Accounting software in UAE helps businesses efficiently manage their financial transactions and streamline their accounting processes. With features like automated bookkeeping, inventory management, and financial reporting, it simplifies tasks and enhances accuracy, saving time and effort for businesses in the UAE.

In the fast-paced business landscape of the United Arab Emirates (UAE), managing finances and staying on top of accounting tasks can be a challenge. However, with the advent of accounting software, businesses can now streamline their financial processes, automate bookkeeping tasks, and generate detailed reports with ease.

Whether you’re a small startup or a large corporation, accounting software in UAE offers a range of features such as invoicing, inventory management, expense tracking, and financial reporting to help simplify and optimize your accounting operations. We will explore the benefits and features of accounting software in the UAE, as well as highlight some popular options available in the market.

Table of Contents

What Is Accounting Software?

Accounting software is a computer program that helps businesses manage and automate their financial processes. It allows companies to track and record financial transactions, generate reports, and analyze data to make informed business decisions.

Definition And Functionality

Accounting software can be defined as a software application designed to streamline and simplify accounting processes within an organization. It enables businesses to efficiently manage their financial activities, such as invoicing, bookkeeping, payroll processing, and tax compliance.

Functionality of accounting software:

- Financial transactions: Accounting software allows businesses to record and track financial transactions, such as income, expenses, and purchases. This functionality helps maintain accurate and up-to-date financial records.

- Invoice management: With accounting software, businesses can easily create and send professional invoices to clients. It automates the invoicing process, saving time and ensuring timely payments.

- Bookkeeping and financial reporting: Accounting software simplifies bookkeeping tasks by automatically categorizing transactions and generating financial reports, such as balance sheets, income statements, and cash flow statements. These reports provide a comprehensive view of the company’s financial health and performance.

- Payroll processing: Many accounting software solutions offer payroll management functionality. They allow businesses to calculate wages, deductions, and taxes, and generate payslips for employees. This feature ensures accurate and timely payroll processing.

- Tax compliance: Accounting software often includes tax management features that assist businesses in staying compliant with tax regulations. It helps calculate and track taxes owed, generate tax forms, and streamline the filing process.

- Integration with other software: Accounting software can integrate with other business systems, such as CRM software or inventory management tools. This integration improves efficiency and reduces manual data entry.

Importance Of Accounting Software In Businesses

Accounting software plays a crucial role in businesses of all sizes. Its importance lies in the benefits it brings to the financial management process.

The use of accounting software offers:

- Accuracy: By automating financial tasks and reducing human error, accounting software ensures accurate calculations and financial reporting. This accuracy helps businesses make informed decisions based on reliable financial data.

- Time savings: Manual financial processes can be time-consuming and prone to errors. Accounting software streamlines these processes, saving valuable time that can be allocated to other critical business activities.

- Efficiency: With features like automated invoicing, financial reporting, and payroll processing, accounting software improves overall efficiency. It eliminates redundant tasks, increases productivity, and allows employees to focus on more strategic activities.

- Cost savings: Investing in accounting software can lead to significant cost savings in the long run. By reducing the need for manual labor, businesses can save on hiring additional accounting staff. Moreover, accurate financial reporting helps identify areas where costs can be minimized.

- Data security: Accounting software often provides data encryption and backup features, ensuring the security of financial information. This protects businesses from data breaches, theft, and loss of critical financial data.

In conclusion, accounting software is a powerful tool that helps businesses simplify their financial management processes. By automating tasks, ensuring accuracy, and providing valuable insights through financial reports, accounting software contributes to the overall success and growth of businesses.

Accounting Software Features

Accounting software in the UAE is an integral part of modern business operations. It offers a range of features that streamline financial tasks, saving time and effort. In this blog post, we will explore the key accounting software features that businesses in the UAE can benefit from. From general ledger management to payroll processing, these features ensure accurate record-keeping, efficient financial management, and informed decision-making.

General Ledger

The general ledger feature is the backbone of accounting software. It allows businesses to maintain a complete and organized record of all financial transactions. With this feature, you can easily track income, expenses, assets, and liabilities – initializing a solid foundation for the financial management of your business.

Accounts Payable And Receivable

Managing accounts payable and accounts receivable is essential for maintaining healthy cash flow. Accounting software provides dedicated modules for efficient management of both. The accounts payable feature helps you to manage and track payments to your suppliers, ensuring timely payments and avoiding late fees. On the other hand, the accounts receivable feature allows you to streamline invoice creation and track the payments from your customers, reducing the chances of unpaid invoices and improving your business’s liquidity.

Inventory Management

Inefficient inventory management can lead to poor cash flow and product wastage. Accounting software helps you take control of your inventory by keeping a real-time record of your stock. With features such as stock tracking, reorder point setting and automatic inventory adjustments, you can optimize your inventory levels, reduce holding costs, and avoid stockouts, ultimately improving customer satisfaction and maximizing profitability.

Payroll Processing

Managing payroll manually can be time-consuming and prone to errors. Accounting software automates the payroll process, ensuring accurate and timely payment to your employees. It allows you to calculate salaries, deduct taxes and other deductions, generate payslips, and maintain employee records. With this feature, you can effectively manage employee benefits, and leave balances, and generate reports for financial analysis and compliance purposes.

Financial Reporting

Financial reporting is crucial for understanding the financial health of your business and making informed decisions. Accounting software provides customizable financial reporting features that allow you to generate reports such as balance sheets, income statements, and cash flow statements. These reports provide you with key insights into your business’s financial performance, helping you identify areas of improvement and make well-informed decisions for sustainable growth.

Different Types Of Accounting Software

Accounting software is an essential tool for businesses to efficiently manage their financial transactions, invoices, and income statements. With technological advancements, there are several types of accounting software available in the market catering to different business needs. In this article, we will explore the three primary types of accounting software: cloud-based accounting software, on-premise accounting software, and open-source accounting software.

Cloud-based Accounting Software

Cloud-based accounting software, also known as online accounting software, is a web-based solution that allows businesses to access their financial data securely from any location using an internet connection. It eliminates the need for physical installation and provides real-time access to critical financial information. Some popular cloud-based accounting software in UAE include QuickBooks Online, Xero, and Zoho Books.

This type of accounting software offers various benefits, including:

- Flexibility: Users can access the software anytime, anywhere, and from any device, making it suitable for businesses with remote or mobile workforce.

- Automatic Updates: Cloud-based software providers handle software updates and security patches, ensuring businesses always have the latest features and protection.

Moreover, cloud-based accounting software often comes with additional features like online invoicing, bank reconciliation, and integrations with other business tools.

On-premise Accounting Software

On-premise accounting software is a traditional solution that requires installation on local computers or servers. The software is managed and maintained by the business internally, which provides complete control and customization options. Some popular on-premise accounting software in UAE includes Tally ERP 9, QuickBooks Desktop, and Sage 50.

Key advantages of on-premise accounting software include:

- Data Control: Businesses have full control over their financial data and can customize the software according to their specific requirements.

- No Internet Dependency: On-premise software does not rely on the Internet connection, making it suitable for businesses with limited or unreliable Internet access.

This type of software is typically more suitable for larger businesses with dedicated IT resources and a higher level of security requirements.

Open-source Accounting Software

Open-source accounting software is a type of software that allows users to view, modify, and distribute the source code. It provides businesses with the freedom to customize the software according to their needs and collaborate with a community of developers. One popular open-source accounting software in UAE is GnuCash.

Benefits of using open-source accounting software include:

- Cost-effective: Open-source software is usually free to use, helping businesses save on software licensing costs.

- Customization: Businesses can customize the software to match their specific requirements without depending on the software provider.

However, it’s important to note that open-source software may require technical expertise and ongoing maintenance.

In conclusion, the choice of accounting software depends on factors such as business size, requirements, and technical capabilities. Cloud-based software provides flexibility and ease of access, on-premise software offers control and customization, while open-source software provides cost-effective customization options. Assessing your business needs is crucial to selecting the most suitable accounting software for your organization.

Benefits Of Using Accounting Software

Accounting software is a powerful tool that can revolutionize the way businesses in the UAE manage their finances. Automating various financial processes, not only saves time and effort but also improves accuracy and efficiency. In this article, we will explore the key benefits of using accounting software and how it can positively impact your business.

Accuracy And Efficiency

One of the primary benefits of using accounting software in the UAE is the improved accuracy and efficiency it provides. Manual bookkeeping methods are prone to human errors and can be time-consuming. However, with accounting software, the chances of making mistakes are significantly reduced as the software performs calculations and data entry automatically. This accuracy not only saves time but also ensures that your financial records are more reliable and up-to-date.

Time And Cost Savings

Accounting software in the UAE can save you valuable time by automating repetitive tasks. As a result, you and your team can focus on more strategic and critical aspects of your business. Additionally, reducing the need for manual paperwork and multiple data entries also helps to minimize the risk of errors. These time-saving features translate into cost savings, as you won’t need to hire additional staff or spend excessive amounts on accounting services.

Improved Data Security

Data security is a major concern for businesses, especially when it comes to financial information. Accounting software offers enhanced security measures to protect your sensitive data. It often includes features such as user access controls, data encryption, and regular backups, ensuring that your financial data remains secure and accessible only to authorized personnel. With accounting software, you can have peace of mind knowing that your financial information is safeguarded against potential threats or breaches.

Access To Real-time Financial Information

Accounting software provides you with real-time access to your financial information. Gone are the days of manually updating spreadsheets or waiting for paper records to be processed. With just a few clicks, you can generate accurate financial reports, view up-to-date cash flow statements, and monitor the financial health of your business. Having instant access to real-time financial information allows you to make informed decisions promptly and adapt your financial strategies as needed.

Easy Collaboration With Accountants And Stakeholders

Collaboration is essential in any business, especially when it comes to financial matters. Accounting software facilitates easy collaboration with your accountants and other stakeholders. With cloud-based accounting solutions, you can grant secure access to your financial data to your accountants, auditors, or even business partners. This seamless collaboration not only saves time but also ensures that everyone is on the same page when it comes to financial management. It enables efficient communication and enhances decision-making processes.

As you can see, the benefits of using accounting software in the UAE are numerous. From improved accuracy and efficiency to time and cost savings, enhanced data security, real-time financial information, and easy collaboration, accounting software is a valuable investment for any business. By harnessing the power of technology, you can streamline your financial processes, make informed decisions, and drive your business toward success.

Factors To Consider When Choosing Accounting Software

When it comes to choosing the right accounting software for your business in the UAE, several factors need to be considered. Accounting software is a crucial tool for managing your finances, tracking expenses, and generating financial reports. Therefore, it is important to select software that meets your specific needs and requirements. In this article, we will discuss the key factors to consider when choosing accounting software in the UAE. These factors include scalability, user interface and ease of use, integration capabilities, customization options, customer support and training, and cost.

Scalability

Scalability is an important factor to consider when choosing accounting software in the UAE. As your business grows, your accounting software should be able to handle the increased volume of transactions and data. Look for software that can accommodate the size of your business and can scale with your changing needs.

User Interface And Ease Of Use

The user interface and ease of use of the accounting software are crucial considerations, especially if you or your employees do not have a background in accounting. Look for software that has a clean and intuitive interface, with easy-to-navigate menus and icons. This will ensure that you can efficiently perform your accounting tasks without spending too much time on training or troubleshooting.

Integration Capabilities

Integration capabilities are important when it comes to accounting software. Your accounting software should be able to integrate with other business applications such as your CRM system or your e-commerce platform. This will enable seamless data flow between systems and reduce the need for manual data entry.

Customization Options

Customization options are another factor to consider when choosing accounting software in the UAE. Every business has unique accounting needs, and it is important to select software that can be customized to meet your specific requirements. Look for software that allows you to tailor your chart of accounts, add custom fields, and generate custom reports.

Customer Support And Training

Customer support and training are crucial for the smooth implementation and ongoing use of accounting software. Look for software providers that offer comprehensive customer support options such as phone, email, and live chat. Training resources like video tutorials, user guides, and webinars should also be easily accessible. Having reliable customer support and training resources will ensure that you can quickly resolve any issues or questions that may arise.

Cost

The cost of accounting software is an important consideration for businesses in the UAE. It is important to consider both the upfront cost, including any licensing fees or subscription fees, as well as any ongoing costs such as maintenance or support fees. Compare the pricing plans of different software providers and consider the value you will get from the software about its cost.

In conclusion, when choosing accounting software in the UAE, it is important to consider factors such as scalability, user interface and ease of use, integration capabilities, customization options, customer support and training, and cost. Assessing these factors will help you select software that meets your business needs and efficiently manages your financial processes.

Top Accounting Software Providers In UAE

When it comes to managing finances and streamlining accounting processes, having the right software can make all the difference. In UAE, several accounting software providers offer robust solutions that cater to the unique needs of businesses in the region. Whether you are a small startup or a large enterprise, choosing the right accounting software is essential for maintaining accurate records, generating financial reports, and ensuring compliance with local regulations.

xero

One of the top accounting software providers in the UAE is Xero. Xero offers a cloud-based platform that allows businesses to manage their finances with ease. With its intuitive interface and powerful features, Xero simplifies tasks such as invoicing, bank reconciliation, and expense tracking. The software also integrates seamlessly with other business applications, enabling businesses to automate processes and save time. Furthermore, Xero provides real-time financial insights and facilitates collaboration with accountants and advisors.

quickbooks Online

Another popular choice among businesses in the UAE is QuickBooks Online. QuickBooks Online offers a user-friendly interface and a wide range of features that help businesses simplify their accounting operations. From managing invoices and tracking expenses to generating financial reports, QuickBooks Online makes it easy to stay organized and in control of your finances. Additionally, the software allows for seamless integration with other business tools, making it a comprehensive solution for small and medium-sized enterprises.

homebase

For businesses looking for an all-in-one solution for their accounting needs, Homebase is a top contender. Homebase offers a suite of tools that not only handle accounting processes but also encompass other essential business functions, such as project management, inventory management, and CRM. With its comprehensive features and user-friendly interface, Homebase provides businesses in the UAE with a platform that centralizes their operations and simplifies their day-to-day tasks.

gusto

Gusto is another accounting software provider that is gaining popularity among businesses in the UAE. Known for its payroll and HR management features, Gusto offers a seamless integration of accounting and employee management functions. The software allows businesses to automate payroll processes, track employee benefits, and generate accurate financial reports. With Gusto, businesses can streamline their operations and focus on what matters most – growing their business.

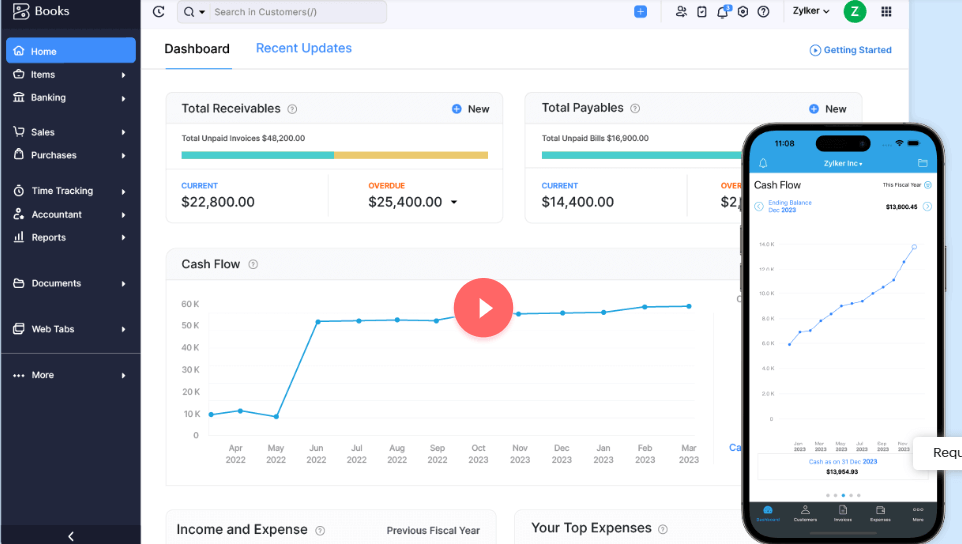

zohoBooks

Zoho Books is a comprehensive accounting software solution that caters to the needs of businesses of all sizes in the UAE. With its advanced features and user-friendly interface, Zoho Books simplifies tasks such as invoicing, expense tracking, and financial reporting. The software also integrates seamlessly with other business applications, allowing for efficient data sharing and collaboration. Zoho Books offers a range of pricing plans, making it an affordable option for businesses looking to manage their finances effectively.

How To Implement Accounting Software

Implementing accounting software is a crucial step for businesses in UAE looking to streamline their financial processes and improve efficiency. However, the process of implementing accounting software can be complex and requires careful planning and execution. In this article, we will discuss the key steps involved in implementing accounting software and guide how to ensure a smooth transition.

Assessing Business Needs

Before implementing accounting software, it is essential to assess your business needs and requirements. This involves evaluating your current accounting processes, identifying pain points, and determining what features and functionalities are necessary for your business.

Take the time to analyze your financial operations, including invoicing, expense tracking, inventory management, and reporting. What are the specific challenges you face? Are there any industry-specific requirements that need to be addressed?

By understanding your business needs, you can make a well-informed decision when choosing the right accounting software.

Choosing The Right Software

Once you have a clear understanding of your business needs, it’s time to choose the right accounting software for your organization. There are several factors to consider when making this decision:

- Budget: Determine your budget and identify software options that fit within your financial constraints.

- Scalability: Consider the future growth of your business and whether the software can accommodate your evolving needs.

- Features: Evaluate the features and functionalities offered by different accounting software solutions and ensure they align with your requirements.

- User-friendliness: Look for software that is intuitive and easy to use, as this will make the transition smoother for your staff.

- Vendor reputation and support: Research the reputation of the software vendor and ensure they offer reliable customer support.

By carefully considering these factors, you can choose an accounting software solution that best suits your business.

Data Migration

Once you have selected the accounting software, the next step is to migrate your existing financial data into the new system. This can be a complex task, and it is crucial to ensure the accuracy and integrity of your data throughout the migration process.

Start by conducting a thorough data cleanup. This involves reviewing and organizing your data, removing duplicates or inaccuracies, and ensuring consistency.

Then, carefully map your existing data into the appropriate fields of the new accounting software. It is recommended to work with a professional IT team or seek guidance from the software vendor to ensure a smooth and accurate data migration.

Staff Training And Adoption

Implementing accounting software involves a significant change for your staff. It is essential to provide comprehensive training to ensure they can effectively utilize the new software.

Develop a training plan that covers all aspects of the software, including data entry, report generation, and any specific features relevant to your business.

Consider conducting hands-on training sessions, providing reference materials such as user manuals or video tutorials, and offering ongoing support to address any questions or concerns.

Monitoring And Maintenance

Implementing accounting software is not a one-time task; it requires ongoing monitoring and maintenance to ensure its effectiveness and reliability.

Regularly review financial reports generated by the software to identify any discrepancies or areas for improvement. Conduct regular data backups to protect against data loss or system failures.

Stay updated with software upgrades and patches provided by the vendor, as these often include bug fixes and security enhancements.

By actively monitoring and maintaining your accounting software, you can maximize its benefits and ensure the smooth operation of your financial processes.

Challenges Of Implementing Accounting Software

Implementing accounting software in the UAE can provide significant benefits to businesses, such as streamlined processes, improved accuracy, and increased efficiency. However, it is essential to be aware of the challenges that may arise during the implementation process. By understanding and addressing these challenges, businesses can ensure a smoother transition and successfully leverage the advantages of accounting software.

Resistance To Change

One of the primary challenges encountered during the implementation of accounting software is resistance to change. Whenever businesses introduce new systems or processes, employees may be reluctant to embrace the changes. They may fear that the software will replace their roles or be unfamiliar with how to use it effectively.

Technical Difficulties

Another challenge that businesses may face when implementing accounting software is technical difficulties. These can range from software compatibility issues to inadequate hardware requirements. Businesses must assess their existing infrastructure and ensure it meets the necessary specifications for a seamless integration of the software.

Integration Issues

Integration issues are also a common challenge when implementing accounting software. Many companies already have various systems in place, such as customer relationship management (CRM) software or inventory management systems. Integrating the accounting software with these existing systems can be complex and requires proper planning to prevent data inconsistencies and duplications.

Data Security Concerns

Data security is a critical consideration when implementing accounting software. Businesses need to ensure that the software they choose has robust security measures in place to protect sensitive financial information. Data breaches can have severe consequences, including financial loss, damaged reputation, and legal ramifications. Therefore, businesses must prioritize data security and implement proper safeguards.

Cost Implications

Cost implications are also a significant consideration when implementing accounting software. While adopting accounting software can lead to long-term cost savings, there may be initial expenses associated with purchasing the software, training employees, and potential customization. Businesses need to carefully analyze their budget and weigh the cost implications against the expected benefits before making a decision.

Best Practices For Using Accounting Software

Accounting software is a powerful tool that can streamline financial processes and improve the accuracy and efficiency of your business’s financial management. However, to get the most out of your accounting software, it’s important to follow best practices that ensure data integrity, security, and compliance. In this article, we will discuss the top best practices for using accounting software in UAE, ranging from regular data backup to monitoring financial performance.

Regular Data Backup

Regular data backup is crucial for safeguarding your financial information. By regularly backing up your accounting software data, you can protect your business from data loss due to hardware failure, natural disasters, or cyber-attacks. Schedule automatic backups on a daily or weekly basis to ensure that your data is always up-to-date and secure.

Periodic Software Updates

Keeping your accounting software up to date is important to leverage the latest features and functionalities and enhance security. Software updates often include bug fixes, performance improvements, and new features that can optimize your financial processes. Regularly check for software updates provided by the software provider and install them promptly to ensure your software remains efficient and secure.

Implementing Internal Controls

Implementing internal controls is essential for maintaining the accuracy and integrity of your financial data. Internal controls help prevent fraud, errors, and discrepancies in financial transactions. Establish procedures and policies, such as segregation of duties, approval processes, and regular audits, to ensure that financial information is handled and recorded correctly within the accounting software.

Using Security Measures

Protecting the privacy and security of your financial data should be a top priority. Use robust passwords and enable multi-factor authentication to prevent unauthorized access to your accounting software. Additionally, consider using encryption technology to secure sensitive financial data both at rest and in transit. Regularly review your security measures and update them as needed to stay ahead of potential threats.

Regularly Reconciling Accounts

Regularly reconciling accounts is critical to identifying and resolving any discrepancies between your accounting records and bank statements. Reconciling accounts ensures that all financial transactions are recorded accurately and helps to identify any possible errors or fraudulent activities. Set a schedule for reconciling accounts, whether it’s monthly or quarterly, and ensure that the process is followed consistently.

Monitoring Financial Performance

Monitoring your business’s financial performance is essential for making informed decisions and driving growth. Use the reporting and analytics features of your accounting software to track key financial metrics, generate financial statements, and analyze trends. Regularly review financial reports to assess the health of your business and make proactive adjustments or strategies based on the insights gained.

Accounting Software For Small Businesses

Running a small business comes with its own unique set of challenges, and managing your finances is one of them. But with the right accounting software, you can streamline your financial processes and stay on top of your business’s financial health. In this blog post, we will explore the benefits of using accounting software specifically designed for small businesses in the UAE.

Special Considerations For Small Businesses

Small businesses often have specific needs when it comes to accounting software. They require a system that is user-friendly, efficient, and cost-effective. Furthermore, small businesses need to track their expenses, invoicing, and cash flow accurately, as these factors play a crucial role in their growth and success.

Affordable Software Options

Fortunately, there are several affordable accounting software options available in the UAE market that cater to the needs of small businesses. Many software providers offer monthly or annual subscription plans, allowing businesses to choose the best option that fits their budget. These affordable software solutions not only save money but also provide essential features that streamline accounting processes.

When looking for an affordable accounting software solution, consider the following factors:

- Features: Make sure the software offers all the necessary features that small businesses require, such as invoicing, expense tracking, financial reporting, and inventory management.

- User-friendly interface: Small business owners may not have extensive accounting knowledge, so it’s essential to choose software with an intuitive and user-friendly interface.

- Customer support: Ensure that the software provider offers reliable customer support, as you may need assistance with the setup or face technical difficulties along the way.

Scalability And Growth Potential

While affordability is important for small businesses, it’s also crucial to consider software that can grow with your business. As your business expands, your accounting requirements will become more complex. Therefore, choosing scalable software enables you to seamlessly upgrade and add more advanced features as your business grows.

When evaluating different accounting software options, keep the following aspects in mind:

| Considerations | Explanation |

| Customizability: | Look for software that allows you to customize reports and tailor the system to your specific business needs. |

| Integration: | Check if the software can integrate with other business tools or software that your business currently uses or might use in the future. |

| Cloud-based: | Consider opting for cloud-based accounting software, which provides flexibility and accessibility to your financial data from anywhere. |

By considering these factors, you can ensure that the accounting software you choose has the scalability and growth potential necessary to support your business’s long-term success.

Accounting Software For Large Enterprises

When it comes to managing the finances of a large enterprise, having powerful and comprehensive accounting software is crucial. It not only streamlines your financial operations but also provides accurate and real-time insights into your company’s financial health. In the UAE, there are several accounting software solutions designed specifically for large enterprises that offer a wide range of features and functionalities. In this article, we will explore how accounting software for large enterprises can meet enterprise-level requirements, integrate with other business systems, and provide advanced reporting and analytics.

Enterprise-level Software Requirements

Accounting software for large enterprises needs to cater to a variety of complex requirements unique to the enterprise environment. These requirements include:

- Scalability: The software should be able to handle the large volume of financial transactions and data that are typical in large enterprises.

- Multi-entity support: Large enterprises often have multiple subsidiaries or branches that require separate financial reporting. Therefore, the software should be capable of handling multiple entities and providing consolidated financial statements.

- User access controls: With a large number of employees involved in financial processes, it’s important to have robust user access controls in place to ensure data security and prevent unauthorized access to sensitive financial information.

- Customization options: Each enterprise has its unique requirements and workflows. The accounting software should offer customization options to adapt to these specific needs.

Integration With Other Business Systems

In a large enterprise, various business systems such as ERP, CRM, and inventory management software are used to manage different aspects of the business. To ensure seamless workflow and data integrity, the accounting software should be capable of integrating with these business systems. This integration allows for the automatic transfer of data, eliminates manual data entry, and provides real-time visibility into financial performance across different departments.

Advanced Reporting And Analytics

Reporting and analytics play a crucial role in making informed financial decisions for large enterprises. Accounting software designed for large enterprises typically offers advanced reporting and analytics capabilities, including:

- Financial statements generation: The software should be able to generate accurate financial statements such as balance sheets, income statements, and cash flow statements promptly.

- Customizable dashboards: Dashboards provide a visual representation of key financial metrics and performance indicators. Customizable dashboards allow users to monitor specific metrics relevant to their roles and responsibilities.

- Trend analysis: Advanced reporting and analytics features enable trend analysis, allowing businesses to identify patterns, spot opportunities, and make data-driven decisions.

- Forecasting and budgeting: The software should support forecasting and budgeting functionalities, enabling enterprises to create accurate and reliable financial forecasts and budgets for strategic planning.

In conclusion, choosing the right accounting software for large enterprises in the UAE is essential for efficient financial management. The software should meet enterprise-level requirements, integrate seamlessly with other business systems, and provide advanced reporting and analytics capabilities. By leveraging the power of accounting software designed specifically for large enterprises, businesses can save time, improve accuracy, and make smarter financial decisions.

Future Trends In Accounting Software

Discover the future trends in accounting software in the UAE. Explore the latest innovations and features that streamline financial processes and enhance efficiency for businesses in the region. Stay ahead in the world of accounting with cutting-edge software solutions.

As technology advances and businesses strive for greater efficiency and accuracy, the future of accounting software in the UAE is poised to undergo significant transformations. Embracing these trends will not only ensure smooth financial operations but also provide businesses with valuable insights into their financial health. In this article, we explore several key trends that are reshaping the accounting software landscape in the UAE.

Artificial Intelligence And Automation

Artificial Intelligence (AI) is revolutionizing the way accounting software functions. With AI-powered algorithms, software can analyze data, detect patterns, and make intelligent predictions. By automating repetitive tasks, such as data entry and reconciliation, AI-powered accounting software enables accountants to focus on more strategic activities and value-added tasks. This ultimately leads to faster processing times, reduced errors, and improved decision-making.

Cloud-based Solutions

Cloud-based accounting software has gained popularity in recent years due to its flexibility, scalability, and cost-effectiveness. Cloud-based solutions allow businesses to securely store and access their financial data from anywhere, at any time, with just an internet connection. This accessibility also enables real-time collaboration and seamless integration with other business systems. As the demand for remote work and data security continues to rise, cloud-based accounting software solutions are expected to become the norm in the UAE.

Mobile Accounting Apps

With the increasing reliance on smartphones and tablets, mobile accounting apps are becoming crucial tools for today’s businesses. These apps provide accountants and business owners with real-time access to financial data, allowing them to monitor cash flows, track expenses, and generate reports on the go. Mobile accounting apps not only enhance productivity but also ensure that important financial information is always at your fingertips.

Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. By leveraging its decentralized and transparent nature, blockchain technology enhances the security and integrity of financial data. With blockchain-powered accounting software, businesses can ensure the immutability of transactions, streamline auditing processes, and reduce the risk of fraud. As regulators in the UAE continue to embrace blockchain technology, its integration with accounting software is expected to gain momentum.

Integration With Emerging Technologies

The future of accounting software lies in its seamless integration with emerging technologies. Integration with technologies such as the Internet of Things (IoT), machine learning, and data analytics enables accounting software to collect and analyze vast amounts of data. This integration unlocks powerful insights and predictive capabilities, bringing significant value to businesses. By embracing these emerging technologies, accounting software in the UAE will continue to evolve and provide businesses with a competitive edge in the ever-changing market.

Frequently Asked Questions On Accounting Software In Uae

Which Software Is Used For Accounting In Dubai?

Dubai businesses often use accounting software like QuickBooks, Xero, and Sage for their financial management needs.

Is Quickbooks Used In Uae?

Yes, QuickBooks is used in the UAE. It is a widely used accounting software for businesses in the region.

Which Erp Software Is Used In Dubai?

The most commonly used ERP software in Dubai is SAP. It is widely implemented by businesses in various industries for efficient management of their operations. SAP provides comprehensive solutions for finance, human resources, supply chain, and more, helping companies streamline their processes and enhance productivity.

Which Software Is Mostly Used For Accounting?

The most commonly used software for accounting is QuickBooks. It is user-friendly and offers a range of features to help manage finances efficiently. QuickBooks is widely used by businesses of all sizes and provides a comprehensive solution for bookkeeping, invoicing, and financial reporting.

Conclusion

In essence, investing in accounting software in UAE is a game-changer for businesses, offering a wide range of benefits. From streamlining financial processes to improving accuracy, efficiency, and scalability, these software solutions are essential for staying competitive in today’s market.

With their user-friendly interfaces and advanced features, businesses can harness the power of automation and make informed financial decisions. Don’t miss out on this transformative technology; take your business to new heights with accounting software in UAE.