Best Accounts Payable Software

The 5 best accounts payable software are Netsuite, Xero, Quickbooks Online, Sage Intacct, and Freshbooks.

Netsuite, Xero, Quickbooks Online, Sage Intacct, and Freshbooks are among the top choices for accounts payable software. These software solutions streamline financial operations, providing efficient and accurate processes for managing invoices, payments, and vendor collaboration. With features like automation, reporting, and integration capabilities, these tools are designed to simplify accounts payable management and improve financial visibility for businesses of all sizes.

Whether you need advanced functionality, user-friendly interfaces, or customizable workflows, these software options offer reliable solutions to optimize your accounts payable processes.

Table of Contents

Navigating Accounts Payable Solutions

The world of accounts payable software can sometimes be overwhelming, with a wide array of options available in the market. Navigating through these solutions can be challenging, especially when you need to find the perfect fit for your business. In this blog post, we will explore the top 5 accounts payable software options available, including Netsuite, Xero, QuickBooks Online, Sage Intacct, and Freshbooks. Let’s dive in and understand the importance of choosing the right software and its impact on business efficiency.

Importance Of Choosing The Right Software

Choosing the right accounts payable software is crucial for any business. With the right tool in place, you can streamline your processes, automate manual tasks, and ensure accurate financial data management. Here’s why it’s important to choose the right software:

- Improved accuracy: Accounts payable software eliminates the need for manual data entry, reducing the risk of human error. It helps accurately track invoices, payments, and expenses, ensuring better financial reporting.

- Enhanced efficiency: By automating routine tasks such as invoice processing, data entry, and payment reconciliation, the right software can significantly improve the efficiency of your accounts payable department. This allows your team to focus on more strategic tasks, ultimately improving productivity.

- Better control: With the right software, you gain better control over your payables. It enables you to track and monitor payment timelines, avoid late fees or missed payments, and maintain a strong relationship with your vendors.

- Cost savings: Accounts payable software helps you save costs by reducing paper usage, eliminating manual errors, and optimizing your payment processes. It also enables you to take advantage of early payment discounts and negotiate better terms with your suppliers.

Impact On Business Efficiency

The impact of choosing the right accounts payable software goes far beyond just streamlining processes. It can have a direct impact on your business efficiency. Here’s how:

- Faster invoice processing: Accounts payable software automates the invoice processing cycle, eliminating the need for manual routing, approvals, and data entry. This speeds up the entire process, allowing you to pay your vendors on time and avoid any bottlenecks.

- Real-time visibility: With the right software, you gain real-time visibility into your accounts payable data. This means you can easily access key financial metrics, track cash flow, and make informed decisions based on accurate and up-to-date information.

- Streamlined workflow: Accounts payable software streamlines the entire payables workflow, from invoice receipt to payment. It enables you to set up automated workflows, route invoices for approvals, and track the status of payments, ensuring smooth and efficient operations.

- Reduced risk: By automating manual processes, accounts payable software reduces the risk of errors and fraud. It helps you establish strong internal controls, enforce segregation of duties, and detect any suspicious or fraudulent activities, enhancing your overall financial security.

Choosing the right accounts payable software is essential for businesses of all sizes. It not only improves accuracy, efficiency, and control but also enables you to make data-driven decisions and optimize your financial operations. The top 5 accounts payable software options, including Netsuite, Xero, QuickBooks Online, Sage Intacct, and Freshbooks, can help you navigate through the vast sea of options and find the perfect solution for your business needs.

Unveiling The 5 Best Accounts Payable Software

Managing accounts payable can be a complex and time-consuming task, especially for businesses that deal with a large number of invoices and payments. Thankfully, there are several software solutions available that can simplify the accounts payable process, making it more efficient and error-free. In this article, we will unveil the 5 best accounts payable software that can help businesses streamline their payment processes and stay on top of their financials.

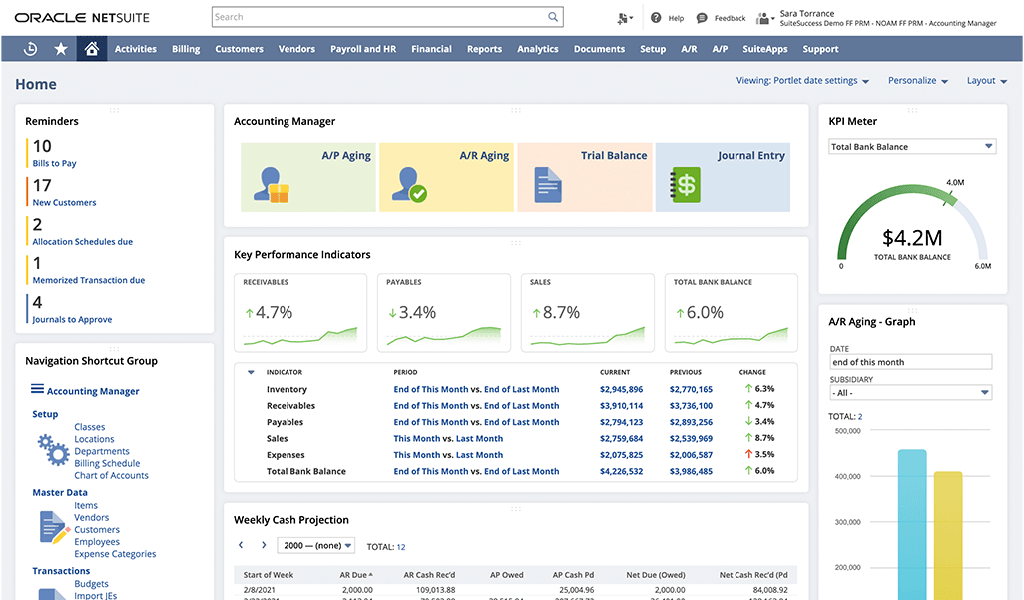

1. Netsuite

Netsuite is a comprehensive cloud-based solution that offers a robust accounts payable software module. The software integrates seamlessly with other Netsuite modules, allowing businesses to automate their entire purchase-to-pay process. Its strength lies in its ability to centralize vendor management, automate invoice processing, and provide real-time visibility into payables. Netsuite also offers flexible approval workflows, ensuring invoices are properly reviewed and authorized before payment.

2. Xero

Xero is an excellent choice if you’re looking for user-friendly yet powerful accounts payable software. With its intuitive interface and extensive automation capabilities, Xero simplifies the accounts payable process for businesses of all sizes. The software’s unique strength lies in its ability to automate invoice data entry through optical character recognition (OCR) technology. This saves time and reduces the chances of manual data entry errors.

3. Quickbooks Online

Quickbooks Online is a popular choice among small businesses for its affordability and user-friendly features. The software’s accounts payable module allows businesses to easily track and manage their payables. Quickbooks Online enables users to set up recurring payments, schedule vendor payments, and reconcile accounts with ease. Its seamless integration with other Quickbooks modules provides a complete financial management solution for small businesses.

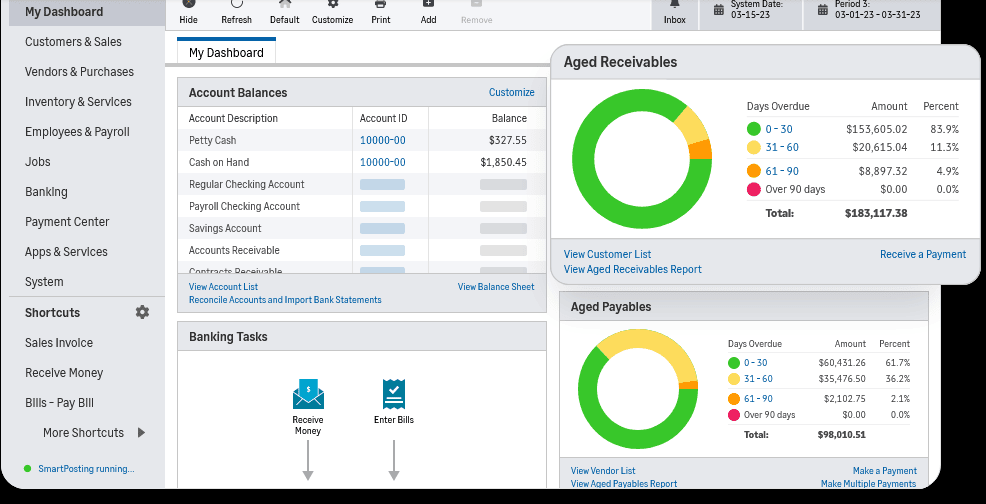

4. Sage Intacct

Sage Intacct is a cloud-based financial management software that offers a robust accounts payable solution. Its unique strength lies in its scalability, making it suitable for growing businesses. Sage Intacct allows users to automate the entire accounts payable process, from invoice capture to payment reconciliation. The software also provides real-time visibility into cash flow, allowing businesses to make informed financial decisions.

5. Freshbooks

Freshbooks is a popular choice for small businesses and self-employed professionals. While primarily known for its invoicing capabilities, Freshbooks also offers a user-friendly accounts payable feature. Businesses can easily track and manage their payables, schedule recurring payments, and set up automatic payment reminders. Freshbooks’ unique strength lies in its simplicity and time-saving automation features.

Deep Dive Into Netsuite Features

NetSuite is a robust and feature-rich accounts payable software that offers a wide range of functionalities to streamline your financial management processes. Whether you are a small business looking for a scalable solution or a large enterprise in need of comprehensive financial management, NetSuite has got you covered. In this section, we will take a closer look at the key features that make NetSuite stand out from the competition. Let’s dive in!

1. Comprehensive Financial Management

NetSuite is renowned for its comprehensive financial management capabilities. With this software, you can easily manage your accounts payable processes, including vendor payments, invoice management, and expense tracking. NetSuite’s intuitive interface and user-friendly features make it easy for your finance team to stay organized and efficient.

One of the standout features of NetSuite is its ability to automate repetitive tasks, such as invoice processing and payment reminders. By automating these processes, you can save time and reduce the likelihood of errors. Additionally, NetSuite integrates with other financial systems, allowing you to connect all your financial operations in one centralized platform.

2. Scalability For Growing Businesses

NetSuite is designed to grow with your business. Whether you are a startup or an established enterprise, NetSuite offers scalability, ensuring that the software meets the evolving needs of your organization. As your company expands, NetSuite can handle increased transaction volumes, additional users, and complex reporting requirements.

Furthermore, NetSuite’s cloud-based architecture makes it easy to scale your operations without the need for expensive hardware upgrades or extensive IT support. This flexibility allows you to focus on your core business activities while NetSuite takes care of your accounts payable processes.

3. Advanced Reporting And Analytics

NetSuite provides robust reporting and analytics capabilities, allowing you to gain valuable insights into your accounts payable processes. With NetSuite’s built-in reporting tools, you can generate customized reports, track key performance indicators, and analyze trends in real time.

These reporting capabilities enable you to make data-driven decisions and identify areas for improvement in your accounts payable workflows. By leveraging the power of analytics, you can optimize your financial operations, enhance cash flow management, and drive profitability.

4. Enhanced Security And Compliance

When it comes to financial management, security, and compliance are of utmost importance. NetSuite understands this and provides robust security features to protect your sensitive financial data. With NetSuite, you can set up user roles and permissions, ensuring that only authorized personnel have access to critical financial information.

In addition to security, NetSuite helps you stay compliant with various financial regulations, including GAAP and IFRS. With automated compliance processes and built-in audit trails, NetSuite simplifies your regulatory reporting obligations, reducing the risk of non-compliance and potential penalties.

5. Seamless Integration With Third-party Applications

NetSuite offers seamless integration with a wide range of third-party applications, allowing you to extend the functionality of the software to meet your specific needs. Whether you require integration with CRM, inventory management, or expense tracking systems, NetSuite enables you to connect with other business systems and streamline your operations.

By integrating NetSuite with your existing software stack, you can create a unified ecosystem that eliminates data silos and enhances collaboration across different departments. This integration capability makes NetSuite a highly scalable and adaptable solution for businesses of all sizes.

In conclusion, NetSuite stands out as one of the best accounts payable software options available. With its comprehensive financial management features, scalability for growing businesses, advanced reporting and analytics, enhanced security and compliance, and seamless integration capabilities, NetSuite can revolutionize your accounts payable processes and drive your business success.

Xero: Streamlining Accounts

Xero streamlines accounts, making it one of the best accounts payable software solutions available. With its user-friendly interface and advanced features, Xero simplifies financial management for businesses of all sizes.

User-friendly Interface

Xero, one of the leading accounts payable software, offers a user-friendly interface that makes managing your accounts a breeze. With its clean and intuitive design, Xero allows even those who are not tech-savvy to navigate easily through the software. You can access all the important features and functions with just a few clicks, saving you valuable time to focus on other aspects of your business. The simplicity of Xero’s interface doesn’t compromise its functionality. Whether you are creating invoices, reconciling bank transactions, or generating financial reports, Xero provides a seamless user experience. Its well-organized layout and clearly labeled features enable you to locate and utilize the tools you need effortlessly.

Strong Banking Integration

Xero goes beyond just streamlining your accounts; it also ensures strong banking integration to simplify your financial management. With Xero’s banking integration feature, you can connect your bank accounts directly to the software. This connectivity enables seamless synchronization of transactions, reducing the need for manual data entry. By integrating your bank accounts with Xero, you can easily reconcile your transactions with real-time updates. This ensures that your financial records are accurate and up to date, providing you with a clear overview of your cash flow. With Xero’s strong banking integration, you can save time on data entry and focus on making informed financial decisions. In addition to hassle-free transaction synchronization, Xero’s banking integration also offers features like automatic bank feeds and bank rules. Automatic bank feeds allow Xero to fetch and import your bank transactions automatically, eliminating the need for manual imports. Bank rules, on the other hand, allow you to categorize your transactions and set specific rules for recurring expenses, further streamlining your accounts payable process. With Xero’s strong banking integration, you can stay on top of your finances without the hassle of manual data entry and reconciliation. Saving you time, improving accuracy, and providing you with valuable insights into your financial health.

| Software | User-friendly interface | Strong banking integration |

| Netsuite | No | Yes |

| Xero | Yes | Yes |

| Quickbooks Online | Yes | No |

| Sage Intacct | No | No |

| Freshbooks | Yes | No |

Quickbooks Online: Simplified Finances

QuickBooks Online: Simplified Finances is one of the top 5 accounts payable software options, alongside Netsuite, Xero, Sage Intacct, and Freshbooks. Manage your finances easily with QuickBooks Online.

When it comes to managing your business’s finances, QuickBooks Online is a game-changer. With its user-friendly interface and powerful features, this accounting software has gained a reputation for simplifying financial management for businesses of all sizes. QuickBooks Online offers a wide range of tools and functions that streamline tasks like invoicing, expense tracking, budgeting, and reporting, allowing you to focus on growing your business.

Popular Among Small Businesses

QuickBooks Online has long been a favorite among small businesses for its ease of use and comprehensive functionality. With its intuitive interface and step-by-step guidance, even those with little to no accounting experience can quickly navigate the software and take control of their finances. Small business owners can easily track income and expenses, generate professional-looking invoices, and monitor cash flow in real time. This popular accounting software ensures that small businesses stay organized and financially compliant.

Vast Third-party Application Ecosystem

QuickBooks Online stands out from the crowd with its vast third-party application ecosystem. This means that users can seamlessly integrate the software with other business applications they may already be using, such as customer relationship management (CRM) systems, project management tools, or e-commerce platforms. With a wide range of integrations available, businesses can customize their accounting software according to their unique needs, making QuickBooks Online a truly versatile solution.

From payroll management to inventory control, there’s an integration available for almost every aspect of your business. This ecosystem of third-party apps allows businesses to optimize their operations, streamline processes, and increase efficiency. QuickBooks Online becomes the central hub for all your financial activities, making it easy to access the information you need when you need it.

Conclusion

With its simplified approach to accounting and extensive integration options, QuickBooks Online is a top choice for businesses seeking to streamline their financial management. Whether you’re a small business owner or a growing enterprise, this powerful software can help you save time, stay organized, and make informed business decisions. Embrace the power of QuickBooks Online and empower your business to thrive.

Credit: www.chase.com

Sage Intacct: Advanced Functionality

Sage Intacct is a leading accounts payable software known for its advanced functionality and robust features. With Sage Intacct, your business can streamline its financial operations and gain valuable insights into its payables process. Let’s explore the advanced functionality that sets Sage Intacct apart from the rest.

Real-time Financial Reporting

Sage Intacct provides real-time financial reporting, allowing you to access up-to-date information and make informed decisions. With its powerful reporting tools, you can generate customizable financial statements, including balance sheets, income statements, and cash flow statements, at any time. This real-time visibility into your organization’s financial health empowers you to track your payables, manage cash flow effectively, and make strategic decisions to drive growth.

Granular Controls For Complex Operations

Sage Intacct offers granular controls that cater to the needs of businesses with complex operations. Its flexible chart of accounts and dimensions enables you to manage payables across multiple entities, locations, departments, projects, and more. You can set up customizable approval workflows to ensure proper authorization of payments and maintain compliance. With its deep customization capabilities, Sage Intacct adapts to your unique business needs, providing the control and scalability required for complex payables processes.

Moreover, Sage Intacct’s flexible payment functionality supports various payment methods, such as checks, ACH payments, and credit cards. You can easily configure payment terms, set up vendor profiles, and automate payment processes, saving time and reducing manual errors. These comprehensive controls ensure accuracy and compliance while streamlining your accounts payable operations.

Efficient Vendor Management

Sage Intacct simplifies vendor management with its comprehensive features. You can easily track vendor information, including contact details, payment terms, and purchase history. The software allows you to generate reports on vendor performance, helping you identify top suppliers and negotiate favorable terms. With centralized vendor data, you can streamline communication, track invoices, and maintain strong relationships with your vendors.

Integrations And Customization

Another advantage of Sage Intacct is its seamless integration with other business systems. You can connect the software with your existing CRM, inventory management, or procurement systems, eliminating manual data entry and ensuring data consistency across platforms. Additionally, Sage Intacct offers a range of customization options, enabling you to tailor the software to your specific payables processes and reporting requirements. Its open API allows for further integrations with third-party applications, expanding its capabilities to meet your evolving business needs.

Summary

Sage Intacct stands out among the best accounts payable software due to its advanced functionality. With real-time financial reporting, granular controls for complex operations, efficient vendor management, and seamless integrations, Sage Intacct empowers businesses to streamline their payables processes and make data-driven decisions. By leveraging this robust software, your organization can optimize its accounts payable function, drive growth, and stay ahead of the competition.

Freshbooks: Intuitive Usability

FreshBooks stands out among the best accounts payable software due to its intuitive usability. With its user-friendly interface, FreshBooks makes managing invoices and payments a breeze for businesses of all sizes.

Designed For Freelancers And Agencies

FreshBooks is an exceptional accounting software that has been specifically designed to meet the unique needs of freelancers and agencies. With its intuitive and user-friendly interface, FreshBooks provides a seamless experience for those who work independently or as part of a creative team. Whether you’re a web designer, writer, photographer, or consultant, FreshBooks offers all the necessary features to help you manage your finances efficiently.

Time-saving Automation Features

FreshBooks understands the importance of saving time and streamlining your workflow. That’s why they have incorporated a range of automation features into their software. These features ensure that repetitive tasks are automated, allowing you to focus on more important aspects of your work. From automated invoice creation and recurring payments to expense tracking and client reminders, FreshBooks eliminates the need for manual data entry, reducing the risk of errors and saving you valuable time.

| Feature | Description |

| Automated invoice creation | Create and send professional invoices to your clients with just a few clicks. FreshBooks saves you the hassle of manual invoice creation, allowing you to get paid faster. |

| Recurring payments | Set up recurring payments for your regular clients and let FreshBooks handle the rest. No more chasing payments each month. |

| Expense tracking | Easily track and categorize your expenses by linking your bank accounts or uploading receipts. FreshBooks automatically updates your financial records, giving you a clear overview of your spending. |

| Client reminders | Forget about manually sending reminders to your clients. FreshBooks sends automated reminders for unpaid invoices, ensuring that you never miss out on getting paid. |

Say Goodbye To Complicated Accounting Tasks

FreshBooks eliminates the complexity often associated with accounting software. Their user-friendly interface and straightforward navigation make it easy for even the least tech-savvy individuals to manage their finances effectively. With FreshBooks, you don’t need to be an accounting expert to keep your books in order. Whether you’re tracking expenses, generating financial reports, or reconciling payments, FreshBooks simplifies the entire process, allowing you to focus on what you do best – your work. So if you’re a freelancer or agency looking for accounting software that is tailored to your needs and offers intuitive usability, FreshBooks is the perfect choice. With its time-saving automation features and simplified accounting tasks, FreshBooks will help you stay organized and in control of your finances, allowing you to dedicate more time to your creative projects and clients.

Comparisons And Contrasts

When it comes to selecting the best accounts payable software for your business, it’s important to thoroughly compare and contrast the available options. This ensures that you make an informed decision and choose a software solution that aligns with your specific needs. In this article, we will highlight key differences and discuss how each software can be tailored to meet your business requirements.

Highlighting Key Differences

Let’s start by delving into the key differences between the top five accounts payable software:

| Software | Key Differences |

| Netsuite | Netsuite offers a comprehensive suite of financial management tools, making it suitable for medium to large enterprises. It provides robust features for managing multiple subsidiaries and global operations. |

| Xero | Xero is known for its user-friendly interface and easy integration with other business applications. It is an ideal choice for small and growing businesses that need a cloud-based solution. |

| Quickbooks Online | Quickbooks Online is a widely popular software that caters to small and mid-sized businesses. It offers strong invoicing capabilities and simplifies the accounting processes. |

| Sage Intacct | Sage Intacct is favored by companies that require advanced financial reporting and analytics. It provides robust multi-dimensional reporting capabilities. |

| Freshbooks | Freshbooks is designed specifically for freelancers and small business owners. It offers simplicity and focuses on ease-of-use, making it ideal for non-accounting professionals. |

Tailoring Choice To Business Needs

Each of these accounts payable software options can be tailored to suit your specific business needs. Here’s how:

- Netsuite: Netsuite offers extensive customization capabilities, allowing you to adapt the software to your unique business requirements. This includes configuring workflows, templates and reports to streamline your accounts payable processes.

- Xero: Xero provides a wide range of add-ons and integrations, enabling you to enhance the functionality of the software. Whether you need to integrate with your e-commerce platform or use specialized reporting tools, Xero can be tailored to meet your needs.

- Quickbooks Online: Quickbooks Online offers various pricing tiers, ensuring that you can choose a plan that aligns with your business size and budget. The software is scalable, allowing you to upgrade as your business grows.

- Sage Intacct: Sage Intacct provides advanced financial reporting and analytics capabilities, empowering you to gain in-depth insights into your accounts payable processes. The software’s flexibility allows you to customize reports and dashboards to track the specific metrics that matter to your business.

- Freshbooks: Freshbooks offers a user-friendly interface that is intuitive and easy to navigate. It provides customizable templates and allows you to personalize your invoicing and payment processes.

By understanding these key differences and considering how each software can be tailored to your business needs, you can make an informed decision and choose the best accounts payable software for your organization.

An Assessment Of Adaptability

When it comes to managing accounts payable processes, having the right software in place is crucial. With the abundance of options available in today’s market, it can be overwhelming to choose the best fit for your organization. In this blog post, we will assess the adaptability of the top 5 accounts payable software solutions – Netsuite, Xero, Quickbooks Online, Sage Intacct, and Freshbooks. Under the subheading “An Assessment of Adaptability,” we will explore two important aspects: software flexibility and customizability, and future-proof features for finance teams.

Software Flexibility And Customizability

When evaluating accounts payable software, it’s important to consider the level of flexibility and customizability offered by each solution. This ensures that the software can be tailored to fit the unique needs and workflows of your organization. Let’s take a closer look at how each software performs in this aspect:

| Software | Flexibility | Customizability |

| Netsuite | High | High |

| Xero | Medium | High |

| Quickbooks Online | Medium | Medium |

| Sage Intacct | High | Medium |

| Freshbooks | Medium | Low |

Note: Flexibility refers to the software’s ability to adapt to different business needs and scale up or down as necessary. Customizability refers to the extent to which the software can be tailored to match specific requirements and workflows.

Netsuite emerges as a frontrunner in terms of both flexibility and customizability. Its highly configurable platform allows businesses to adapt the software to their unique processes and changing needs. Xero and Sage Intacct also offer a good level of customizability, enabling finance teams to personalize the software according to their requirements. Quickbooks Online falls slightly behind, providing a medium level of flexibility and customizability. On the other hand, Freshbooks offers limited customizability, making it suitable for small businesses with straightforward accounts payable needs.

Future-proof Features For Finance Teams

As technology continues to evolve, finance teams need to invest in software that offers future-proof features. These features enable organizations to stay ahead of the curve and adapt to changing financial landscapes. Let’s explore how the top 5 accounts payable software solutions fare in this regard:

- Netsuite: Netsuite stays ahead of the game by regularly updating its software with cutting-edge features. From AI-powered automation to advanced reporting and analytics, Netsuite ensures that finance teams have access to the latest tools and technologies to streamline their accounts payable processes.

- Xero: Xero also focuses on providing future-proof features, with a strong emphasis on automation and integrations. Its intuitive interface and a robust ecosystem of third-party apps enable finance teams to automate repetitive tasks and keep pace with industry advancements.

- Quickbooks Online: Quickbooks Online offers a range of advanced features, including AI-enabled expense categorization and automatic bill payments. While it may not be as future-proof as some other solutions, it still provides a solid foundation for finance teams looking to optimize their accounts payable processes.

- Sage Intacct: Sage Intacct prides itself on being a forward-thinking solution, with features like multi-entity management and intelligent insights. These features empower finance teams to make data-driven decisions and adapt to changing business requirements.

- Freshbooks: Freshbooks, although primarily designed for small businesses, offers features like online payments and expense tracking that are essential for efficient accounts payable management. However, its focus on simplicity may limit its ability to keep up with advanced future-proof functionalities.

In conclusion, when it comes to adaptability, Netsuite emerges as a standout performer with its high level of flexibility, customizability, and future-proof features. Xero and Sage Intacct also offer valuable options for finance teams looking to optimize their accounts payable processes. Quickbooks Online and Freshbooks, while still effective, may have some limitations in terms of customizability and future-proof functionality. By assessing these factors, you can choose the best accounts payable software that aligns with your organization’s unique needs and future growth.

Aligning Software With Your Financial Workflow

Choosing the right accounts payable software is crucial for streamlining your financial operations. With various options available in the market, it can be overwhelming to find a solution that aligns perfectly with your unique business requirements. In this blog post, we will explore the top 5 accounts payable software options and discuss how each software can seamlessly integrate with your existing financial workflow.

Ensuring Seamless Integration

To effectively align your chosen accounts payable software with your financial workflow, it is essential to ensure seamless integration. Each of the following software solutions provides different integration capabilities:

| Software | Integration Capabilities |

| Netsuite | Offers robust integration features, allowing you to connect with other financial systems, CRM software, and other business applications to create a unified ecosystem. |

| Xero | Enables seamless integration with popular accounting software, banking institutions, payment gateways, and third-party applications through its extensive library of integrations. |

| Quickbooks Online | Provides a wide range of integrations with various software solutions including CRM, payroll, project management, and inventory management systems to enhance your overall financial workflow. |

| Sage Intacct | Offers robust integration capabilities by connecting with other cloud-based financial applications, specialized industry solutions, and CRM systems to streamline your accounts payable processes. |

| Freshbooks | Allows seamless integration with various payment gateways, financial tools, and third-party applications to streamline your invoicing and payment processes for more efficient accounts payable management. |

Steps For A Smooth Transition

Transitioning to new accounts payable software can be a complex process. To ensure a smooth and efficient transition, follow these steps:

- Evaluate your existing financial workflow: Before implementing new accounts payable software, evaluate your current financial workflow to identify areas for improvement and determine how the new software can integrate seamlessly.

- Define your integration goals: Clearly define what you want to achieve with the software integration. Whether it is automating invoice processing, improving vendor management, or optimizing payment processes, having specific goals will help guide your implementation strategy.

- Prepare and clean your data: Ensure that your financial data is accurate, up-to-date, and well-organized. Cleanse your data by removing duplicates, inconsistencies, and errors to prevent any data-related issues during the integration process.

- Create an implementation plan: Develop a comprehensive plan that outlines the steps, timelines, and resources required to integrate the new accounts payable software. Consider involving key stakeholders and training your team to maximize the benefits of the software.

- Test and monitor the integration: Once the integration is complete, thoroughly test the software to ensure all functionalities are working as expected. Continuously monitor the integration process, making necessary adjustments and optimizations along the way.

By following these steps and aligning your chosen accounts payable software with your financial workflow, you can optimize your accounts payable processes, improve efficiency, and make informed financial decisions. Choose the best software that suits your business needs and seamlessly integrate it into your existing financial ecosystem.

Investing In The Right Tool

Investing in the right tool is vital for efficient accounts payable management. Netsuite, Xero, Quickbooks Online, Sage Intacct, and Freshbooks stand out as the top choices, offering robust features and seamless integration.

When it comes to managing and streamlining your accounts payable process, investing in the right software tool can be a game-changer. By automating manual tasks, reducing errors, and improving efficiency, accounts payable software can save your company time and money. But with so many options available in the market, how do you choose the best one for your business?

Considerations For Return On Investment

Before making any investment, it’s crucial to consider the potential return on investment (ROI). In the case of accounts payable software, this means evaluating the cost of the software against the savings and benefits it can provide.

Here are a few key factors to consider when determining the ROI of accounts payable software:

- Cost: Evaluate the upfront and ongoing costs associated with each software option. It’s essential to consider not only the initial investment but also any monthly or annual fees, implementation costs, and support charges.

- Time savings: Accounts payable software streamlines the process of invoice processing, approval workflows, and payment. Consider the amount of time your team currently spends on these tasks and how much time the software can potentially save. Time saved can be utilized for more strategic tasks and productivity.

- Error reduction: Manual data entry and processing can lead to errors, resulting in additional costs and delays. Look for software that offers features like automated data capture and validation, reducing the risk of errors and associated expenses.

- Visibility and reporting: Good accounts payable software provides real-time visibility into your payables, allowing you to track invoices, manage cash flow, and generate reports. This improved visibility can help you make informed financial decisions, negotiate better terms with vendors, and optimize your working capital.

- Vendor discounts and improved relationships: Timely payments and accurate record-keeping can help build strong relationships with your vendors. Some accounts payable software can even provide early payment discount management, ensuring you take full advantage of vendor discounts.

Long-term Benefits For Accounts Payable

Investing in the right accounts payable software can provide numerous long-term benefits for your business. Here are some advantages:

- Improved efficiency: With streamlined and automated processes, your accounts payable team can work more efficiently, reducing the time and effort required to complete tasks.

- Reduced costs: By eliminating manual errors, optimizing cash flow, and capturing early payment discounts, accounts payable software helps reduce costs associated with inaccuracies, late fees, and missed opportunities.

- Better compliance: Accounting regulations and rules are constantly evolving. Accounts payable software enables you to stay compliant with industry standards, reducing the risk of non-compliance penalties.

- Enhanced data security: Accounts payable software often comes equipped with robust data security features like encryption, user permissions, and access controls. This helps protect sensitive financial data and prevents unauthorized access.

- Scalability: As your business grows, so does your accounts payable volume. Choosing a software tool that can scale with your needs ensures that you won’t outgrow its capabilities and have to switch to a different solution.

By carefully considering the ROI and long-term benefits, you can make an informed decision when choosing the best accounts payable software for your business. Whether it’s Netsuite, Xero, Quickbooks Online, Sage Intacct, or Freshbooks, these top software options offer the features and functionality needed to streamline your accounts payable process and drive success.

Frequently Asked Questions Of 5 Best Accounts Payable Software

Does Xero Do Accounts Payable?

Yes, Xero offers accounts payable functionality. It allows you to manage and track your company’s expenses, pay bills, and keep track of outstanding payments. Xero’s accounts payable feature helps streamline your financial processes and ensure timely payments.

What Are Examples Of Accounts Payable?

Examples of accounts payable include invoices from suppliers, monthly utility bills, and outstanding loans or credit card payments.

What Is Netsuite Account Payable?

NetSuite account payable is a feature that manages and tracks a company’s payable transactions. It helps streamline the payment process, track outstanding invoices, and improve cash flow management. With NetSuite accounts payable, businesses can easily review and approve payments, track vendor invoices, and handle payment disputes efficiently.

What Programs Are Used In Accounts Payable?

Accounts payable programs commonly used include popular software such as QuickBooks, Xero, SAP, and Oracle. These programs streamline the process of managing and tracking financial transactions related to accounts payable, ensuring efficiency and accuracy in payment processing and vendor management.

Conclusion

To sum it up, when it comes to finding the best accounts payable software, these top 5 options – Netsuite, Xero, Quickbooks Online, Sage Intacct, and Freshbooks – remain unbeatable. With their diverse range of features and user-friendly interfaces, these platforms offer easy and efficient solutions for managing accounts payable.

Whether you’re a small business owner or a larger enterprise, implementing these software programs can streamline your accounting processes and save you valuable time and resources. So, choose the software that aligns with your business needs and take your accounts payable management to new heights.