Do You Need Accounting Software For Small Business?

Small businesses need accounting software for efficient financial management and accurate record-keeping. Effective financial management and accurate record-keeping are crucial for small businesses, and investing in accounting software is essential to achieve these goals.

With the right accounting software, businesses can streamline their financial processes, track income and expenses, manage invoices and payments, generate accurate financial reports, and ensure compliance with tax regulations. Accounting software saves time, eliminates manual errors, provides real-time insights into cash flow, and enables businesses to make informed financial decisions.

Moreover, it minimizes the need for hiring a dedicated accountant and reduces costs in the long run. Therefore, accounting software is valuable for small businesses to enhance their financial efficiency and maintain accurate financial records.

Table of Contents

Benefits Of Accounting Software

Accounting software offers numerous benefits for small businesses. It streamlines financial tasks, improves accuracy, saves time, provides real-time data, and supports informed decision-making. Embracing accounting software can significantly enhance your business’s financial management and overall productivity.

Automated Bookkeeping

One of the key benefits of using accounting software for your small business is the ability to automate your bookkeeping processes. With manual bookkeeping, business owners and accountants often spend countless hours entering data, reconciling accounts, and creating financial statements. This can be a time-consuming and error-prone task.

However, with accounting software, you can simplify and automate these processes. The software allows you to input transactions, generate invoices, and track expenses with just a few clicks. The software also automatically reconciles your bank accounts, making it easier to spot errors or discrepancies. By automating your bookkeeping tasks, you save time and reduce the risk of errors that can lead to financial mismanagement or compliance issues.

Streamlined Financial Processes

Accounting software brings efficiency and streamlines financial processes for small businesses. With manual accounting, keeping track of all the economic activities can be challenging, especially as your business grows. This can lead to missed payments, delayed invoicing, and difficulty tracking receivables and payables.

However, accounting software provides a centralized platform where you can manage all your financial processes in one place. You can easily create and send custom invoices, track incoming and outgoing payments, and generate financial reports. The software also allows you to set up automatic reminders for overdue payments, helping you improve cash flow management. By streamlining your financial processes, accounting software enables you to stay organized, improves efficiency, and ensures you stay on top of your finances.

Accurate And Real-time Financial Information

Having accurate and real-time financial information is crucial for making informed business decisions. With proper accounting tools, business owners can rely on updated and complete data, leading to correct financial analysis, missed opportunities, and poor decision-making.

Accounting software provides you with up-to-date and accurate financial information. By integrating with your bank accounts and other financial platforms, the software automatically tracks and categorizes your income and expenses in real-time. You can generate financial reports instantly, such as profit and loss statements, balance sheets, and cash flow statements. This gives you a clear and comprehensive view of your business’s financial health, allowing you to make data-driven decisions.

Moreover, accounting software allows you to easily share financial information with stakeholders, such as shareholders, investors, or tax authorities. This improves transparency and helps you build trust with external parties. With accurate and real-time financial information, you can confidently navigate your small business’s economic landscape and make sound strategic decisions to drive growth and success.

Features To Consider

Considering the needs of your small business, it is crucial to evaluate the features of accounting software. Opt for a solution that offers essential features like invoicing, expense tracking, financial reporting, and integration options to streamline your financial management effectively.

Invoicing And Billing Functionality

One of the essential features to consider when choosing accounting software for your small business is invoicing and billing functionality. This feature allows you to streamline and automate your invoicing process, making issuing invoices to clients and receiving payments easier. With invoicing and billing functionality, you can create professional-looking invoices, add customized branding, and track outstanding payments. The software lets you send invoices via email or print them if necessary, providing convenience and flexibility.

Expense Tracking And Management

Expense tracking and management is another critical feature to look for in accounting software. Keeping track of your business expenses is crucial for proper financial management. The software should allow you to capture and categorize expenses effectively, helping you monitor your spending and identify areas where you can cut costs. Look for a solution that enables you to connect your bank accounts or credit cards for manageable expense importing and reconciliation. This feature can save you time and effort by automating the process.

Inventory Management

Inventory management is an essential feature for businesses that deal with products. Effective inventory management ensures you have the right amount of stock on hand, preventing overstocking or understocking situations. The software should enable you to track your inventory levels, record sales, and purchase orders, and generate reports on product availability. You can make informed decisions about restocking, pricing, and overall product management with accurate inventory data.

Summary

When choosing accounting software for your small business, it’s essential to consider specific features that will suit your needs. Invoicing and billing functionality simplifies the process of sending invoices and receiving payments. Expense tracking and management streamline your financial records, helping you stay organized and identify cost-saving opportunities. Inventory management ensures you have the right amount of products in stock, preventing stockouts or excessive inventory. Assess your business requirements and select the accounting software with the right features to support your business growth.

Cost Considerations

When considering cost implications for your small business, evaluating the necessity of accounting software is essential. Understanding the benefits and matching them with your budget will help determine if it’s a worthwhile investment.

One-time Purchase Vs. Subscription-based Models

When considering accounting software for your small business, one of the vital cost considerations is whether to opt for a one-time purchase or a subscription-based model. Each option comes with its advantages and drawbacks.

A one-time purchase entails buying the software outright and then using it indefinitely. This can be a preferred choice for businesses with a stable budget and who want to avoid recurring monthly expenses. Additionally, with a one-time purchase, you can own the software outright, giving you complete control over its usage and customizability.

On the other hand, a subscription-based model offers the flexibility of paying for the software monthly or annually. This can benefit small businesses that prefer lower upfront costs and the ability to scale their software usage as their needs change. Furthermore, subscription-based models often include regular updates and support, ensuring your software is always up to date and functioning optimally.

Additional Fees Or Hidden Costs

When evaluating accounting software options, it’s crucial to consider any additional fees or hidden costs associated with the software. While some software providers offer transparent pricing structures, others may include extra charges for features such as advanced reporting, payroll management, or customer support.

To avoid any unpleasant surprises, it’s essential to carefully review the pricing details and terms of service. Look for software providers that clearly outline their pricing structure and ensure that no unexpected costs could impact your budget.

| Types of fees to consider: | |

| Setup fees | These fees are charged for initial software installation or configuration. |

| Transaction fees | Some accounting software may charge fees for each transaction processed through the system. |

| Additional module fees | If you require additional functionalities or modules, they may come at an extra cost. |

| Support fees | Some software providers charge for customer support beyond essential assistance. |

Choosing The Right Accounting Software For Your Business

While cost considerations play a significant role in selecting accounting software, it’s also essential to assess your business’s specific needs and requirements. Evaluate whether the software aligns with your workflow, integrates seamlessly with your existing systems, and offers the necessary features to handle your financial operations efficiently.

Remember to look beyond the price tag and focus on the overall value that the accounting software can bring to your small business.

Credit: www.freshbooks.com

Choosing The Right Accounting Software

When managing your small business’s finances, having the right accounting software can make all the difference. With so many options available, choosing the perfect fit for your needs can be overwhelming. In this section, we will discuss the key factors to consider when selecting accounting software that not only meets your current requirements but also has the potential to support your future growth.

Assessing Business Needs

Before diving into the sea of accounting software options, it is essential to assess your business needs. Take the time to evaluate your financial processes, such as invoicing, budgeting, and tax preparation. Identify any pain points or areas that are time-consuming or prone to errors. Determining your business requirements will help narrow your search for the right accounting software.

Scalability And Future Growth

As a small business owner, you undoubtedly have big plans for the future. When selecting accounting software, scalability and future growth potential are crucial considerations. The software you choose should accommodate your business as it expands. Look for features such as multi-user access, advanced reporting options, and the ability to handle larger volumes of transactions. Investing in scalable accounting software now will save you the hassle of switching to a different system as your business grows.

Integration With Other Business Tools

Your accounting software should be manageable but integrate seamlessly with other essential business tools. This integration eliminates manual data entry and ensures accurate and up-to-date financial information. Look for software that offers integrations with popular business tools such as customer relationship management (CRM), payment gateways, and e-commerce platforms. Integration streamlines your financial management processes, saving you time and effort.

Choosing the right accounting software is a decision that can significantly impact the financial well-being of your small business. By carefully considering your business needs, scalability, and integration requirements, you can select a software solution that sets the stage for streamlined, efficient, and error-free financial management.

Types Of Accounting Software

If you are a small business owner, you understand the importance of keeping your finances in check. Managing your accounts manually can be time-consuming and prone to errors in today’s digital world. That’s where accounting software comes in. With the right accounting software, you can streamline your financial processes and make informed decisions. This blog post will discuss the different types of accounting software available so you can choose the one that best suits your business needs.

Cloud-based Vs Desktop Accounting Software

Regarding accounting software, one of the first decisions you must make is whether to go for cloud-based or desktop accounting software. Let’s take a closer look at each option.

Cloud-based Accounting Software

Cloud-based accounting software is hosted on remote servers and accessed over the Internet. This type of software offers several advantages:

- It allows you to access your financial data anytime, anywhere, as long as you have an internet connection. This flexibility is especially beneficial if you have a distributed team or need to work on your accounts while on the go.

- Cloud-based software usually offers automatic updates, so you don’t have to manually install the latest version.

- Cloud-based accounting software often has built-in data backup and recovery mechanisms, ensuring your data is safe and secure.

Desktop Accounting Software

On the other hand, desktop accounting software is installed on your local computer and operated offline. This type of software offers certain advantages as well. Firstly, you have complete control over your data stored locally on your computer. This can be particularly important if you have strict data security requirements or if you prefer to keep your financial information within your premises. Secondly, desktop software usually offers a one-time upfront cost compared to cloud-based software, which requires monthly or annual subscriptions. If you are looking for a more cost-effective solution and don’t need remote access to your accounts, desktop accounting software might be the right choice.

Industry-specific Accounting Software

Another factor to consider when selecting accounting software for your small business is whether you require industry-specific features. Specific industries have unique accounting requirements, and generic accounting software may only fulfill some of your needs. That’s where industry-specific accounting software comes in.

Industry-specific accounting software is tailored to meet the particular needs of a specific industry. For example, if you run a restaurant, you might need software that includes features like menu costing, inventory management, and recipe management. Similarly, in the construction industry, you might require software with functionalities such as job costing, change order tracking, and project management.

Choosing industry-specific accounting software allows you to automate industry-specific processes, save time, and ensure accurate financial reporting.

Choosing the right accounting software for your small business can significantly impact your financial management. Whether you opt for cloud-based or desktop software and need industry-specific functionalities, assessing your business needs and selecting a solution that fits your requirements is essential. Investing in the right accounting software allows you to streamline your financial processes and focus on growing your business.

Accounting Software For Small Business

You know the importance of keeping your finances in order if you’re a small business owner. One of the most effective ways to do this is by using accounting software for small business. Accounting software offers a range of benefits that can streamline your financial management processes and help you make better business decisions. This section will discuss three key factors that make accounting software a valuable tool for your small business: the simplified and user-friendly interface, affordability and pricing options, and support and customer service.

Simplified And User-friendly Interface

Accounting software is designed to be user-friendly and straightforward, even for those without an accounting background. The interface is intuitive, making it easy to navigate and perform various financial tasks. Whether you need to input income and expenses, track inventory, generate reports, or manage payroll, the software simplifies these processes with step-by-step instructions and user-friendly menus.

Affordability And Pricing Options

One of the significant advantages of accounting software for small businesses is its affordability. There are various pricing options available to suit different budgets and needs. Many software providers offer different tiers of plans, allowing you to choose the features and functionality that are most relevant to your business. This means you don’t have to pay for unnecessary features, making it a cost-effective solution for small business owners.

Support And Customer Service

When you choose accounting software for your small business, you also gain access to dedicated support and customer service. Most software providers offer technical assistance through various channels, such as phone, email, or live chat. This ensures that any issues or questions can be resolved quickly, minimizing disruption to your business operations. Additionally, software providers often provide regular updates and improvements so you can stay current with the latest features and enhancements.

Common Mistakes To Avoid

Choosing the right accounting software for your small business can significantly streamline your financial processes and help you stay on top of your numbers. However, making inevitable mistakes in the software selection process can lead to inefficiencies and setbacks. To ensure you choose the best accounting software for your needs, it’s crucial to avoid these common mistakes:

Choosing Overly Complex Software

One of small business owners’ biggest mistakes when selecting accounting software is opting for overly complex solutions. While robust software may seem appealing with its numerous features and capabilities, navigating through the complexities can become time-consuming and frustrating if you need a background in accounting or finance.

When choosing accounting software, prioritize simplicity and user-friendliness. Look for intuitive interfaces and workflows that allow you to input and access your financial data effortlessly. Streamlined software saves time and reduces the learning curve for you and your team, leading to faster onboarding and increased efficiency.

Ignoring Security Measures

Protecting your financial data should be a top priority when choosing accounting software. Ignoring security measures can expose your business to data breaches, unauthorized access, or loss of critical information. It’s crucial to ensure that your chosen software has robust security features.

Look for software with encryption protocols, regular data backups, and permissions-based access controls. Additionally, compliance with industry security standards such as PCI-DSS (Payment Card Industry Data Security Standard) may be essential if your business handles sensitive customer information. Prioritizing the security of your financial data helps safeguard your business’s integrity and build trust with your customers.

Not Considering Scalability

While your small business may have limited accounting needs currently, it’s essential to consider scalability when selecting accounting software. As your business grows, you’ll likely encounter increased transaction volumes, a more extensive customer base, and complex financial processes.

Choosing software to adapt and support your business’s growth is crucial to avoid outgrowing your accounting system too quickly. Look for software with customizable features, automated processes, and integration capabilities with other business tools. Scalable accounting software allows you to handle growing demands seamlessly, saving you the hassle of switching systems or investing in additional software.

Avoiding these common mistakes when selecting accounting software for your small business ensures that you choose a solution that fits your needs, boosts productivity, and helps you stay on top of your finances. By selecting user-friendly, secure, and scalable software, you can focus on growing your business while efficiently managing your financial tasks.

Credit: www.runn.io

Implementing Accounting Software

Considering the needs of your small business, implementing accounting software can streamline financial management tasks effectively and efficiently. With its user-friendly interface and automated features, accounting software can help you track expenses, generate financial reports, and ensure accurate bookkeeping, saving you time and effort.

Data Migration And Setup

Implementing accounting software for your small business involves several essential steps to ensure smooth operations. One of the first considerations is data migration and setup. It is necessary to transfer all your existing financial data into the new software accurately and securely. During this process, it’s crucial to have a data backup to avoid any loss or misplacement. The accounting software will provide you with guidelines on how to migrate your data successfully. Additionally, the software should be able to import data from various file formats such as Excel, CSV, or QuickBooks.

Staff Training And Support

After the data migration and setup are complete, the next step is to provide adequate training and support to your staff. While accounting software is designed to be user-friendly, it requires some understanding and familiarity to fully utilize its features and functionalities. Training sessions can be held in person or through online tutorials and webinars. Ensuring that your staff members feel confident and comfortable using the software is essential. Offering ongoing support is also crucial, as your staff may encounter occasional challenges or have questions that must be addressed promptly.

Integrating Software With Existing Systems

When implementing accounting software, it is essential to consider how to integrate it with your existing systems. This ensures a seamless flow of information and eliminates the need for manual data entry or redundant processes. Integration can include linking the accounting software with your customer relationship management (CRM) system, inventory management system, or point of sale (POS) system. This allows for real-time updates and improved accuracy in financial reporting. By integrating your accounting software with existing systems, you can streamline operations, reduce errors, and save valuable time for your business. In conclusion, implementing accounting software for your small business involves critical steps such as data migration and setup, staff training and support, and integrating the software with existing systems. By following these steps and considering the specific needs of your business, you can optimize the software’s functionality and improve your overall financial management.

Overcoming Potential Challenges

Overcoming potential challenges in managing your small business finances? Accounting software could be the solution for efficient and accurate bookkeeping, saving you time and reducing errors. Stay on top of your financial obligations with ease.

Implementing accounting software for your small business has its fair share of challenges. However, these obstacles can be overcome with the right strategies to revolutionize your financial processes. Here, we discuss some common hurdles and offer practical solutions to ensure a smooth and hassle-free transition to accounting software.

Resistance To Change

One of the main challenges businesses face when introducing accounting software is resistance to change. Employees might be comfortable with traditional accounting methods or fear the learning curve associated with new technology. However, embracing accounting software brings numerous advantages that outweigh initial apprehensions.

To address resistance to change, it is crucial to communicate the benefits of accounting software to your team. Highlight the time savings, improved accuracy, and streamlined workflows resulting from such software. Provide proper training and support to help employees feel confident and capable of navigating the new system. Open channels for feedback and address concerns promptly, ensuring everyone feels valued and involved throughout the transition.

Data Entry Errors

Data entry errors can be a significant stumbling block in accounting. Manual processes are prone to human error, severely affecting your financial records. However, employing accounting software significantly reduces the likelihood of data entry mistakes.

With accounting software, automated data entry and validation mechanisms ensure accuracy and consistency in your financial information. The chances of errors are dramatically minimized by eliminating the need for manual data entry. Additionally, software features such as pre-set templates and drop-down menus further assist in error prevention, guaranteeing reliable financial data.

Software Compatibility Issues

Compatibility issues can arise When implementing accounting software, particularly if you have other software systems in place. Incompatibility can cause integration problems, leading to data consistency and wasted time. However, these issues can be effectively managed with careful planning and guidance.

Before selecting an accounting software, conduct thorough research and consult with experts to ensure compatibility with your existing systems. Look for software with integration capabilities and a proven track record for harmonious collaborations. In some cases, it may be necessary to enlist the assistance of an IT professional to ensure a seamless integration process that meets your specific business needs.

Adopting accounting software for your small business should not be hindered by potential challenges. By addressing resistance to change, mitigating data entry errors, and adequately managing software compatibility, you can overcome these obstacles and make a successful transition. Embrace the advantages of accounting software and empower your business to reach new heights in financial management.

Popular Accounting Software For Small Businesses

When it comes to managing your small business’s finances, having the right accounting software can make all the difference. With the many options available, finding the perfect fit for your business can be overwhelming. This article will explore three popular accounting software options for small businesses: QuickBooks, FreshBooks, and Xero. Let’s dive in and see what each software has to offer.

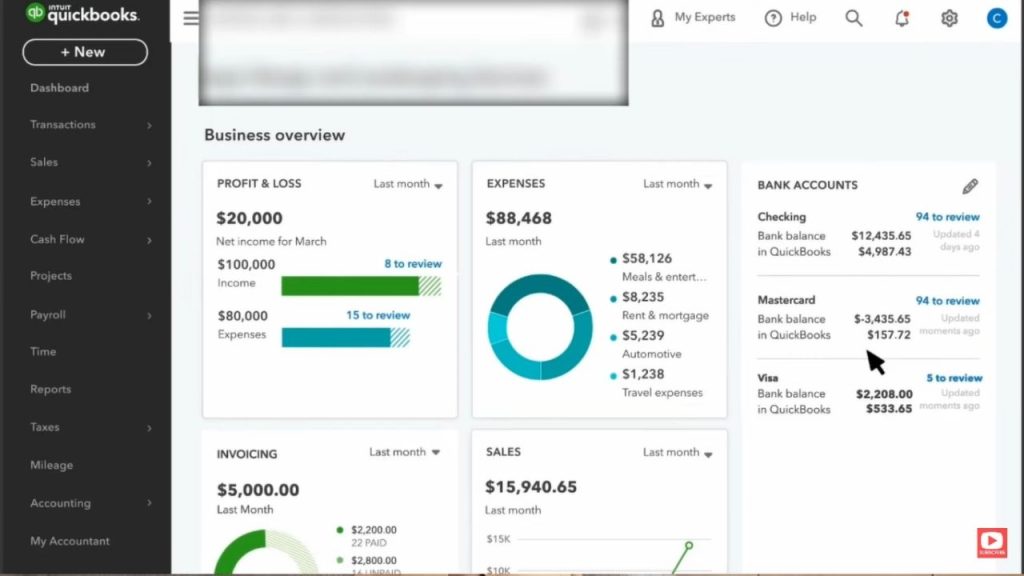

Quickbooks

QuickBooks is a well-established accounting software trusted by small businesses for years. With its user-friendly interface and robust features, it is no wonder why QuickBooks is a top choice for many entrepreneurs.

One of the key features of QuickBooks is its ability to handle all aspects of your accounting needs. QuickBooks has you covered everything from invoicing and expense tracking to payroll and tax preparation.

With QuickBooks, you can quickly generate financial reports that provide valuable insights into the financial health of your business. This allows you to make informed decisions and plan for the future.

Additionally, QuickBooks offers integrations with other business tools, such as CRM software and payment processors, making it a comprehensive solution for small businesses.

Freshbooks

FreshBooks is another popular accounting software catering to small businesses and self-employed professionals. With its intuitive interface and user-friendly features, FreshBooks is an excellent choice for a simple yet powerful accounting solution.

One of the standout features of FreshBooks is its invoicing capabilities. You can easily create professional-looking invoices and send them to your clients directly from the software. FreshBooks also allows you to track the status of your invoices, ensuring that you get paid on time.

In addition to invoicing, FreshBooks offers critical features like expense tracking, time tracking, and project management. These features provide a comprehensive view of your business finances and help streamline your operations.

Furthermore, FreshBooks seamlessly integrates with popular payment gateways and collaboration tools, making it easy to manage transactions and work with your team.

Xero

Xero is a cloud-based accounting software that has gained popularity among small businesses for its ease of use and powerful features. With Xero, you can manage your finances anytime, anywhere, with an internet connection.

One of the standout features of Xero is its bank reconciliation functionality. Xero automatically imports and categorizes your bank transactions, saving time and effort. This ensures that your books are always up-to-date and accurate.

Xero also offers comprehensive features, including invoicing, expense tracking, payroll management, and inventory management. These features help streamline your financial processes and give you a clear picture of your business performance.

Moreover, Xero integrates with hundreds of third-party apps, allowing you to customize and expand the software’s functionality to suit your business needs.

Credit: quickbooks.intuit.com

Frequently Asked Questions: Do You Need Accounting Software For Your Small Business?

Should I Use Accounting Software For My Business?

Yes, accounting software is recommended for your business as it simplifies bookkeeping, reduces manual errors, and saves time. It provides accurate financial reports, tracks expenses, and helps with tax preparation. Streamlining these tasks can improve efficiency, save costs, and enable better decision-making.

What Accounting Is Needed For A Small Business?

Small businesses need basic accounting practices such as bookkeeping, tracking income and expenses, managing invoices, and preparing financial statements. These activities are essential for managing cash flow, tax compliance, and making informed business decisions. A sound accounting system helps small businesses stay organized and financially sound.

What Is The Need For Small Business Accounting Software?

Small business accounting software is essential for efficient financial management. It helps track income and expenses, simplifies invoicing and billing, and generates detailed reports. With automated bookkeeping, it saves time and minimizes errors. It also allows easy collaboration with your accountant and ensures compliance with tax regulations.

Do I Have To Have Accounting Software?

Yes, accounting software is essential for managing your financial records efficiently. It simplifies tasks like tracking income and expenses, generating reports, and ensuring compliance with tax regulations. Its automated features save time and reduce errors, improving overall productivity and accuracy in managing your finances.

Conclusion

Investing in accounting software for your small business can streamline your financial operations, save time, and improve accuracy. With features like automated bookkeeping, invoicing, and expense tracking, you’ll have better control over your financial data. Additionally, the ability to generate reports and analyze data will provide valuable insights for making informed business decisions.

So, consider the impact of accounting software on the growth and success of your small business. Take the leap and unlock the full potential of your financial management.