Canadian small business accounting software

Several accounting software options are available for Canadian small businesses. These software solutions help businesses manage their financial transactions, track expenses, and generate reports, making financial management efficient and accurate.

Managing finances is a critical aspect of any business, but it can be cumbersome and time-consuming. Canadian small business owners need accounting software tailored to their needs and comply with Canadian tax regulations. Fortunately, several accounting software options are designed specifically for Canadian small businesses.

These software solutions offer features such as income and expense tracking, invoicing, payroll management, and tax preparation. We will explore some of the top accounting software options available for Canadian small businesses, highlighting their features, pricing, and suitability for different business types and sizes. Finding the right accounting software is crucial for your financial success, whether you are a sole proprietor, freelancer, or small business owner. So, let’s look at the best accounting software solutions for Canadian small businesses.

Table of Contents

Understanding The Importance Of Small Business Accounting Software

Running a small business entails various responsibilities; one critical aspect is managing your finances effectively. This is where small business accounting software comes into play. With its comprehensive features and user-friendly interfaces, accounting software can streamline financial management tasks, providing accurate and up-to-date information. This article will explore the benefits of using accounting software for your small business and how it can simplify financial management.

Benefits Of Using Accounting Software For Your Small Business

Accounting software brings a multitude of benefits to small business owners. Here are some key advantages that make it an indispensable tool:

- Time-saving:

Accounting software saves time by automating repetitive tasks such as data entry, invoicing, and report generation. This time can be dedicated to other important aspects of your business.

- Accuracy:

Manual accounting can be prone to human errors, leading to inaccuracies that significantly affect your business. With accounting software, you can minimize errors and discrepancies as it performs calculations automatically and ensures data consistency.

- Financial insights:

Accounting software provides real-time financial insights, enabling you to make informed decisions for your business. With interactive dashboards, customizable reports, and charts, you can comprehensively understand your financial position at any given time.

- Streamlined record keeping:

Maintaining and organizing paper-based financial records can be cumbersome and time-consuming. With accounting software, you can digitize and store all your financial data securely in one central database. This allows for easy access, efficient record keeping, and reduced risk of data loss.

How Accounting Software Can Simplify Financial Management

The complexities of financial management can significantly impact the success and growth of your small business. Accounting software simplifies this aspect by offering the following:

- Invoicing and billing: Accounting software quickly generates professional-looking invoices and bills. The software can also automatically calculate taxes, track payments, and send reminders to clients for outstanding payments.

- Expense tracking: Monitoring your business expenses is crucial for budgeting and cost control. Accounting software allows you to categorize expenses, track receipts, and generate expense reports effortlessly.

- Bank reconciliation: Reconciling your bank statements manually can be tedious and prone to errors. Accounting software simplifies this process by automatically matching your bank transactions with the corresponding entries in your system, ensuring accuracy and saving you valuable time.

- Payroll management: If you have employees, accounting software can handle payroll calculations, tax deductions, and pay stub generation. This streamlines the payroll process, increasing efficiency and minimizing payroll-related errors.

- Tax preparation: Accounting software often integrates tax compliance features, making it easier to keep track of tax obligations and generate tax reports. This simplifies the tax preparation process and ensures compliance with tax regulations.

In conclusion, small business accounting software is indispensable for efficient financial management. With its time-saving capabilities, accurate calculations, and comprehensive insights, accounting software can help you streamline your financial tasks, improve record-keeping, and make informed decisions for your business’s success.

Key Features To Consider In Canadian Small Business Accounting Software

Choosing the right accounting software is crucial for small businesses in Canada. It not only helps manage finances but also streamlines day-to-day operations. When searching for the ideal accounting software, it’s essential to consider critical features that cater to the unique needs of Canadian businesses. This blog post will dive into the must-have functionalities for Canadian small business accounting software.

Cloud-based Vs. Desktop Accounting Software

Gone are the days of traditional desktop-based accounting software. Today, cloud-based accounting software has gained popularity, offering numerous advantages for small businesses. With cloud-based accounting software, you can access your financial data anytime, anywhere, as long as you have an internet connection. This flexibility is particularly beneficial for remote or mobile businesses. On the other hand, desktop software resides on your computer, providing a more traditional approach.

If you prefer keeping your data on-premises for additional security, desktop accounting software might be the way to go. However, if you value convenience, accessibility, and ease of collaboration, cloud-based software is a preferred choice.

Integration With Other Business Tools And Platforms

In today’s digital landscape, efficient integration with other business tools and platforms is crucial when selecting accounting software. Seamlessly connecting with your CRM, e-commerce platform, payroll system, and other business applications saves time by automating data transfer and ensuring consistent and accurate financial records. This integration eliminates manual data entry and the risk of human error, enabling smoother business operations.

Multi-currency And Multi-language Support

For Canadian small businesses engaged in international trade or serving diverse demographics, multi-currency and multi-language support are essential. Accounting software that can handle multiple currencies enables easy recording and conversion of transactions in various currencies. On the other hand, multi-language support ensures that users with different language preferences can navigate the software comfortably. These features simplify financial management for businesses dealing with international clients and suppliers, promoting efficient cross-border transactions.

Customizable Reporting And Analytics

Understanding your small business’s financial health requires insightful reporting and analytics capabilities. Look for accounting software that offers customizable reporting options, allowing you to create and tailor reports to your needs. This flexibility empowers you to analyze critical financial data such as income statements, balance sheets, cash flow reports, and more, all at your fingertips.

Data Security And Backup Options

Protecting sensitive financial data should be a top priority for any small business. Ensure that the accounting software offers robust data security features, including encrypted storage, secure login protocols, and user access controls. Additionally, automatic data backup options are crucial to prevent data loss in the event of hardware failure, human error, or unforeseen disasters. Prioritize software that regularly backs up your data, minimizing the risk of losing critical financial information.

Canadian small business accounting software

Top Canadian Small Business Accounting Software Solutions

Managing the financial aspects of your small business can be challenging, but with the right accounting software, it doesn’t have to be. In Canada, there are various accounting software solutions specifically designed to meet the needs of small businesses. Whether you need to streamline your financial processes, simplify accounting tasks, or have a user-friendly solution, accounting software can make your life easier. This blog post will explore the top Canadian small business accounting software solutions that will help you stay organized and focused on growing your business.

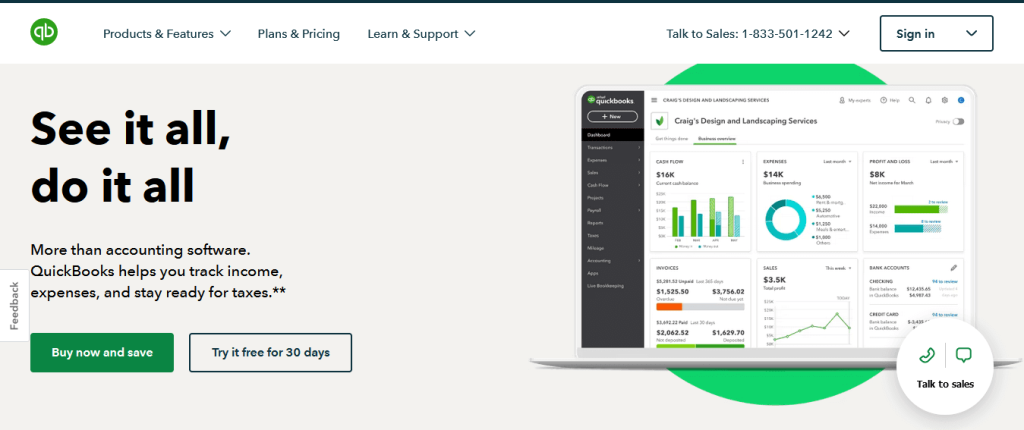

Quickbooks Online: Streamlining Financial Processes For Small Businesses

Regarding streamlining financial processes, QuickBooks Online is a top choice for small businesses in Canada. This cloud-based accounting software offers a range of features that allow you to manage your finances efficiently. With QuickBooks Online, you can easily track income, expenses, and invoices, generate financial reports, and even integrate with other business applications. The user-friendly interface and intuitive navigation make it popular among small business owners.

Sage Business Cloud Accounting: Simplifying Accounting Tasks For Small Business Owners

If you want accounting software that simplifies your accounting tasks, Sage Business Cloud Accounting is a great option. With this software, small business owners can easily manage their finances, track expenses and invoicing, and even automate recurring transactions. The real-time reporting feature allows you to monitor your business’s financial health and make informed decisions. Whether you are a seasoned entrepreneur or just starting out, Sage Business Cloud Accounting offers powerful tools to streamline your accounting processes.

Freshbooks: A User-friendly Accounting Solution For Small Businesses

FreshBooks is renowned for its user-friendly interface and ease of use. This accounting software allows small business owners to manage their finances, track expenses, create professional-looking invoices, and even accept online payments. The intuitive dashboard provides a comprehensive overview of your business’s financials, making it easy to stay organized and focused. FreshBooks also offers time-tracking features, which are handy for service-based companies charging billable hours.

Wave: Free Accounting Software With Essential Features For Small Businesses

Wave provides a free accounting software solution for small businesses on a tight budget that keeps essential features intact. With Wave, you can track income and expenses, create professional invoices, and connect your bank accounts for seamless reconciliation. The clean and straightforward interface makes it easy to navigate, even for users with limited accounting knowledge. Wave also offers optional paid services, such as payroll and credit card processing, for businesses that require more advanced features.

Xero: Connecting Your Small Business To Your Financial Data

Xero is a comprehensive accounting software that aims to connect your small business to your financial data seamlessly. With Xero, you can manage invoices, track expenses, reconcile bank transactions, and collaborate with your accountant or bookkeeper. The customizable dashboard lets you view critical financial information at a glance, empowering you to make informed decisions. Xero also integrates with various third-party applications, making it a versatile and scalable accounting solution for growing businesses.

Credit: certinia.com

Choosing The Right Canadian Small Business Accounting Software For Your Needs

Finding the ideal Canadian small business accounting software can be daunting. With a comprehensive selection of tailored options, you can ensure the perfect match for your needs.

When running a small business in Canada, efficient and reliable accounting software is crucial for managing your finances and ensuring accurate record-keeping. With so many options available, choosing the right accounting software that suits your specific needs can be overwhelming. In this blog post, we will discuss the key factors to consider when selecting Canadian small business accounting software, enabling you to make an informed decision.

Assessing Your Business Requirements And Budget

Before exploring the vast array of accounting software options, it is important to assess your business requirements and budget. Take the time to determine the specific features and functionalities you need to manage your finances effectively. Do you require basic bookkeeping features such as invoicing and expense tracking? Or do you need more advanced capabilities like payroll management and inventory tracking? Identifying your business needs will help you narrow the options and focus on the software that aligns with your requirements.

Once you clearly understand your business requirements, you must consider your budget constraints. Accounting software’s pricing can vary significantly, so it’s crucial to set a budget and stick to it. While cost is essential, it should not be the sole determining factor in your decision-making process. Consider the software’s value and long-term benefits to your business.

Comparing Features And Pricing Of Different Software Options

Now that you have assessed your business requirements and budget, it’s time to compare the features and pricing of different accounting software options. One effective way to do this is by quickly creating a comparison table to identify each software’s strengths and weaknesses. Below is an example:

| Software | Features | Pricing |

| Quickbooks Online | Invoicing, expense tracking, payroll management | $15/month |

| Sage | Invoicing, expense tracking, inventory tracking | $20/month |

| Freshbooks | Invoicing, expense tracking, multi-user access | $10/month |

By comparing features and pricing, you can make an objective assessment of which software offers the best value for your money. Remember to consider any additional costs, such as integration fees or support fees.

Reading Customer Reviews And Seeking Recommendations

Customer reviews and recommendations are invaluable when it comes to choosing accounting software. Reviewing other small business owners using the software can provide valuable insights into its strengths and weaknesses. Look for reviews highlighting the software’s usability, reliability, customer support, and any specific features that have particularly benefited similar businesses.

Additionally, seek recommendations from fellow entrepreneurs or industry professionals with accounting software experience. They can offer valuable suggestions based on their firsthand knowledge and steer you towards software that best suits your needs.

Taking Advantage Of Free Trials And Demos

Most reputable accounting software companies offer free trials or demos of their products. Take advantage of these opportunities to test the software’s functionalities and determine if it meets your business requirements. During the free trial or demo period, pay attention to the software’s user interface, ease of use, customization options, and any integrations available. This hands-on experience will give you a real sense of how the software will perform in your day-to-day operations. Don’t hesitate to contact the software provider with any questions or concerns.

In conclusion, when choosing Canadian small business accounting software, it is essential to assess your business requirements and budget, compare features and pricing, read customer reviews and seek recommendations, and take advantage of free trials and demos. Considering these factors, you can confidently select accounting software to streamline financial management and help your business thrive.

Implementing Canadian Small Business Accounting Software: Tips For A Smooth Transition

Transitioning to new accounting software can be daunting for any small business. However, with careful planning and preparation, importing and migrating existing financial data, training your team, and regularly reviewing and updating your accounting processes, you can ensure a smooth implementation of Canadian small business accounting software. This article will explore these steps in detail to help you successfully navigate this transition.

Planning And Preparing Before The Software Implementation

- Assess your current needs: Before choosing a Canadian small business accounting software, take the time to evaluate your business requirements. Consider the features and functionalities you need, such as invoicing, inventory management, and financial reporting. This will help you select the software that aligns best with your business needs.

- Set clear goals and objectives: Define what you hope to achieve with the new accounting software. Whether it’s reducing manual data entry, improving financial reporting accuracy, or streamlining your bookkeeping processes, having specific goals will guide you during the implementation process.

- Allocate resources: Ensure you have the necessary resources, both in terms of hardware and staff, to support the new software. Determine if additional hardware upgrades or training will be required and allocate the appropriate budget.

- Backup and secure your data: Before starting the implementation process, back up your existing financial data and ensure it is securely stored. This will prevent any loss of crucial information during the transition.

- Create a timeline: Develop a realistic timeline that includes key milestones and deadlines for each implementation phase. Having a clear roadmap enables you to track progress and keep everyone accountable.

Importing And Migrating Existing Financial Data

One of the critical aspects of transitioning to Canadian small business accounting software is importing and migrating your existing financial data seamlessly. Follow these steps to ensure a smooth transfer:

- Organize and cleanse your data: Review your current financial data and clean up any duplicate, outdated, or inaccurate information. Ensure that your data is in a standardized format to facilitate the migration process.

- Map data fields: Carefully map the fields from your existing system to the corresponding fields in the new software. This will ensure the data is transferred accurately without any loss or misinterpretation.

- Test the migration: Before fully committing to the new software, conduct a test migration to identify and rectify any issues or inconsistencies. This will help you iron out any potential problems and ensure the accuracy of your data.

- Backup your data: Once the migration is complete and validated, create a backup of the newly migrated data. This serves as an additional safety net in case of any unforeseen circumstances.

Training And Educating Your Team On Using The Software

An essential part of a smooth transition to Canadian small business accounting software is ensuring that your team is proficient in using the new system. Consider the following tips to facilitate training and education:

- Provide comprehensive training: Develop a training plan covering all software aspects, from basic functionalities to advanced features. Conduct training sessions or workshops to familiarize your team with the software and its capabilities.

- Assign software champions: Identify individuals within your organization who can be software champions. These individuals will become the go-to experts for their respective departments, providing additional support and guidance to other team members.

- Encourage hands-on practice: Make sure your team has ample opportunities to practice using the software in a safe environment. Offer hands-on assignments or simulation exercises to reinforce their learning and boost their confidence.

- Provide ongoing support: Implementing new accounting software may bring forth questions or challenges from your team. Establish a support system, such as a dedicated help desk or knowledgeable personnel, to address concerns and provide timely assistance.

Regularly Reviewing And Updating Your Accounting Processes

Once your Canadian small business accounting software is up and running, it is crucial to regularly review and update your accounting processes to maximize its benefits. Consider these strategies:

- Monitor and evaluate: Regularly monitor the performance of your accounting software and measure its effectiveness in meeting your goals and objectives. Use the software’s reporting capabilities to generate insights and identify areas for improvement.

- Stay updated with software updates: Keep up with the software provider’s updates and new releases. These updates often include bug fixes and enhancements that can improve the performance and security of your system.

- Continuously train your team: As the software evolves and new features are introduced, provide ongoing training to keep your team up-to-date. This will enable them to leverage the software’s full potential and optimize your accounting processes.

- Seek professional assistance: If you encounter complex accounting scenarios or require assistance optimizing your processes, consider hiring an accountant or a consultant specializing in Canadian small business accounting. They can provide valuable insights and guidance tailored to your specific needs.

Frequently Asked Questions For Canadian Small Business Accounting Software

Which Software Is Used For Accounting In Canada?

Popular accounting software in Canada includes QuickBooks, Sage 50, and FreshBooks. These software solutions streamline financial tasks, such as bookkeeping, invoicing, and payroll management, for businesses of all sizes.

Is Quickbooks Used In Canada?

Yes, QuickBooks is widely used in Canada to manage business finances. It is a popular accounting software trusted by businesses of all sizes to track income, expenses, and taxes effectively. With its user-friendly interface and support for Canadian tax regulations, QuickBooks is a valuable tool for businesses in Canada.

What Accounting Is Used In Canada?

Accounting in Canada follows the Generally Accepted Accounting Principles (GAAP), which ensures consistency and accuracy in financial reporting. GAAP sets guidelines for recording, organizing, and presenting financial information to stakeholders. Canadian accounting standards are aligned with international practices, supporting transparency and accountability.

What Is The Difference Between Quickbooks And Freshbooks?

QuickBooks and FreshBooks are both accounting software, but they have differences. QuickBooks is designed for small to medium businesses, while FreshBooks is more suitable for freelancers and service-based professionals. QuickBooks offers more advanced features and integrations, while FreshBooks focuses on simplicity and a user-friendly interface.

Conclusion

Canadian small business accounting software is essential for efficiently managing finances, streamlining operations, and improving overall business growth. Its user-friendly interface, customizable features, and robust capabilities offer small businesses a cost-effective solution to handle their accounting needs.

This software simplifies the financial management process, from tracking expenses to generating financial reports, saving business owners valuable time and resources. Investing in the right accounting software can significantly improve the success and growth of a small business in Canada.