonprofits heavily rely on grants to support their initiatives. Managing grants can be a complex and time-consuming task. However, online accounting software streamlines grant management by centralizing all relevant information. It allows organizations to track grant applications, monitor fund usage, and generate comprehensive reports on grant performance. By providing accurate and real-time grant data, the software helps nonprofits stay organized, comply with funding requirements, and build stronger relationships with grant providers.

Provides Real-time Financial Insights

Timely and accurate financial insights are essential for nonprofits to make informed decisions. Online accounting software offers real-time dashboards and reports that provide a clear overview of the organization’s financial health. It enables nonprofits to track income, expenses, and cash flow, facilitating budgeting and resource allocation. With real-time financial data at their fingertips, nonprofits can identify trends, spot potential issues, and take proactive measures to ensure financial stability.

Facilitates Collaboration Among Team Members

Collaboration is key to the success of nonprofit organizations. Online accounting software fosters collaboration by allowing multiple team members to access and work on financial data simultaneously. It eliminates the need for exchanging spreadsheets or waiting for updates, ensuring everyone has access to the latest information. This collaboration enhances efficiency, promotes transparency, and facilitates better decision-making within the organization.

Factors To Consider When Choosing Online Accounting Software

Choosing the right online accounting software is crucial for nonprofit organizations. Factors to consider include a user-friendly interface, customizable features, integration with other platforms, data security, and cost-effectiveness. Making an informed decision ensures streamlined financial management for nonprofit entities.

Factors to Consider when Choosing Online Accounting Software Choosing the right online accounting software is crucial for nonprofit organizations. It not only helps streamline financial operations but also ensures efficient management of funds. Before making a decision, consider these key factors to find the best software that meets the specific needs of your nonprofit organization.

Cost

The cost is always an important consideration for nonprofits when choosing online accounting software. While some software options come with a high price tag, others offer affordable solutions that can fit well within your budget. It’s essential to consider the features included in the software and evaluate whether they align with your organization’s requirements.

Scalability

As a nonprofit organization grows, its accounting needs evolve too. Therefore, scalability should be a vital factor when selecting online accounting software. Ensure that the software can accommodate your organization’s future growth and expansion without hindering its functionality or requiring a complete system overhaul.

Integration Capabilities

Your nonprofit organization may already use several software applications for different purposes. It is crucial to choose online accounting software that seamlessly integrates with these existing systems. The ability to synchronize data across multiple platforms can save time and minimize the risk of manual errors.

User-friendliness

Ease of use is an essential factor to consider when selecting online accounting software for nonprofits. Your staff may not have extensive accounting backgrounds, so a user-friendly interface is vital to avoid steep learning curves and minimize the chances of errors. Look for software that offers intuitive navigation and clear instructions to maximize productivity.

Data Security

Nonprofits handle sensitive financial data, including donor information, grant details, and payroll records. Therefore, ensuring the security of your organization’s data becomes paramount. Look for software that incorporates robust security measures, such as data encryption, secure servers, and regular backups. Additionally, check whether the software complies with industry-standard security certifications, such as SOC 2 Type II or ISO 27001.

Customer Support

Reliable customer support is crucial when it comes to online accounting software. Ensure that the software provider offers prompt and effective customer support to address any technical issues or questions that may arise. Look for providers that offer multiple support channels, such as phone, email, and live chat, to assist when needed. In conclusion, when choosing online accounting software for nonprofit organizations, it is vital to consider factors such as cost, scalability, integration capabilities, user-friendliness, data security, and customer support. By carefully evaluating these key aspects, you can find the perfect software solution to effectively manage your organization’s finances and ensure its long-term success.

Popular Online Accounting Software For Nonprofit Organizations

Managing finances is a critical aspect of running a nonprofit organization. It requires keeping track of donations, grants, expenses, and budgeting effectively. Traditional accounting methods can be time-consuming and prone to errors, making online accounting software a valuable tool for nonprofit organizations. These software solutions provide user-friendly interfaces, automation features, and real-time data access, allowing nonprofits to streamline their financial processes and focus on their mission. In this article, we’ll explore some popular online accounting software options specifically tailored for nonprofit organizations.

Quickbooks Nonprofit Edition

QuickBooks, the widely recognized accounting software, offers a specialized edition designed specifically for nonprofits. The QuickBooks Nonprofit Edition provides a comprehensive set of features to manage funds, grants, and donors while ensuring compliance with nonprofit accounting standards.

Key Features of QuickBooks Nonprofit Edition include:

- Tracking donations and grants

- Generating fundraising reports

- Managing budgets and expenses

- Monitoring and reporting on programs

- Automating recurring transactions

- Tracking and reimbursing expenses

With its intuitive interface and tailored features, QuickBooks Nonprofit Edition offers nonprofits a reliable solution for managing their finances effectively.

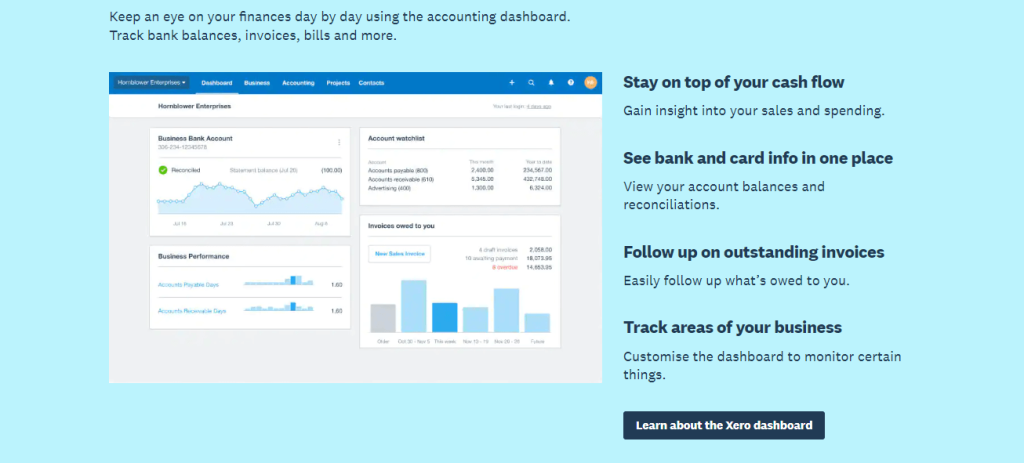

Xero

Xero is another popular online accounting software that provides a range of features suitable for nonprofit organizations. With its cloud-based platform, Xero allows nonprofits to manage their finances securely from anywhere, at any time. It offers several key features that help nonprofits streamline their accounting processes.

Key Features of Xero for nonprofits include:

- Tracking donations and grants

- Monitoring expenses and budgets

- Creating customized financial reports

- Sending professional invoices and receipts

- Integrating with other nonprofit tools and apps

- Collaborating with team members and stakeholders

Whether you’re a small nonprofit or a growing organization, Xero provides the flexibility and scalability required to meet your accounting needs.

Wave

Wave is a free online accounting software that offers a range of features suitable for nonprofits operating on a tight budget. While Wave may not have all the advanced features of paid solutions, it provides essential accounting functionalities without compromising on quality.

Key Features of Wave for nonprofits include:

- Tracking income and expenses

- Generating financial reports

- Invoicing and receipt management

- Accepting online payments

- Bank account reconciliation

- Collaboration with accountants and bookkeepers

Wave’s user-friendly interface and affordability make it an attractive option for nonprofits looking for a simple yet effective accounting solution.

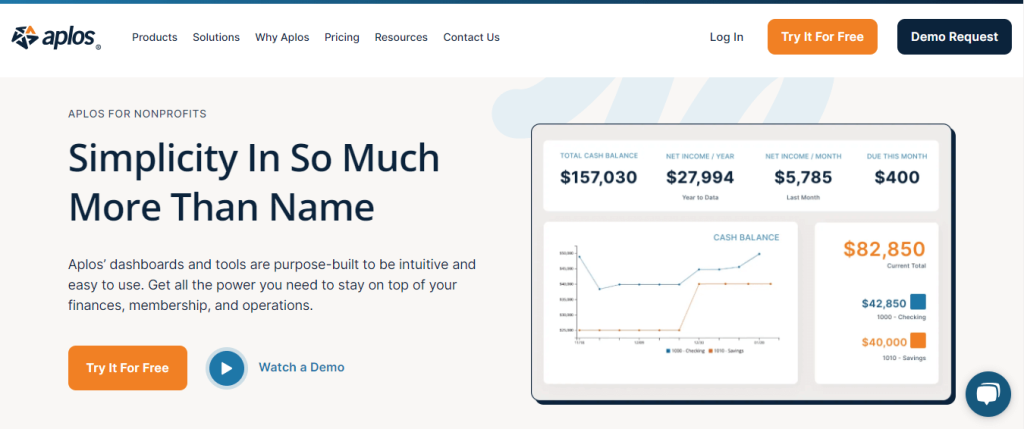

Aplos

Aplos is an online accounting software specifically built for nonprofits and churches. With its specialized features and robust financial management capabilities, Aplos helps nonprofit organizations stay compliant and organized.

Key Features of Aplos include:

- Donor management with tracking and reporting

- Effective fund accounting for nonprofits

- Bank integration and reconciliation

- Budgeting and expense management

- Generating reports for board members and funders

- Online donation processing

Aplos provides nonprofits with the tools they need to simplify their accounting processes and make informed financial decisions.

How To Implement Online Accounting Software For Nonprofit Organizations

Implementing online accounting software for nonprofit organizations can significantly streamline financial processes, enhance transparency, and improve overall efficiency. However, the success of this implementation relies heavily on careful planning and execution. In this section, we will explore the key steps involved in implementing online accounting software for nonprofit organizations to help you achieve a smooth transition and maximize the benefits for your organization.

Assessing Organizational Needs

Before embarking on the journey of implementing online accounting software, it is crucial to conduct a comprehensive assessment of your nonprofit organization’s needs. Begin by assessing your existing accounting processes, identifying pain points, and highlighting areas that could be improved with the help of technology. Consider factors such as the volume of transactions, reporting requirements, donor management, grant tracking, and compliance regulations.

Selecting The Right Software

Once you have identified your organization’s specific needs, the next step is to select the right accounting software. Take the time to research and evaluate different options based on criteria such as functionality, scalability, user-friendliness, reporting capabilities, and cost. Consider seeking recommendations from other nonprofit organizations and read online reviews to gain insights into the software’s performance and customer support.

Training Staff And Volunteers

It is essential to provide thorough training to your staff and volunteers to ensure a successful implementation of the online accounting software. Start by creating a training plan that covers the features and functionality of the software, as well as any specific modules relevant to your organization. Conduct hands-on training sessions, provide user manuals or video tutorials, and encourage Q&A sessions to address any queries or concerns. Additionally, consider appointing a dedicated staff member as the go-to person for technical support and troubleshooting.

Data Migration And Customization

Once you have selected the software and trained your team, the next step is to migrate your existing financial data into the new system. This is a critical process that requires careful attention to detail to ensure accurate and seamless data transfer. Work closely with the software vendor or IT professional to map out the data migration plan, conduct thorough testing, and verify the integrity of the migrated data. Additionally, customize the software settings and templates to align with your organization’s specific financial reporting and compliance requirements.

Monitoring And Evaluating Implementation

After deploying the online accounting software, it is important to continuously monitor and evaluate the implementation to identify any issues or areas that require improvement. Regularly review financial reports, track key performance indicators, and gather feedback from users to ensure the software is meeting your organization’s needs. Address any challenges or concerns promptly to optimize the software’s functionality and maximize its benefits.

Implementing online accounting software for nonprofit organizations can be a transformative step towards greater financial efficiency and accountability. By carefully assessing organizational needs, selecting the right software, providing adequate training, ensuring smooth data migration, and monitoring implementation, your nonprofit organization can harness the power of technology to streamline financial processes and focus more on furthering its mission.

Challenges In Implementing Online Accounting Software

Implementing online accounting software in nonprofit organizations brings several challenges that need to be addressed. Whether it’s resistance to change, data migration complexities, integration issues, or a lack of technical expertise, these obstacles must be overcome to successfully adopt and utilize the software’s benefits. Let’s explore each challenge in detail.

Resistance To Change

Nonprofit organizations, just like any other sector, may face resistance to change when introducing online accounting software. Employees who have been accustomed to traditional accounting methods may find it difficult to adapt to new processes and technologies. This resistance can stem from a fear of the unknown, concerns about job security, or even a lack of confidence in using digital tools.

To overcome this challenge, it is essential to emphasize the advantages of online accounting software. Highlight how it streamlines accounting processes, improves accuracy, and provides real-time access to financial data. Additionally, conducting training sessions and offering ongoing support can help employees feel more confident in using the software, ultimately reducing resistance and increasing adoption rates.

Data Migration Complexities

One of the key challenges in implementing online accounting software for nonprofit organizations is the complexity of migrating existing data. Nonprofits usually have years of financial data stored in various formats, including physical documents and spreadsheets. Migrating this data to a new system can be time-consuming and prone to errors if not executed properly.

To address this challenge, careful planning and organization are crucial. Start by conducting a thorough review of the existing data and determine what needs to be transferred to the new software. Create a detailed migration plan, ensuring data integrity and accuracy throughout the process. Consider seeking assistance from professionals experienced in data migration to minimize any potential risks and ensure a smooth transition.

Integration Issues

Integrating online accounting software with other systems, such as donor management or fundraising platforms, can be a challenge for nonprofit organizations. These integrations are vital for maintaining seamless data flow and avoiding manual duplication of information. However, compatibility issues and technical complexities may arise during the integration process.

To tackle this challenge, nonprofits should closely evaluate the compatibility and integration capabilities of the chosen accounting software before implementation. It is essential to choose a solution that offers seamless integration with other essential systems used by the organization. Working closely with the software provider and seeking their guidance during the integration process can help overcome any compatibility issues and ensure a smooth integration experience.

Lack Of Technical Expertise

Many nonprofit organizations face a lack of technical expertise when implementing online accounting software. Nonprofits often have limited IT resources or staff members with a primary focus on other areas, such as fundraising or program management. This can pose challenges when it comes to configuration, customization, and ongoing technical support for the accounting software.

To address this challenge, consider providing training and educational resources for staff members involved in using and managing the software. This can include comprehensive user manuals, video tutorials, or even on-site training sessions. In some cases, outsourcing technical support or seeking assistance from consultants with expertise in nonprofit accounting software can provide the necessary expertise to overcome any technical challenges.

In conclusion, implementing online accounting software in nonprofit organizations comes with its fair share of challenges. Overcoming resistance to change, addressing data migration complexities, resolving integration issues, and dealing with a lack of technical expertise are key aspects that require planning, support, and effective communication. By addressing these obstacles head-on, nonprofit organizations can unlock the full potential of online accounting software and streamline their financial management processes.

Best Practices For Using Online Accounting Software

Using online accounting software can greatly benefit nonprofit organizations by streamlining financial management processes and ensuring accurate records. To make the most of this technology, it is important to follow these best practices:

Regularly Reconcile Accounts

Reconciling your accounts regularly is crucial for maintaining accurate financial records. By comparing your online accounting software data with bank statements, you can identify and resolve any discrepancies or errors.

Backup Data Regularly

Backing up your data regularly is essential for protecting your nonprofit organization’s financial records. In the event of data loss or software failure, having a recent backup ensures that you can quickly restore your information and avoid potential disruptions.

Properly Categorize Income And Expenses

Properly categorizing income and expenses in your online accounting software helps you accurately track and analyze your organization’s financial activities. Assigning appropriate categories to transactions allows you to generate insightful reports and make informed financial decisions.

Keep Track Of Grant And Donor Information

Maintaining a comprehensive record of grant and donor information is vital for nonprofits. Your online accounting software should allow you to track grants, donations, and pledges, as well as generate reports that provide a clear overview of your organization’s funding sources.

Generate Accurate Financial Reports

Utilizing the reporting features of your online accounting software enables you to generate accurate and comprehensive financial reports. These reports provide crucial insights into your organization’s financial health, allowing you to assess budget performance, monitor expenses, and demonstrate transparency to stakeholders.

By adhering to these best practices, nonprofit organizations can effectively use online accounting software to streamline financial management processes, maintain accurate records, and make informed decisions for the betterment of their cause.

Case Studies Of Nonprofit Organizations Successfully Using Online Accounting Software

Implementing online accounting software for nonprofit organizations can be a game-changer, offering countless benefits in terms of efficiency, transparency, and financial management. Real-world examples of nonprofits that have leveraged these software solutions to their advantage serve as powerful testimonials of the effectiveness of these tools. In this article, we will explore three case studies of nonprofit organizations that have successfully utilized online accounting software in different ways.

Organization A: Streamlining Financial Processes

Organization A, a prominent environmental nonprofit, recognized the need to streamline its financial processes to ensure accurate recording and swift access to crucial financial data. By adopting online accounting software, they were able to digitize their receipts and invoices, eliminate manual data entry, and automate their expense tracking. This streamlined approach not only saved valuable time but also reduced the risk of human error.

The software’s advanced reporting features enabled Organization A to generate real-time financial reports, allowing them to closely monitor their expenditures and revenues. With access to up-to-date financial information, they were able to make informed decisions regarding budget allocations, identify cost-saving opportunities, and allocate resources more efficiently. The enhanced financial visibility also facilitated meaningful conversations with donors and supporters, leading to stronger relationships and increased confidence in Organization A’s financial management.

Organization B: Improving Transparency And Stakeholder Trust

In today’s highly transparent world, maintaining the trust of stakeholders, including donors, partners, and the public, is paramount for nonprofit organizations. Organization B, a local community services nonprofit, understood the importance of transparency to effectively engage their stakeholders. By implementing online accounting software, they were able to provide stakeholders with access to relevant financial information in a secure and user-friendly online portal.

The software’s customizable dashboards and reports allowed Organization B to present key financial data, such as funding sources, program expenditures, and financial ratios, in a visually appealing and easy-to-understand format. This transparent approach not only fostered trust but also empowered stakeholders to actively engage with the organization’s financial performance. By having greater visibility into how their contributions were being utilized, donors and partners felt more confident in continuing to support Organization B’s mission.

Organization C: Enhancing Grant Management Capabilities

For nonprofits heavily reliant on grant funding, effective grant management is crucial to ensuring funds are utilized as intended and reporting requirements are met. Organization C, a research-focused nonprofit, faced numerous challenges in managing its grants, from tracking grant-related expenses to meeting strict reporting deadlines. With the help of online accounting software, they were able to streamline their grant management processes.

By utilizing the software’s features such as project-specific budget tracking, expense categorization, and the ability to generate grant-specific financial reports, Organization C gained greater control and visibility over its grant funds. The software’s automated reminders and notifications ensured they never missed any reporting deadlines, enhancing their compliance and reducing the risk of penalties.

In addition, Organization C could easily generate comprehensive reports showcasing how grant funds were utilized, demonstrating accountability to their grantors. This comprehensive and accurate reporting significantly strengthened their relationships with funding agencies and positioned Organization C as a reliable grantee, increasing their chances of securing future grant funding.

Risks And Limitations Of Using Online Accounting Software

In today’s digital age, online accounting software has become an invaluable tool for nonprofit organizations. Its convenience, accessibility, and cost-effectiveness make it an appealing choice for managing financial transactions. However, like any technology, there are inherent risks and limitations that organizations should be aware of before fully embracing online accounting software. This section explores some of the potential challenges that nonprofit organizations may face when using such software.

System Vulnerabilities And Cyber Threats

One of the foremost concerns when utilizing online accounting software is the risk of system vulnerabilities and cyber threats. As organizations store their financial data in the cloud or on remote servers, they become susceptible to hackers, data breaches, and malware attacks. Safeguarding sensitive financial information is paramount, as even a single breach can compromise the organization’s reputation, donor trust, and financial stability.

Dependence On Internet Connection

An important aspect to consider when using online accounting software is the dependence on a stable internet connection. Organizations must ensure uninterrupted internet access to perform critical financial functions such as updating records, generating reports, and processing transactions. A slow or unreliable connection can significantly hamper day-to-day activities, leading to delays, frustration, and potential financial inaccuracies.

Learning Curve For New Users

While online accounting software offers numerous benefits, incorporating it into an organization’s workflow may require some adjustments. Nonprofit organizations must invest time and resources into training employees to effectively use the software. With features like automated tracking, inventory management, and budgeting tools, there is a learning curve associated with understanding the software’s functionalities and maximizing its potential.

Integrating With Legacy Systems

Another challenge organizations may encounter is integrating online accounting software with existing legacy systems. Nonprofits often have established accounting systems or software in place, and migrating to a new online platform may involve complexities. Ensuring seamless data transfer, compatibility, and synchronization between the old and new systems is crucial to maintaining accurate financial records and minimizing disruptions.

In summary, while online accounting software offers numerous advantages for nonprofit organizations, it is essential to be aware of the potential risks and limitations. By addressing system vulnerabilities, ensuring a dependable internet connection, providing adequate training for employees, and tackling system integration challenges, organizations can mitigate these issues and harness the full potential of online accounting software.

Future Trends In Online Accounting Software For Nonprofit Organizations

Future Trends in Online Accounting Software for Nonprofit Organizations

In today’s rapidly evolving digital landscape, online accounting software plays a fundamental role in managing financial operations for nonprofit organizations. With the continuous advancements in technology, several emerging trends are set to revolutionize the way nonprofit organizations handle their accounting processes. Let’s explore some of these exciting trends:

Artificial Intelligence And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are two game-changing technologies that are transforming the way accounting is conducted. AI-powered online accounting software can analyze vast amounts of financial data at an unprecedented speed, enabling nonprofit organizations to make data-driven decisions. From automating mundane tasks such as data entry and categorization to predicting potential financial risks, AI and ML are streamlining accounting processes, freeing up valuable time for nonprofit professionals to focus on their core mission.

Cloud-based Solutions

Migrating to cloud-based accounting solutions has become a popular choice for nonprofit organizations. With the cloud, financial data can be securely stored, accessed, and collaborated on from anywhere, at any time. Cloud-based software eliminates the need for costly infrastructure and hardware, providing a scalable and cost-effective solution for nonprofits with limited resources. Additionally, automatic software updates ensure that organizations are always utilizing the latest features and security protocols.

Enhanced Mobile Applications

In an increasingly mobile world, nonprofit organizations are embracing the power of mobile applications to manage their accounting needs. Enhanced mobile applications offer a user-friendly interface, allowing users to easily access financial data, track expenses, and generate reports on-the-go. These applications provide real-time insights into financial performance, empowering nonprofit professionals to make informed decisions, even when they are away from their desks.

Data Analytics And Visualization

Effective data analysis is crucial for nonprofit organizations to gain valuable insights into their financial health and performance. Advanced online accounting software now incorporates robust data analytics and visualization tools. With these tools, nonprofits can analyze financial data through customizable reports, charts, and graphs, generating detailed visual representations of their financial standing. This enables organizations to identify trends, detect anomalies, and optimize their financial strategies for future growth.

In conclusion, the future of online accounting software for nonprofit organizations is filled with exciting advancements. From AI-powered technologies to cloud-based solutions and enhanced mobile applications, these trends are poised to enhance the efficiency and effectiveness of nonprofit accounting. By leveraging these tools, nonprofit organizations can streamline their financial processes, make data-driven decisions, and ultimately maximize their impact on the communities they serve.

Credit: www.netsuite.com

Frequently Asked Questions For Online Accounting Software For Nonprofit Organizations

Is There An Online Version Of Quickbooks For Nonprofits?

Yes, there is an online version of QuickBooks specifically designed for nonprofits. It offers features tailored to meet the accounting needs of nonprofit organizations. The online platform allows for easy financial management, tracking of donations, and generation of specialized reports to comply with nonprofit reporting requirements.

What Is The Best Accounting Method For Nonprofit Organizations?

The best accounting method for nonprofit organizations is the accrual basis. It provides a more accurate picture of income and expenses, allowing for better financial management. This method matches revenues and expenses to the period they occur, providing clearer financial statements.

Is Quickbooks Online Good For Nonprofits?

Yes, QuickBooks Online is great for nonprofits. It helps with financial management, budgeting, and tracking donations. It’s easy to use, accessible from anywhere, and has customizable reports for nonprofit needs. Plus, it integrates with other software for streamlined operations.

Is Quicken Good for Nonprofits?

Yes, Quicken is suitable for non-profits as it helps manage finances efficiently and track expenses. It provides tools for budgeting, income, and expense tracking, and generates reports for financial analysis. Quicken also offers features to handle invoicing, payroll, and tax preparation.

Conclusion

To effectively manage the financial aspects of a nonprofit organization, online accounting software proves to be an indispensable tool. With its user-friendly interface and powerful features, it simplifies tasks such as tracking expenses, generating reports, and managing budgets. By streamlining these processes, nonprofit organizations can focus more on their mission and impact, ensuring that every dollar is utilized efficiently.

Embracing technology in accounting brings efficiency, accuracy, and transparency to nonprofit financial management, ultimately contributing to their success and sustainability.