Cloud Accounting Software Comparison: Find the Perfect Solution for Your Business

Cloud accounting software comparison provides an accurate and concise comparison of various cloud-based accounting software options in the market. In today’s digital age, businesses are increasingly moving their accounting operations to the cloud to streamline processes, improve efficiency, and access real-time financial data from anywhere, at any time.

With the wide range of software available, it can be challenging to determine the right fit for your business. This comparison aims to simplify the decision-making process by highlighting the key features, pricing plans, and user reviews of different cloud accounting software options.

By understanding the unique strengths and limitations of each software, you can make an informed choice that aligns with your business needs and goals.

Table of Contents

Benefits Of Cloud Accounting Software

There are numerous benefits to using cloud accounting software for your business. In this article, we will explore some of the key advantages that cloud accounting software offers. From improved accessibility and flexibility to real-time collaboration and automatic updates with backups, cloud accounting software can streamline your financial processes and provide you with valuable insights into your business’s financial health.

Accessibility And Flexibility

One of the main benefits of cloud accounting software is its accessibility and flexibility. With cloud-based solutions, you can access your financial data from anywhere, at any time, as long as you have an internet connection. This means you can view your company’s financial records, send invoices, or track expenses even when you are away from your office. Whether you are on a business trip, working from home, or on vacation, cloud accounting software ensures that you have access to your financial data whenever you need it.

Real-time Collaboration

Another advantage of cloud accounting software is the ability to collaborate in real time with your team members, accountants, or advisors. Traditional accounting software often requires the transfer of files back and forth, leading to version control issues and potential errors. With cloud accounting software, you can invite multiple users to access your financial data simultaneously, ensuring that everyone is working on the most up-to-date information. This promotes efficient teamwork, enhances decision-making, and reduces the risk of data discrepancies.

Automatic Updates And Backups

Cloud accounting software also takes away the hassle of manual updates and backups. With cloud-based solutions, updates are automatically installed, ensuring that you are always using the latest version of the software with the most recent features and bug fixes. Additionally, cloud accounting software provides automatic backups of your financial data. This means that even if your computer crashes or you experience a data breach, your data is securely stored in the cloud and can be easily restored, preventing the loss of valuable financial information.

Key Features To Consider

In today’s technologically advanced world, cloud accounting software has become an essential tool for businesses of all sizes. However, with so many options available in the market, choosing the right cloud accounting software can be overwhelming. To help you narrow down your options, it is crucial to consider the key features that each software offers. In this blog post, we will explore three essential key features to consider when comparing cloud accounting software: User Interface and Ease of Use, Integrations and Add-ons, and Security and Data Privacy.

User Interface And Ease Of Use

When selecting cloud accounting software, it is important to consider the user interface and ease of use. A user-friendly interface can significantly improve the efficiency of your accounting tasks and reduce the learning curve for your team. Look for software that offers an intuitive and visually appealing interface, with easy-to-navigate menus and clearly labeled features.

Here are a few factors to consider:

- Accessibility to important functions such as creating invoices, managing expenses, and generating reports.

- Customization options that allow you to tailor the software to your business’s specific needs.

- Organizational tools, such as categorizing transactions and creating customizable dashboards for at-a-glance insights.

By prioritizing user interface and ease of use, you can ensure that your team can quickly adapt to the software and maximize their productivity.

Integrations And Add-ons

Another crucial aspect to consider when comparing cloud accounting software is its integrations and add-on capabilities. The ability to seamlessly integrate with other essential business tools can streamline your workflows and improve efficiency.

Consider the following:

- Integrations with popular payment gateways, allow you to easily receive and reconcile online payments.

- Compatibility with e-commerce platforms and inventory management systems, enabling automated syncing of sales and inventory data.

- Add-ons that provide advanced features such as CRM integration, project management, or time tracking.

By choosing software that offers a wide range of integrations and add-ons, you can create a cohesive ecosystem of tools that work seamlessly together, saving you time and effort.

Security And Data Privacy

Security and data privacy are critical considerations when it comes to cloud accounting software. Your financial data is sensitive and confidential, so it is crucial to choose software that prioritizes the security and protection of your information.

Here are a few key factors to assess:

- Encryption protocols to ensure that your data is transmitted securely.

- Regular data backups and disaster recovery plans to safeguard against data loss.

- Compliance with industry regulations, such as GDPR or HIPAA, if relevant to your business.

Furthermore, consider the software’s reputation for data breaches and its approach to handling security incidents. A trustworthy cloud accounting software provider will prioritize the security and privacy of your data, giving you peace of mind.

Popular Cloud Accounting Software

If you are a business owner or accountant looking to streamline your financial processes, cloud accounting software is the way to go. With the ability to access your financial data anytime, anywhere, these software solutions have become increasingly popular in recent years. In this article, we will be comparing the top players in the market: QuickBooks Online, Xero, FreshBooks, and Zoho Books.

QuickBooks Online is one of the most widely used cloud accounting software in the market. It offers a range of features and functionalities that cater to businesses of all sizes. From managing expenses and tracking income to generating financial reports and sending invoices, QuickBooks Online has got you covered. The user-friendly interface and intuitive navigation make it easy to navigate through the software, even for those with little to no accounting experience.

Xero is another popular cloud accounting software that is known for its robust features and comprehensive functionality. One of the standout features of Xero is its ability to automate repetitive tasks, such as bank reconciliation and invoice reminders. With integrated payroll and inventory management, Xero is a great choice for businesses that require advanced features. The software also offers a wide range of integrations with other business tools, allowing for seamless workflow management.

FreshBooks is a cloud accounting software that is designed specifically for small businesses and freelancers. It offers a simplified approach to accounting, with features such as time tracking, expense management, and online invoicing. The software also allows for easy collaboration with clients and team members, making it a great choice for businesses that require constant communication and collaboration. It is worth noting that FreshBooks does not have as many advanced features as some of its competitors, but its simplicity and ease of use make it an attractive option for small businesses.

Zoho Books is a cloud accounting software solution that offers a range of features to help businesses manage their finances. With features such as expense tracking, bank reconciliation, and project management, Zoho Books provides a comprehensive solution for accounting needs. The software also offers integration with other Zoho apps, making it easier to manage all aspects of your business from one place. While Zoho Books may not be as well-known as some of the other software solutions on this list, it is worth considering for its extensive feature set and affordable pricing options.

No matter which cloud accounting software you choose, it is important to consider your business’s specific needs and requirements. Each software solution has its strengths and weaknesses, and what works for one business may not work for another. By comparing the features and functionality of this popular cloud accounting software, you can make an informed decision and find the right solution for your business.

Quickbooks Online

QuickBooks Online is a cloud accounting software that offers a range of features to help businesses efficiently manage their finances. With its user-friendly interface and robust functionalities, QuickBooks Online has become a popular choice among small and medium-sized enterprises.

Overview

QuickBooks Online is designed to streamline accounting processes and provide real-time access to financial data. As a cloud-based solution, it allows users to manage their finances from anywhere, keeping them connected to their business at all times. Whether you are a freelancer, a startup, or an established business, QuickBooks Online caters to businesses of all sizes and industries with its customizable features.

Key Features

QuickBooks Online offers many features that make accounting tasks easier and more efficient. Some of the key features include:

- Expense tracking: Easily track and categorize your business expenses to keep a close eye on your financial health.

- Invoicing and payment management: Create professional invoices and send them to your clients, while also managing payments and tracking receivables.

- Bank reconciliation: Automatically import and categorize your bank transactions, saving you time and reducing the chances of manual errors.

- Financial reporting: Generate reports such as profit and loss statements, balance sheets, and cash flow statements to gain valuable insights into your business performance.

- Time tracking: Track billable hours for your projects and easily convert them into invoices, ensuring accurate invoicing and billing.

These are just a few of the many features that QuickBooks Online offers. The software is constantly updated with new features and improvements, catering to the evolving needs of businesses.

Pricing

QuickBooks Online offers different pricing plans to fit the specific needs and budgets of businesses. The pricing plans are as follows:

| Plan | Monthly Fee |

| Simple Start | $25 |

| Essentials | $40 |

| Plus | $70 |

Each plan offers different features and allows a specific number of users and access privileges. Businesses can choose the plan that aligns with their requirements and upgrade or downgrade as needed.

Xero

Xero is a leading cloud-based accounting software that has revolutionized the way small businesses manage their financials. Built specifically for small businesses, Xero provides a comprehensive and user-friendly accounting solution that simplifies the process of tracking expenses, invoicing clients, and managing cash flow. With its intuitive interface and powerful features, Xero has gained popularity among entrepreneurs and accountants alike. In this article, we will delve into the key features of Xero, its pricing structure, and why it stands out among other accounting software options.

Overview

When it comes to cloud accounting software, Xero stands out for its usability and flexibility. The software is designed to offer a seamless experience to small businesses, from startups to established companies. With Xero, you have access to your financial data at any time, from any device, ensuring that you can stay on top of your finances no matter where you are.

Key Features

Xero offers a robust set of features that streamline accounting processes, reduce manual work, and improve overall efficiency. Some of the key features that make Xero a top choice for small business owners include:

- Invoicing: Xero simplifies the process of creating and sending professional invoices to your clients. You can customize your invoices, track their status, and even set up automatic reminders for overdue payments.

- Expense Tracking: With Xero, you can easily track and categorize business expenses. The software integrates with your bank accounts, credit cards, and payment providers, making it effortless to reconcile transactions and stay on top of your cash flow.

- Bank Reconciliation: Xero automatically imports and categorizes your bank transactions, making it a breeze to reconcile your accounts. This feature saves you time and eliminates the risk of errors associated with manual data entry.

- Financial Reporting: Xero offers a range of financial reports that provide valuable insights into your business’s financial health. From profit and loss statements to balance sheets, these reports help you make informed decisions and monitor your company’s performance.

Pricing

Xero offers three pricing plans that cater to the diverse needs of small businesses:

| Plan | Monthly Cost |

| Early | $9 |

| Growing | $30 |

| Established | $60 |

Each plan offers a different level of functionality and caters to businesses at various stages of growth. The Early plan is perfect for startups and small businesses with basic accounting needs. The Growing plan is suitable for businesses that require advanced features such as multi-currency support and payroll functionality. The Established plan is designed for larger businesses that need more comprehensive financial management tools.

Overall, Xero is an all-in-one accounting software that provides small businesses with the tools they need to manage their finances effectively. Its user-friendly interface, powerful features, and flexible pricing make it a standout choice in the cloud accounting software market. Whether you’re a freelancer, a small business owner, or an accountant, Xero offers a solution that simplifies your financial management tasks, saves you time, and helps you make informed decisions for the growth of your business.

Credit: www.acumatica.com

Freshbooks

FreshBooks is a cloud accounting software that offers a user-friendly interface and seamless integration with other tools. With its robust features and intuitive design, it simplifies the accounting process for businesses of all sizes and streamlines their financial management.

Overview

FreshBooks is a popular cloud accounting software that offers a range of features designed to simplify and streamline the financial management process for businesses of all sizes. With a user-friendly interface and intuitive design, FreshBooks aims to make accounting tasks more efficient, allowing users to focus on growing their business. From invoicing and expense tracking to time tracking and project management, FreshBooks offers a comprehensive suite of tools to help businesses stay organized and in control of their finances.

Key Features

FreshBooks boasts an impressive array of key features that make it a top choice for businesses seeking an all-in-one accounting solution. Let’s take a closer look at some of its standout features. 1. Invoicing and Payment Management: FreshBooks makes it easy to create professional-looking invoices and send them to clients directly from the platform. You can customize your invoices with your brand logo and colors, and even set up automatic recurring invoices for repeat clients. The software also enables online payment acceptance, allowing your clients to pay you faster and reducing the need for manual payment tracking. 2. Expense Tracking: With FreshBooks, you can effortlessly track and categorize your business expenses. Simply snap a photo of your receipts using the mobile app, and the software will automatically extract important details like the date, vendor, and amount. This feature ensures accurate expense records, making tax season a breeze. 3. Time Tracking: If you bill clients by the hour, FreshBooks’ time tracking feature is a game-changer. You can easily track the time spent on different tasks and projects, and then convert those tracked hours into client invoices with just a few clicks. This not only helps you accurately bill clients but also provides insights into your team’s productivity. 4. Project Management: FreshBooks offers project management tools that allow you to collaborate with your team, assign tasks, set deadlines, and track progress all in one place. This feature improves communication and ensures everyone is on the same page, promoting efficient project completion.

Pricing

FreshBooks offers different pricing plans to cater to businesses with varying needs and budgets.

1. Lite: The Lite plan starts at $15 per month and is ideal for freelancers and solo entrepreneurs. It includes features such as invoicing, expense tracking, time tracking, and basic reporting.

2. Plus: The Plus plan, priced at $25 per month, is suitable for small businesses. It builds upon the Lite plan, offering additional features like proposals, double-entry accounting reports, and team member access.

3. Premium: The Premium plan is priced at $50 per month and adds even more features to assist growing businesses. It includes advanced reports, customizations, and the ability to accommodate up to 500 billable clients.

4. Select: For large businesses with complex financial needs, FreshBooks offers a custom-priced Select plan. This plan is tailored to meet the unique requirements of each organization and provides personalized support, advanced reporting, and third-party integrations.

In conclusion, FreshBooks is a user-friendly accounting software that offers a range of key features to simplify financial management for businesses. With its invoicing and payment management, expense tracking, time tracking, and project management tools, FreshBooks helps businesses stay organized and in control of their finances. Additionally, its pricing options cater to businesses of all sizes, making it a versatile choice.

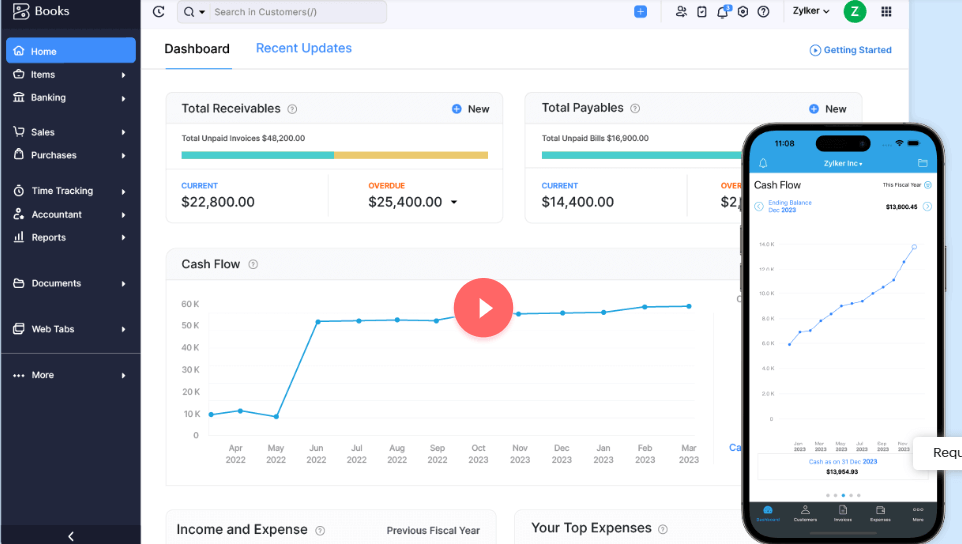

Zoho Books

Zoho Books is an exceptional cloud-based accounting software that provides an efficient solution for businesses of all sizes. With its intuitive interface and feature-rich functionalities, Zoho Books streamlines and automates various financial tasks, helping businesses focus on their core operations. Let’s explore the key features, pricing, and an overview of Zoho Books.

Overview

Zoho Books offers a comprehensive suite of accounting tools designed to simplify the financial management process. Whether you are a small business or a freelancer, Zoho Books provides essential features to meet your accounting needs. From invoicing and expense tracking to inventory management and financial reporting, this software has it all.

Key Features

Zoho Books comes packed with numerous features that enhance efficiency and save time for businesses. Some of the standout features include:

- Invoicing: Create and send professional invoices to clients, while tracking payment status in real-time. Customize invoices with your company logo and choose from a range of professional templates.

- Expense Tracking: Effortlessly keep track of your expenses by attaching receipts, categorizing transactions, and monitoring your expenditures. Streamline the expense approval process with automated workflows.

- Bank Reconciliation: Seamlessly reconcile your bank accounts with Zoho Books. Connect to your bank and automatically import transactions, making it easier to match records and identify any discrepancies.

- Inventory Management: Manage your inventory by tracking stock levels, creating purchase orders, and recording sales. Get real-time insights into product performance and make informed decisions to optimize your inventory.

- Financial Reporting: Generate detailed financial reports such as profit and loss statements, balance sheets, and cash flow statements. Gain valuable insights into your business’s financial health.

- Collaboration: Collaborate seamlessly with your team, accountant, and other stakeholders. Grant access permissions, share documents, and communicate effectively within the software.

- Integration: Integrate Zoho Books with other Zoho applications as well as various third-party tools, including payment gateways and CRM software, to improve efficiency and streamline workflows.

Pricing

Zoho Books offers different pricing plans tailored to meet the needs of different businesses:

| Plan | Features | Price |

| Basic | Perfect for freelancers and sole proprietors | $9 per organization per month |

| Standard | Ideal for small businesses | $19 per organization per month |

| Professional | Advanced features for growing businesses | $29 per organization per month |

| Elite | Comprehensive features for large enterprises | $39 per organization per month |

Each plan offers a free 14-day trial, allowing businesses to explore the software before committing. Additionally, Zoho Books frequently runs promotions and discounts, making it even more affordable for businesses looking to switch to a cloud accounting solution.

Factors To Consider When Choosing

When it comes to choosing cloud accounting software, several factors need to be considered. From budget and cost to scalability and growth, as well as specialized industry needs, each factor plays a crucial role in making the right decision for your business. By carefully evaluating these factors, you can ensure that you choose the software that best meets your requirements, while also providing long-term value and efficiency.

Budget And Cost

One of the primary considerations when selecting cloud accounting software is your budget and the overall cost of the software. It’s important to have a clear understanding of your financial constraints and determine how much you can allocate toward your accounting software. Additionally, you should evaluate the pricing structure of different software solutions. Some may charge a monthly subscription fee, while others may have an upfront cost or additional costs for add-ons and support. Consider your current budget and future growth plans to ensure that the software you choose aligns with your financial goals.

Scalability And Growth

Scalability and growth are essential factors to consider when selecting cloud accounting software. Your business may experience expansion over time, so it’s crucial to choose software that can handle your evolving needs. Look for software that offers flexible options for upgrading or adding features as your business grows. A scalable solution will allow you to easily adapt to changes in your business volume, transaction volume, and user requirements without incurring significant downtime or migration efforts. Considering scalability ensures that your accounting software can keep up with your business’s development and future demands.

Specialized Industry Needs

In addition to budget and scalability, it’s essential to consider whether the cloud accounting software meets your industry-specific needs. Some industries, such as construction, healthcare, or retail, may require specialized features and functions tailored to their unique requirements. Make a list of your industry-specific accounting needs and compare them against the features offered by different software providers. Look for software that integrates with industry-specific tools or provides customized solutions for businesses in your sector. By selecting software that caters to your specialized needs, you can streamline your accounting processes and ensure compliance with industry-specific regulations.

Case Studies

When it comes to choosing the right cloud accounting software for your business, it can be helpful to look at real-life examples of how different companies have implemented and benefitted from these solutions. In this article, we will explore three case studies that highlight the benefits of using cloud accounting software in different business settings. Whether you are a small business owner, a freelancer, or part of a multi-branch corporation, these case studies will provide valuable insights into the advantages of adopting cloud accounting software.

Case Study 1: Small Business

For small business owners, managing finances can often be a challenging and time-consuming task. With limited resources and staff, it is crucial to find cost-effective solutions that streamline accounting processes. ABC Inc., a small retail business with four employees, decided to switch to cloud accounting software to simplify its financial management.

By implementing XYZ Accounting Software, ABC Inc. was able to:

- Automate their bookkeeping tasks, saving them several hours per week.

- Access real-time financial data, allowing them to make informed decisions regarding inventory and pricing.

- Generate customized reports and dashboards, providing a holistic view of the company’s financial health.

- Collaborate with their accountant remotely, saving time and ensuring accurate and up-to-date financial records.

Case Study 2: Freelancer

Being self-employed comes with unique challenges, and managing finances is no exception. As a freelancer, it is crucial to track income and expenses accurately and efficiently. John Smith, a freelance graphic designer, decided to leverage cloud accounting software to simplify his financial management.

By utilizing the PQR Accounting Software, John was able to:

- Track his time spent on different projects, ensuring accurate billing for his clients.

- Automatically generate professional invoices and send them to clients, reducing administrative tasks.

- Monitor his expenses and easily categorize them for simplified tax preparation.

- Store and organize important financial documents securely in the cloud.

Case Study 3: Multi-branch Corporation

Managing finances for a multi-branch corporation can be complex, especially when each branch operates independently. XYZ Corporation, a company with branches in three different cities, transitioned to cloud accounting software to streamline its financial operations.

Through the implementation of MNO Accounting Software, XYZ Corporation experienced:

- Centralized access to financial data across all branches, allowing for better decision-making and coordination.

- Improved communication between branch managers and the finance team with real-time data sharing and collaboration features.

- Streamlined inter-branch financial transactions and consolidated reporting, resulting in increased efficiency and accuracy.

- Enhanced security and data protection with robust cloud-based infrastructure.

As these case studies demonstrate, cloud accounting software provides significant advantages for businesses of all sizes and types. Whether you are a small business, a freelancer, or part of a multi-branch corporation, adopting cloud accounting software can significantly improve your financial management processes, saving you time, improving accuracy, and providing valuable insights for informed decision-making.

Frequently Asked Questions Of Cloud Accounting Software Comparison

Which Is The Best Cloud-based Accounting Software?

The best cloud-based accounting software depends on your specific needs. Popular options include QuickBooks Online, Xero, and Zoho Books.

What Are The Disadvantages Of Cloud Accounting?

Cloud accounting has a few downsides. Accessibility issues may arise if the internet connection is poor or unreliable. Security concerns also exist due to potential data breaches. Additionally, reliance on third-party service providers can lead to dependency and limited control over data.

What Is The Easiest Online Accounting Software?

Xero is widely regarded as the easiest online accounting software, offering user-friendly features and a simple interface. With its intuitive design, Xero makes it easy to track expenses, manage invoices, and monitor cash flow—all in a digestible and easily understandable format.

How Much Does Cloud Accounting Cost?

Cloud accounting costs vary depending on the provider and the size of your business, but generally range from $10 to $30 per month for basic plans. Advanced plans with additional features may cost up to $60 per month.

Conclusion

To conclude, this cloud accounting software comparison highlights the key features, benefits, and pricing plans of some of the top options in the market. Whether you’re a small business owner or a freelance professional, finding the right accounting software can greatly streamline your financial management processes.

Consider your specific needs, budget, and scalability requirements before making a decision. With the right cloud accounting software in place, you can automate tasks, improve accuracy, and gain valuable insights to drive your business forward.